Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

“All about” posts take an in-depth look into various topics. See all of them here. Have a topic you want to read more about? Sound off in the comments!

Table of Contents

Chase Ultimate Rewards cards

Consumer cards:

- The Chase Sapphire Preferred® Card is currently offering 60,000 Chase Ultimate Rewards points after $4,000 of spending within 3 months. Read more here.

- The Chase Sapphire Reserve®® card is currently offering 60,000 Chase Ultimate Rewards points after spending $4,000 within 3 months. Read more here.

- The Chase Freedom Unlimited®® Card is currently offering 3% cash back in the form of 3 Chase Ultimate Rewards points per dollar within 12 months on up to $20,000 in spending.

- The Chase Freedom Flex℠ Card is currently offering $200 cash back in the form of 20,000 Chase Ultimate Rewards points after $500 of spending within 3 months.

Business cards:

- The Ink Business Unlimited® Credit Card® Card. Read more here.

- The Ink Business Cash® Credit Card® Card. Read more here.

- The Ink Business Preferred® Credit Card® Card is currently offering a best ever 100,000 Chase Ultimate Rewards points after $15,000 of spending within 3 months. Read more here.

Current signup rules

- All of the cards above are generally subject to 5/24 restrictions, read more about that here. However there are also reports of the business cards bypassing 5/24 restrictions. Note that business cards, even Chase business cards, do not get added to your 5/24 count of recently opened cards. However if you want to open a new business card they will usually check your 5/24 count.

- Additional user consumer cards from any bank are counted by the system towards your 5/24 count as they appear on your credit report. However you can have them manually excluded from the 5/24 count by calling reconsideration after you are rejected for a card and pointing out which cards are additional user cards and that you are not responsible for paying the balance on those cards.

- You won’t get approved for a Chase Sapphire Preferred® Card or Sapphire Reserve card if you received a bonus for one of those cards within the past 48 months. You won’t be approved for a Sapphire family card if you already have an open Sapphire card. However you can change a Sapphire card to a Freedom Unlimited or Freedom Flex card, wait 2-3 days, and then apply for a Sapphire card, and you will get the signup bonus. If you apply and get rejected for being ineligible to open a Sapphire card due to these rules, your credit will not be pulled and your score won’t be affected.

- As long as you are approved for a Chase Ultimate Rewards card, you will get the signup bonus.

- If you are an additional user on someone else’s account you can still apply for the same card yourself and get the signup bonus.

- You won’t get approved for a Freedom Flex card if you received a bonus for a Freedom Flex card within the past 24 months.

- You won’t get approved for a Freedom Unlimited card if you received a bonus for a Freedom Unlimited card within the past 24 months.

- If you apply and get rejected for being ineligible to open a Freedom card due to these rules, your credit will not be pulled and your score won’t be affected.

- You can receive signup bonuses on Chase Ink cards multiple times. You can get the same card for the same business if you have a reason to need multiple cards or you can open the same card for different businesses.

Which cards are best?

All of these are excellent cards that each excel in their own areas. The good news is that you can convert from any of these consumer cards to another consumer card or from any these business cards to another business card as needed. There is no hard credit pull needed to change cards. You will only get a signup bonus for opening a new card, not for a card conversion. Note that some reps will only allow card conversions after you have had the card for 12 months.

How do these cards stack up against each other?

Ultimate Comparison Chart Of Chase Ultimate Rewards Cards

| Freedom Flex | Chase Freedom Unlimited® | Chase Sapphire Preferred® Card | Chase Sapphire Reserve® | Ink Business Cash® Credit Card | Ink Business Unlimited® Credit Card | Ink Business Preferred® Credit Card | |

|---|---|---|---|---|---|---|---|

| Signup bonus | 20K points for spending $500 in 3 months | 1.5 bonus Chase Ultimate Rewards points per dollar within 12 months on up to $20K of spending. | 60K points for spending $4,000 in 3 months | 60K points for spending $4,000 in 3 months | Earn 35K points when you spend $3,000 on purchases in first 3 months, and an additional 40K points when you spend $6,000 on purchases in the first 6 months | 75K points for spending $6,000 in 3 months. | 120K points for spending $8,000 in 3 months. |

| Annual Fee | $0 | $0 | $95 | $550 | $0 | $0 | $95 |

| Additional Cardholder Fee | $0 | $0 | $0 | $75 | $0 | $0 | $0 |

| Allows you to transfer Chase points from any card to airline miles | No | No | Yes | Yes | No | No | Yes |

| Annual Travel Credit (Airfare, hotels, car rentals, Uber, etc) | $0 | $0 | $0 | $300 | $0 | $0 | $0 |

| Annual Hotel Credit booked through Chase Travel | $0 | $0 | $50 | $0 | $0 | $0 | $0 |

| 10% Anniversary points bonus | No | No | Yes | No | No | No | No |

| $100 Global Entry/Pre-Check Fee Refund | None | None | None | Once every 4 years for Primary cardholder | None | None | None |

| Instacart Credit | $10 quarterly credit | $10 quarterly credit | $15 quarterly credit | $15 monthly credit | None | None | None |

| Instacart+ Membership | 3 free months | 3 free months | 6 free months | 12 free months | None | None | None |

| Doordash Credit | None | None | None | $5 monthly credit, stack up to $15 | None | None | None |

| Doordash Dashpass Membership | 3 free months | 3 free months | Free through 12/31/24 | Free through 12/31/24 | None | None | None |

| Priority Pass membership | None | None | None | Primary and secondary cardholders can bring 2 guests into a lounge | None | None | None |

| Value of points towards paid airfare, hotels, car rentals, cruises, and activities | 1 cent | 1 cent | 1.25 cents | 1.5 cents | 1 cent | 1 cent | 1.25 cents |

| Chase Pay Yourself Back | None | None | None | Redeem points at a value of 1.25 cents on rotating categories | None | None | None |

| Points earned on everyday spending | 1 per dollar | 1.5 per dollar | 1.1 per dollar | 1 per dollar | 1 per dollar | 1.5 per dollar | 1 per dollar |

| Points earned on travel (Airfare, hotels, car rentals, Uber, etc) | 1 per dollar (5 during bonus quarters) | 1.5 per dollar | 2.1 per dollar | 3 per dollar | 1 per dollar | 1.5 per dollar | 3 per dollar ($150K cap) |

| Points earned on air travel booked via Chase Travel | 5 per dollar | 5 per dollar | 5.1 per dollar | 5 per dollar | 1 per dollar | 1.5 per dollar | 3 per dollar ($150K cap) |

| Points earned on non-air travel booked via Chase Travel | 5 per dollar | 5 per dollar | 5.1 per dollar | 10 per dollar | 1 per dollar | 1.5 per dollar | 3 per dollar ($150K cap) |

| Points earned on dining | 3 per dollar | 3 per dollar | 3.1 per dollar | 3 per dollar | 2 per dollar ($25K cap on 2x categories) | 1.5 per dollar | 1 per dollar |

| Points earned on streaming | 1 per dollar (5 during bonus quarters) | 1.5 per dollar | 3.1 per dollar | 1 per dollar | 1 per dollar | 1.5 per dollar | 1 per dollar |

| Points earned on online grocery | 1 per dollar (5 during bonus quarters) | 1.5 per dollar | 3.1 per dollar | 1 per dollar | 1 per dollar | 1.5 per dollar | 1 per dollar |

| Points earned on advertising with social media sites and search engines | 1 per dollar | 1.5 per dollar | 1 per dollar | 1 per dollar | 1 per dollar | 1.5 per dollar | 3 per dollar ($150K cap) |

| Points earned on shipping | 1 per dollar | 1.5 per dollar | 1 per dollar | 1 per dollar | 1 per dollar | 1.5 per dollar | 3 per dollar ($150K cap) |

| Points earned on internet, cable and phone services | 1 per dollar | 1.5 per dollar | 1 per dollar | 1 per dollar | 5 per dollar ($25K cap on 5x categories) | 1.5 per dollar | 3 per dollar ($150K cap) |

| Points earned on office supply spending | 1 per dollar | 1.5 per dollar | 1 per dollar | 1 per dollar | 5 per dollar ($25K cap on 5x categories) | 1.5 per dollar | 1 per dollar |

| Points earned on drugstores | 3 per dollar | 3 per dollar | 1 per dollar | 1 per dollar | 1 per dollar | 1.5 per dollar | 1 per dollar |

| Points earned on $250+ Peloton purchases | 1 per dollar | 1.5 per dollar | 5 per dollar through 3/31/25 | 10 per dollar through 3/31/25 | 1 per dollar | 1.5 per dollar | 1 per dollar |

| Points earned on Lyft purchases | 5 per dollar through 3/31/25 | 5 per dollar through 3/31/25 | 5 per dollar through 3/31/25 | 10 per dollar through 3/31/25 | 5 per dollar through 3/31/25 | 5 per dollar through 3/31/25 | 5 per dollar through 3/31/25 |

| Points earned on gas stations | 1 per dollar (5 during bonus quarters) | 1.5 per dollar | 1 per dollar | 1 per dollar | 2 per dollar ($25K cap on 2x categories) | 1.5 per dollar | 1 per dollar |

| Points earned on rotating quarterly categories | 5 per dollar ($1,500 quarterly cap) | N/A | N/A | N/A | N/A | N/A | N/A |

| Intro APR | 0% intro APR on purchases and balance transfers within 15 months of account opening. After that, 20.49%–29.24% variable APR. | 0% intro APR on purchases and balance transfers within 15 months of account opening. After that, 20.49%–29.24% variable APR. | No | No | 0% intro APR on purchases within 12 months of account opening, with no negative effect on personal credit. After that, 18.49%–24.49% variable APR. | 0% intro APR on purchases within 12 months of account opening, with no negative effect on personal credit. After that, 18.49%–24.49% variable APR. | No |

| Foreign transaction fee | 3% | 3% | 0% | 0% | 3% | 3% | 0% |

| Cell Phone Damage and Theft Protection | $800 of coverage with a $50 deductible. | None | None | None | None | None | $600 of coverage with a $100 deductible. |

| US Car Rental CDW Coverage | Secondary | Secondary | Primary | Primary | Primary on rentals primarily for a business purpose, secondary on rentals for personal reasons | Primary on rentals primarily for a business purpose, secondary on rentals for personal reasons | Primary on rentals primarily for a business purpose, secondary on rentals for personal reasons |

| Worldwide Car Rental CDW Coverage | Primary | Primary | Primary | Primary | Primary | Primary | Primary |

| Roadside Assistance | Available for a $59.95 charge | Available for a $59.95 charge | Available for a $59.95 charge | Free battery boost, flat tire service, 2 gallons of fuel delivery, towing, or lockout assistance | Available for a $59.95 charge | Available for a $59.95 charge | Available for a $59.95 charge |

| Purchase Protection for items damaged or stolen within 120 days | $500 per item | $500 per item | $500 per item | $10,000 per item | $10,000 per item | $10,000 per item | $10,000 per item |

| Extended Warranty Protection | 1 extra year for items up to $10,000 | 1 extra year for items up to $10,000 | 1 extra year for items up to $10,000 | 1 extra year for items up to $10,000 | 1 extra year for items up to $10,000 | 1 extra year for items up to $10,000 | 1 extra year for items up to $10,000 |

| Trip Cancellation/Trip Interruption Insurance | $1,500 per person, up to $6,000 per trip with multiple travelers | $1,500 per person, up to $6,000 per trip with multiple travelers | $10,000 per trip or $20,000 per trip with multiple travelers | $10,000 per trip or $20,000 per trip with multiple travelers | None | None | $5,000 per trip or $10,000 per trip with multiple travelers |

| Return Protection | None | None | None | $500/item up to $1,000/year | None | None | None |

| Trip Delay Reimbursement | None | None | $500 per person for reasonable expenses (Hotel, food, toiletries, medicine, etc) required for delays more than 12 hours. | $500 per person for reasonable expenses (Hotel, food, toiletries, medicine, etc) required for delays more than 6 hours. | None | None | $500 per person for reasonable expenses (Hotel, food, toiletries, medicine, etc) required for delays more than 12 hours. |

| Lost Luggage Insurance | None | None | $3,000 per person per trip (limit of $500 per person for jewelry, watches, electronics) | $3,000 per person per trip (limit of $500 per person for jewelry, watches, electronics) | $3,000 per person per trip (limit of $500 per person for jewelry, watches, electronics) | $3,000 per person per trip (limit of $500 per person for jewelry, watches, electronics) | $3,000 per person per trip (limit of $500 per person for jewelry, watches, electronics) |

| Baggage Delay Reimbursement | None | None | $100 per day per person (max of 5 days) for essential items needed (Clothing, toiletries, charger, etc) for delays more than 6 hours. | $100 per day per person (max of 5 days) for essential items needed (Clothing, toiletries, charger, etc) for delays more than 6 hours. | $100 per day per person (max of 3 days) for essential items needed (Clothing, toiletries, charger, etc) for delays more than 6 hours. | $100 per day per person (max of 3 days) for essential items needed (Clothing, toiletries, charger, etc) for delays more than 6 hours. | $100 per day per person (max of 5 days) for essential items needed (Clothing, toiletries, charger, etc) for delays more than 6 hours. |

| Travel Accident Insurance | None | None | $500,000 per person | $1,000,000 per person | $500,000 per person | $500,000 per person | $500,000 per person |

| Visa Savings Edge Rebates | No | No | No | No | Yes | Yes | Yes |

| Emergency Evacuation and Transportation due to injury or illness on a trip | None | None | None | $100,000 for trips between 5-60 days, more than 100 miles from your home | None | None | None |

| Repatriation of Remains Insurance | None | None | None | $1,000 for a coffin and to return your body to your home country if you die on a vacation | None | None | None |

| Emergency Medical and Dental Benefit | None | None | None | $2,500 for medical expenses on trips between 5-60 days, more than 100 miles from your home | None | None | None |

| Subject to 5/24 rules | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adds to 5/24 count | Yes | Yes | Yes | Yes | No | No | No |

| Download Guide of Benefits | Freedom Flex Link | Link | Link | Link | Link | Link | Link |

Create your own bifecta, trifecta, quadfecta, or quinfecta killer combo to supercharge your earnings

I’ve been talking about creating a Chase Trifecta since 2011. Over the years the components have changed, but the overall strategy to maximize your earnings has not.

As each Chase Ultimate Rewards card has their own benefits, the more diverse of a portfolio that you and/or your household has, the better you can optimize your spending. Chase allows you to transfer points between authorized users in your household, so you can maximize your spending and limit annual fees by taking advantage of household members. You can give authorized user cards to everyone in your household so that everyone can maximize their spending strategy.

You can transfer points from all of your Chase cards to your most valuable premium Chase card by clicking on combine points in the Ultimate Rewards portal. That portal also allows you to transfer points to authorized users, to airline miles, or to hotel miles. You can also check how much free travel or bonus category spending you’ve done on each of your cards in the portal. You can also book travel at a increased value of 1.25 cents or 1.5 cents by clicking on your most premium card in the portal.

Premium cards

The first key is to determine which of the premium cards to get. The no annual fee cards earn lots of points, but they can’t transfer points into airline miles and hotel points unless someone in your household has a premium card with an annual fee. There are 3 premium cards that will allow you to make those transfers, so someone in your household will want to have at least one of these cards.

The premium cards also don’t have foreign transaction fees.

- The Sapphire Reserve is a consumer card with a $550 annual fee, but it’s actually only going to cost you $250 out of pocket or less if you use Doordash or Instacart.

- The signup bonus on this card is 60,000 points, worth $900-$1,200.

- The card offers $300 in annual refunds that post automatically whenever you charge something that is categorized as travel, which includes airfare, Airbnb, car rentals, cruises, hotels, Lyft, subways, taxis, tolls, trains, Uber, UberEats, etc. It’s pretty easy to spend $300 over the course of a year given the wide range of eligible categories.

- You’ll earn 10 points per dollar on hotels and car rentals booked through the Ultimate Rewards portal.

- You’ll earn 5 points per dollar on Airfare booked through the Ultimate Rewards portal.

- You’ll earn 10 points per dollar on Chase Dining booked through the Ultimate Rewards portal.

- You’ll earn 3 points per dollar on all other travel.

- You’ll earn 10 points per dollar on Lyft through 3/31/25.

- You’ll earn 10 points per dollar on $250+ Peloton purchases through 3/31/25.

- Cardholders get $15 monthly Instacart credit.

- Cardholders get 12 months of Instacart+ membership.

- Cardholders get $5 monthly DoorDash credit. Credit expires every 3 months, so you can stack up to $15.

- Cardholders get a free DoorDash DashPass through 12/31/24 to save money on deliveries, a $9.99 monthly value.

- You’ll get a Priority Pass lounge membership that allows you to bring 2 guests with you into over 1,000 airport lounges. There are now many airports with restaurants that have $28 credit per person with Priority Pass membership. I’ve used that to get free granola bars, potato chips, fruit, and drinks to go! There are also Priority Pass spas and other non-lounge partners and while AMEX and Capital One only allow traditional lounges, Chase allows access to all Priority Pass options!

- You’ll get a full rebate every 4 years when you buy Global Entry/Pre-Check/NEXUS membership. That means you can skip the lines and forms when flying back from abroad and you can leave your shoes on, laptops in their bags, and go through metal detectors when flying from the US or transiting between the US and Canada. It makes flying so much easier!

- You’ll get free roadside assistance and a plethora of travel/medical/baggage insurance and benefits.

- All of your Chase points can be used for a minimum value of 1.5 cents each towards travel if you have this card. Or you can transfer Chase points from any of your household’s cards into airline miles or hotel points.

- This is the only card that charges an annual fee for additional cardholders as they each get their own Priority Pass lounge membership. If you don’t care about that membership, you can always request replacement cards or non-metal to have spare cards. If you do add an additional user card you can cancel the card within 30 days to get back the fee. The secondary Priority Pass membership will be cancelled, but the credit card will still work as secondary Chase consumer cards have the same exact card number, expiration date, and CVV as the primary cardholder’s card.

- The Chase Sapphire Preferred® Card is a consumer card with a $95 annual fee.

- The signup bonus on this card is 60,000 points, worth $900-1,200 when used ideally.

- This card now offers a 10% anniversary points bonus on all spending. For example if you spend $20K on your card in a cardmembership year, you’ll get a 2,000 point bonus. The bonus does not apply to the signup bonus or bonus point categories.

- Get a $50 annual hotel credit as a statement credit when you book a hotel through the Ultimate Rewards portal.

- Earn 5.1 points per dollar on all travel booked through the Ultimate Rewards portal.

- Earn 3.1 points per dollar on select streaming include Disney+, Hulu, ESPN+, Netflix, Sling, Vudu, Fubo TV, Apple Music, SiriusXM, Pandora, Spotify and YouTube TV.

- Earn 3.1 points per dollar on dining.

- Earn 3.1 points per dollar on online grocery shopping, excluding Target, Walmart, and wholesale clubs. The online grocery category includes purchases for grocery pickup and delivery that are placed online with grocery stores, specialty food stores, or delivery service merchants that classify as grocery store merchants such as Instacart (excluding membership and subscription fees). Meal kit delivery services are included in this category.

- Cardholders get $15 quarterly Instacart credit.

- Cardholders get 6 months of Instacart+ membership.

- You’ll earn 5.1 points per dollar on Lyft through 3/31/25.

- You’ll earn 5.1 points per dollar on $250+ Peloton purchases through 3/31/25.

- All of your Chase points can be used for a minimum value of 1.25 cents each towards travel if you have this card. Or you can transfer Chase points from any of your household’s cards into airline miles or hotel points.

Note: The Chase Sapphire Preferred® Card and Sapphire Reserve’s spending categories are similar, but Sapphire Reserve is no longer the clear winner that it once was.

While Sapphire Reserve still earns more points than Chase Sapphire Preferred® Card for travel not booked in the Chase portal (3 vs 2.1), you will be better off with Chase Sapphire Preferred® Card for most other purchases.

Still, the card are similar enough that you’ll only need one of them as part of an optimized spending strategy. Personally, I prefer the Sapphire Reserve as that card allows you to redeem all of your Chase points (including the points of an authorized user) at a minimum value of 1.5 cents per point on paid airfare, car rentals, hotels, and vacation activities. You will still get trip insurances, even when you use points to pay for the trip.

My goal is to receive a value of 2 cents per point via transfers to miles, but having a minimum value of 1.5 cents per point when mileage redemptions aren’t valuable can be very useful and it makes your points much more versatile.

That being said, Chase Sapphire Preferred® Card also makes your points more valuable and transferrable to miles and points at a much lower annual fee.

It’s always important to check and see if you’ll do better with airline miles/hotel points for a redemption or if you’ll do better by just using Chase points for a redemption. You’ll also need to bear in mind the taxes owed on an award ticket and the miles you can earn by using Chase points towards a paid airline ticket or hotel stay. Finally you also need to bear in mind that it is typically free to cancel and refund an award ticket, while paid tickets may have free changes, but won’t have free cancellations.

- The Ink Business Preferred® Credit Card is a business card with a $95 annual fee.

- The signup bonus on this card is 100,000 points, worth $1,500-$2,000 when used ideally.

- This card offers 3 points per dollar on up to $150K in annual spending on online advertising, shipping, and travel.

- You’ll earn 5 points per dollar on Lyft through 3/31/25.

- All of your Chase points can be used for a minimum value of 1.25 cents each towards travel if you have this card. Or you can transfer Chase points from any of your household’s cards into airline miles or hotel points.

- Your points are worth even more with Pay Yourself Back. You can points to offset any purchases on internet, cable and phone services, shipping, and select charitable contributions at a rate of 1.25 cents per point and the program is now a permanent feature of Ultimate Rewards. You also keep the points earned on purchases that you offset with points, which makes your points worth up to 1.28 cents each!

- The Ink Plus card is no longer offered to new customers. The Ink Plus card is a premium card with a $95 annual fee. Benefits are similar to the Ink Cash card, with 5 points per dollar earned at office supply stores and telecom, but it has a higher annual cap of $50K in 5x spending instead of $25K on the Ink Cash card. The Ink Plus card also earns 2 points per dollar on up to $50K of annual spending on gas and hotels and it has no foreign transaction fees. You can convert an Ink Plus card into any existing business card, but you can’t convert back to an Ink Plus card again.

- The JPMorgan Reserve card is only available to JPMorgan private bank clients. It mimics the Sapphire Reserve card, with some added benefits like United Club membership and a credit line that is not reported on your personal credit report.

Non-premium cards

The next step is to determine which of the non-premium cards to get. These no annual fee cards earn lots of points, but they can’t transfer points into airline miles and hotel points unless someone in your household has a premium card with an annual fee. There are currently 4 non-premium cards to choose from, and it’s ideal for someone in your household to have 1-3 of these cards. These cards all carry a 3% foreign transaction fees.

- The Chase Freedom Unlimited® is a consumer card with no annual fee.

- This card is currently offering 3% cash back in the form of 3 Chase Ultimate Rewards points per dollar within 12 months on up to $20,000 in spending.

- This card markets itself as earning 1.5% cash back, but really it earns 1.5 points per dollar everywhere. Used ideally, that’s 2.25%-3% back everywhere.

- This card earns 3 points per dollar on dining and drugstore purchases, plus 5 points per dollar on travel booked via the Chase portal.

- Cardholders get $10 quarterly Instacart credit.

- Cardholders get 3 months of Instacart+ membership.

- You’ll earn 5 points per dollar on Lyft through 3/31/25.

- 0% APR on purchases for 15 months.

- The Ink Business Unlimited® Credit Card is a business card with no annual fee.

- This card markets itself as earning 1.5% cash back, but really it earns 1.5 points per dollar everywhere. Used ideally, that’s 2.25%-3% back everywhere.

- You’ll earn 5 points per dollar on Lyft through 3/31/25.

- 0% APR on purchases for 12 months, with the added benefit of there being no effect on your personal credit score as this is a business card.

Note: The Freedom Unlimited and Ink Unlimited cards are very similar, so you’ll only need one of these cards as part of an optimized spending strategy.

- The Chase Freedom Flex is a consumer card with no annual fee.

- The signup bonus on this card is marketed at $200, but will actually come in the form of 20,000 points. Used ideally, those points will be worth $300-$400.

- This card markets itself as earning 5% cash back in rotating categories, but really it earns 5 points per dollar in rotating categories. Used ideally, that’s 7.5%-10% back in rotating categories.

- The maximum spending in the rotating categories is $1,500 per quarter.

- Rotating categories have included restaurants, Amazon, Walmart, telecom, department stores, grocery stores, gas stations, wholesale stores, mobile payment purchases, and more.

- This card earns 3 points per dollar on dining and drugstore purchases, plus 5 points per dollar on travel booked via the Chase portal.

- Cardholders get $10 quarterly Instacart credit.

- Cardholders get 3 months of Instacart+ membership.

- You’ll earn 5 points per dollar on Lyft through 3/31/25.

- 0% APR on purchases for 15 months.

Note: The old Freedom Visa card is no longer offered but you can still change from another consumer Chase Ultimate Rewards card to it. The Freedom Visa is very similar to Freedom Flex Mastercard. The Freedom Flex Mastercard adds cell phone insurance, as well as 3x points on dining and drugstores and 5x points on travel booked via the Chase Ultimate Rewards portal. One potential downside of the Freedom Flex Mastercard is that Costco only accepts Visa, so the Freedom Flex Mastercard won’t work there. Generally speaking, this isn’t a good card for Costco anyway as it only earns 1 point per dollar there, but when Freedom has wholesale clubs or gas (which works at Costco) as the quarterly bonus then you may want the Freedom Visa. However, you can also purchase Costco Cash cards on Costco.com with a Mastercard that can be used in store.

- The Ink Business Cash® Credit Card is a business card with no annual fee.

- This card markets itself as earning 2% cash back or 5% cash back in select categories, but really it earns 2 or 5 points per dollar everywhere. Used ideally, that’s 3%-4% or 7.5%-10% back in those categories.

- The 2 point categories include up to $25,000 of annual spending on gas stations and restaurants.

- The 5 point categories include up to $25,000 of annual spending at office supply stores and on internet, cable, and cell phone bills.

- Stores like Office Depot/Max and Staples sell gift cards to hundreds of other stores and you’ll earn 5 points per dollar. If you shop at Amazon, Airbnb, Bed Bath & Beyond, Bloomingdale’s, BP, Cabela’s, Delta, DisneyLand/DisneyWorld, eBay, Express, Gap, Google Play, Groupon, Home Depot, iTunes, JCrew, Kohl’s, Lands End, LLBean, Lowe’s, Macy’s, Marshalls, Nike, Nordstrom, Safeway, Sears, Shell, Southwest, Starbucks, StubHub, Target, TJMaxx, Uber, Whole Foods, and more, you can be earning 5 points per dollar by buying their gift cards. Some gift cards are available online and many more are available in store.

- You can even buy $300 Visa gift cards from Staples from the comfort of your home, which will earn 5 points per dollar. Office Depot/Max and Staples often run promotions to save even more on Visa gift cards.

- Your local school or charity will be more than happy to accept donations of Amazon gift cards for supplies or any other useful gift cards for chinese auctions, raffles, fundraisers, etc. They will give you a tax deductible receipt for the full face value-the price you paid for the gift cards. And at the same time you’ll earn 5 points per dollar. So while doing good you can still get a nice chunk of points and you’ll save on your taxes.

- You’ll earn 5 points per dollar on Lyft through 3/31/25.

- 0% APR on purchases for 12 months, with the added benefit of there being no effect on your personal credit score as this is a business card.

Creating a Killer Combo with Hybrid Points:

Having cards from the same bank that compliment each other can help you rack up the miles more rapidly and spend them more lucratively. The sum of a killer combo is worth more than its parts.

While airline miles and hotel points can allow you to get some truly insane values for your points, they can also be devalued at any time. That’s why I keep transferable points and send them over to airlines and hotels on demand as needed.

I call points like Chase Ultimate Rewards “hybrid points” as you can get an increased value for your points when they are used towards travel or you can transfer the points into airline miles or hotel points.

The increased value of points sets a minimum value you can get from your points and it protects you from points being devalued. You can get a higher value for your points by transferring them into airline miles and hotel points, but having the ability to use your points at an increased value for paid travel makes them into hybrid points. You can choose to redeem them for either paid travel or award travel, depending on which provides a better value.

Creating A Chase Quinfecta Killer Combo

Stacking multiple Ultimate Rewards cards together can supercharge your earnings by getting you more points per dollar while increasing the value of all your points.

A Chase Bifecta would consist of a household that has the Chase Sapphire Preferred® Card or Sapphire Reserve and the Freedom Unlimited. The total effective annual fees would be either $95 with Chase Sapphire Preferred® Card or $250 with Sapphire Reserve after accounting for that card’s $300 annual travel credit. With the Chase Sapphire Preferred® Card+Freedom Unlimited you would earn 1.5 points per dollar everywhere, 2.1 points per dollar on all travel, 3 points per dollar on drugstores, 3.1 points per dollar on dining, streaming, and online grocery shopping, and 5.1 points per dollar on travel booked via Chase. You’ll be able to transfer all of your points into airline miles or hotel points or use the pay yourself back feature. Read more about Freedom Unlimited here.

A Chase Trifecta adds a no annual fee card like Ink Cash or Chase Freedom Flex into the mix, so your total effective annual fee will still be $95 or $250. Both of those cards give options to earn a whopping 5 points per dollar in various categories on top of the 2-3 points per dollar that the Sapphire cards offer and the 1.5-5 points per dollar everywhere else with a Freedom Unlimited card. Read more about Freedom Flex here and read more about Ink Cash here.

A Chase Quadfecta would add both the Ink Cash and Chase Freedom Flex on top of a Sapphire card and an Unlimited card, so your total effective annual fee will still be just $95 or $250. The Quadfecta is the sweet spot and allows you to really supercharge your spending everywhere.

A Chase Quinfecta could add the Ink Business Preferred® Credit Card to that mix, adding $95 to the annual fee total. This make sense if you spend money on shipping, social media advertising, or search engine advertising, or if you want free cell phone insurance.

Alternatively, you can create a Chase Quinfecta by adding the Chase United Explorer card, United Gateway℠ Card, United Quest℠ Card, United Club Infinite Card, or Chase United Business Card into the mix. Those cards don’t earn Ultimate Rewards points, but it makes your Ultimate Rewards points more valuable. Having a United card enables you to have access to significantly expanded United saver and standard award space in addition to benefits like 2 free club passes, a free checked bag, a free carry-on bag, and priority boarding, even when you’re on a basic economy fare. See more about those benefits here.

Again, all of these cards don’t need to be in one person’s name. 2 people from the same household can split up the requisite cards that make up the Quinfecta, as they can transfer the Ultimate Rewards points back and forth between themselves freely and they can add each other as an authorized user on their cards!

Once you have these cards and create your own killer combo, here is the the ideal way to spend

- Everyday spending: Freedom Unlimited or Ink Unlimited 1.5x (2.25%-3% back)

- Airfare: Sapphire Reserve 3x (4.5%-6% back) or buy gift cards at office supply stores on Ink Cash 5x (7.5%-10% back)

- Airfare booked via the Chase portal: Chase Sapphire Preferred® Card 5.1x (7.65%-10.2% back)

- Airbnb: Sapphire Reserve 3x (4.5%-6% back) or buy gift cards at office supply stores on Ink Cash 5x (7.5%-10% back)

- Amazon: Buy gift cards at office supply stores on Ink Cash 5x (7.5%-10% back)

- Car rentals: Sapphire Reserve 3x (4.5%-6% back)

- Car rentals booked via the Chase portal: Sapphire Reserve 10x (15%-20% back)

- Cruises: Sapphire Reserve 3x (4.5%-6% back)

- Drug stores: Freedom Flex or Freedom Unlimited 3x (4.5%-6% back)

- Federal taxes (1.85% processing fee applies): Freedom Unlimited or Ink Unlimited 1.5x (2.25%-3% back)

- Foreign currency transactions: Chase Sapphire Preferred® Card, Sapphire Reserve, or Ink Business Preferred® Credit Card depending on the transaction type.

- Gas: Ink Cash 2x (3%-4% back or 5%-6% back on Chevron, Sheetz, or Texaco with Visa Savings Edge) or buy gift cards at office supply stores on Ink Cash 5x, or buy during Freedom 5x Quarterly spending (7.5%-10% back).

- Gift cards for other stores or Visa gift cards: Ink Cash bought at office supply stores 5x (7.5%-10% back)

- Groceries: During rotating quarter on Freedom 5x (7.5%-10% back), during the first year of Freedom/Freedom Unlimited 5x (7.5%-10% back), buy gift cards for stores like Safeway or Whole Foods at office supply stores on Ink Cash 5x (7.5%-10% back), or Freedom Unlimited 1.5x (2.25%-3% back).

- Groceries online/grocery delivery: During rotating quarter on Freedom 5x (7.5%-10% back), during the first year of Freedom/Freedom Unlimited 5x (7.5%-10% back), or Chase Sapphire Preferred® Card 3.1x (4.65%-6.2% back).

- Hotels: Sapphire Reserve 3x (4.5%-6% back)

- Hotels booked via the Chase portal: Sapphire Reserve 10x (15%-20% back)

- Lyft: Sapphire Reserve 10x (15%-20% back)

- Office supplies: Ink Cash 5x (7.5%-10% back)

- Peloton over $495: Sapphire Reserve 10x (15%-20% back)

- Restaurants and restaurant delivery: Chase Sapphire Preferred® Card 3.1x (4.65%-6.2% back).

- Restaurants booked via Chase Dining: Sapphire Reserve 10x (15%-20% back).

- Rotating category spending (Up to $1,500 of mobile payments, gas, grocery, Amazon, Walmart in their respective quarters): Freedom 5x (7.5%-10% back)

- Shipping: Ink Business Preferred® Credit Card 3x (4.5%-6% back)

- Social media and Search Engine advertising: Ink Business Preferred® Credit Card 3x (4.5%-6% back)

- Starbucks: Chase Sapphire Preferred® Card 3.1x (4.65%-6.2% back) or buy gift cards at office supply stores on Ink Cash 5x (7.5%-10% back)

- Streaming: Chase Sapphire Preferred® Card 3.1x (4.65%-6.2% back) or buy gift cards at office supply stores on Ink Cash 5x (7.5%-10% back)

- Subways/Trains: Sapphire Reserve 3x (4.5%-6% back)

- Taxis: Sapphire Reserve 3x (4.5%-6% back)

- Telecom/Internet/Cell Phones/Cable: Ink Cash 5x (7.5%-10% back). However Ink Business Preferred® Credit Card 3x (4.5%-6% back) and Freedom Flex 1x (1.5%-2% back) come with cell phone protection.

- Travel booked via Chase portal: Freedom Flex or Freedom Unlimited 5x (7.5%-10% back)

- Uber/UberEats: Sapphire Reserve, Freedom Flex, or Freedom Unlimited 3x (4.5%-6% back) or buy gift cards at office supply stores on Ink Cash 5x (7.5%-10% back)

- Wholesale Clubs: During rotating quarter on Freedom 5x (7.5%-10% back) or Freedom Unlimited or Ink Unlimited 1.5x (2.25%-3% back)

There are some caveats to all this of course…

- This scenario is just for Chase cards and ignores other point currencies. It’s a good idea to have multiple currencies.

- Using gift cards means the loss of credit card protections like extended warranty or air travel protections, so use them only when it makes sense to earn more points at the expense of potential protections.

- You may want to prioritize Sapphire Reserve spending for travel related categories like Uber/UberEats before buying gift cards on an Ink Cash card if you otherwise would not hit the $300 in annual free travel spending.

- The value received per point is highly variable based on how you will use it. The nice thing about having a killer combo with a Sapphire Reserve is that you’ll receive a minimum of 1.5 cents per point. 2 cents is a good goal to set, so just compare the cost of a ticket or hotel to the amount of miles you’ll need for it to see how much value you are receiving.

Business card information, benefits, and 5/24

The Ink cards are business cards, but you may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business name. You don’t need to file any messy government paperwork to be allowed to do that. Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field.

It’s important to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork.

If you’re like me and you run more than one business you can signup for multiple of the same card for each business to manage each businesses expenses separately.

All Chase cards that earn Ultimate Rewards are subject to 5/24 restrictions. That means it will be nearly impossible to get approved if you have been approved for 5 or more consumer credit cards in the past 24 months. Read more about that here.

However, it’s important to note that business cards from most banks, including Chase business cards, do not get added to your 5/24 count of recently opened cards. That’s because business cards from most banks don’t show up on your personal credit report and the 5/24 count is based off of your personal credit report. That means that applying for these cards won’t “hurt” your 5/24 count.

Another benefit of business cards not reporting on your personal credit report is that your credit score won’t be hurt when you spend money on your cards. When you spend money on personal cards your score will be hurt even if you pay your bill on time. That’s because a whopping 30% of your credit score is based on credit utilization, so you lose lots of points even if you pay your bills before the statement due date. You can pay off your credit card bill before your statement close date to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On business cards from banks like AMEX and Chase the spending is not reported on your personal credit report, so you can wait until the money is due without it having a negative effect on your score. That also means if you close the card, it won’t have an effect on your credit score.

The great thing about Chase Ultimate Rewards is how versatile and valuable they are

The Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card allow you and anyone in your household to transfer Chase points into miles. They also allow you to use points at a value of 1.25 cents each towards travel.

The Sapphire Reserve also allows you and anyone in your household to transfer Chase points into miles. Plus it allows you to use points at a value of 1.5 cents each towards travel.

The fixed value is excellent and doesn’t require hunting down award space, but those points can be much more valuable by transferring them into airline miles or hotel points.

- If I want to stay in a 5 star Park Hyatt in the Maldives, Melbourne, NYC, Paris, Sydney, or Tokyo that would cost over $1,000/night, I can instantly transfer 25-40K points to Hyatt to do that, a value of up to 6 cents per point.

- If I need a one-way flight from Cleveland (or Chicago, Detroit, Miami, Montreal, Orlando, Pittsburgh, Toronto, etc) to NYC that can cost $500 each way, I can instantly transfer 7.5K points to British Airways to book a short-haul on American with no last minute booking fees. Or if American doesn’t have availability I can instantly transfer 10K points to United for their short-haul award. That’s a value of up to 7 cents per point.

- Air Canada offers one-way short haul awards for just 6K miles. You can also get stopover awards for 5K miles, build round-the-world awards, and get free lap child awards in the US/Canada and bring lap children to anywhere else in the world for just C$25!

- If I want to stay in a non-chain hotel that costs $300/night and don’t want to pay cash, I can redeem 20K points for the room thanks to my Sapphire Reserve card’s minimum redemption value of 1.5 cents per point or 24K points with the Chase Sapphire Preferred® Card ’s minimum redemption value of 1.25 cents per point

- Flying Blue has award flights to Israel for 25K miles for adults or 18,750 miles for kids.

- If I want to fly in a $25,000 ANA First Class Suite round-trip from the US to Tokyo, I can instantly transfer 110K or 120K points to Virgin Atlantic. That’s a value of up to 23 cents per point. You can now redeem one-way awards for half the price as well!

- If I want to book a $2,281 business class ticket on Air Canada to Tel Aviv I can redeem 152K points for the flight thanks to my Sapphire Reserve card’s minimum redemption value of 1.5 cents per point or 182K points with the Chase Sapphire Preferred® Card ’s minimum redemption value of 1.25 cents per point, plus I’ll earn Qantas miles for more future travel as it’s considered a paid flight instead of an award flight.

- And thousands of other possibilities from Singapore couples suites to booking Southwest awards with 2 free bags and free cancellations, to stealing 2nd base in middle of an MLB game.

Chase 1:1 transfer partners include:

- United (Star Alliance)

- Singapore (Star Alliance)

- Air Canada (Star Alliance)

- Air France/KLM Flying Blue (Skyteam)

- British Airways (OneWorld)

- Aer Lingus (OneWorld)

- Iberia (OneWorld)

- Emirates

- JetBlue

- Southwest

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

What cards do you have in your killer combo?

I have 16 active Chase credit cards, including all of the cards in the Quinfecta mentioned in this post (Sapphire Reserve, Chase Sapphire Preferred® Card, Freedom Unlimited, Freedom Flex, Freedom, Ink Cash, United Lifetime Club, and United Quest). I also have multiples of cards like Chase Freedom and Ink Cash as those cards have caps on their bonus spending categories.

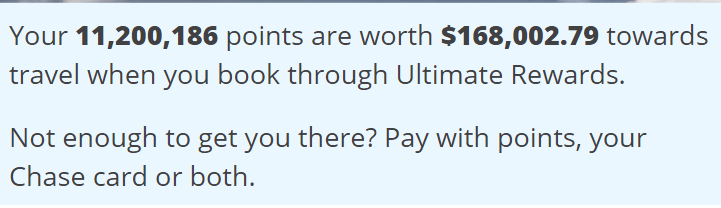

That has allowed me to build up a nice stash of Ultimate Rewards points over the years:

By transferring points into airline miles and hotel points on demand as needed, I’ll make them worth far more than Chase thinks they are worth.

I don’t save the points as they don’t earn interest. Instead I spend 7 figures of miles every year and see the world in ways that I never imagined possible.

Some will call that crazy, but I just call it the best hobby on Earth.

So, which cards do you have to create a killer combo?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

26 Comments On "2023 Ultimate Comparison Chart Of Chase Ultimate Rewards Cards; Supercharge Your Earnings By Creating Your Own Chase Quinfecta Killer Combo!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

@dan can you please do this for amex?

I was going to sign up for a Chase business card, but the terms say that the card is supposed to be used for business expenses, of which I have very few.

It’s not enforced.

You had years ago a chart for every category which card is best to use across all banks and cards, it would be nice to have that updated.

Thanks for this post !!

I currently have 600k Chase points and best I know is to redeem with the reserve card for 1.5 towards travel.

I see that when writing the value of points in parentheses you say it’s worth 50-100 percent more .

Would love to understand how that is ?

By transferring to partners like Hyatt and United.

Why is it 3.1 and not 3.3 with the 10% bonus on the csp?

Because the bonus is on the base spending only.

How do you justify the $250 effective AF on the CSR?

I also use the $240/year in Instacart and Doordash credits.

Wouldn’t you say the biz ink premier is the best, because even though the UR cant be transferred, the cash back value on purchases over $5,000 is 2.5%?

I used the roadside benefit recently. Not $60 anymore. Inflation. I think it was $80 or maybe $90.

I think I’ve fully digested this chart, a real pice art, thanks Dan for sharing!

What portal would you recommend booking coast to coast flights on? Understanding correctly to book through a partner airline and not directly with united or American?

Thank you

Hi Dan,

On Chase website, the current offer for Freedom Unlimited is $200 bonus plus 5% grocery store offer ($200 bonus = 20,000 UR, correct?). From your link for this same card, the offer is “3 Chase Ultimate Rewards points per dollar within 12 months on up to $20,000 in spending.” Which offer is better? Please advise and TIA!

I have stopped using Chase cards for a few years and now want to take advantage of the signup bonuses and follow your bi/trifecta. Just got approved for Ink Cash and I’m trying to apply for the 2nd card.

Why not go for Ink Unlimited over Freedom Unlimited?

I don’t think I can reach the spending threshold for 2 Ink cards at the same time :-\

Can always make an estimated tax payment to put you over the top.

https://www.dansdeals.com/points-travel/milespoints/2023-best-year-ever-pay-taxes-credit-card-breakdown-earnings-card-benefit-paying-taxes-earn-elite-status/

Okay I followed your suggestion on Ink Unlimited. Just applied and received “In Review” status (I applied for Ink Cash earlier today and got instant approval). Dan, what to do now – wait for their decision in the mail or call recon? Could you please let me know the recon phone#? Thank you!

Ah nevermind Dan – just got email that it has been approved!

TYSM for your responses and your great posts as always 🙂

Congrats!

I see Pyb on groceries for reserve now says 23 day’s remaining, does that mean that they are changing categories again? Any clue as to what?

Good morning Dan,

I’ve been approved for ink cash in Dec, and ink unlimited in Feb, with 5k and 4k credit line, respectively. I applied separately since I wasn’t sure if I’d be able to meet the spend, but BH made it on both. So, I’m ready to go for a 2nd ink cash, but not too optimistic about being approved since my credit lines are pretty low. If my application is denied, would I get a hard credit pull? Sole proprietor if it makes any difference…

Hi dan,

This is the very first time being on your site. I’m still figuring it out. I’ve been approved for both chase ink cards and so was my wife. from this alone, I’ll probably have 400,000 points. I also have freedom unlimited and a credit score between 750 and 800. what card(s) should I apply for to be able to transfer points and make the most of it?

Had a Sapphire Preferred for more than 48 months since bonus and want to get 60000 points for a new Sapphire Preferred. Called to convert the Sapphire Preferred to Freedom Flex. Because it is changing from Visa to MasterCard, the account number has to change. They said the old account number stays active for another 60 days to allow any lingering automatic charges to go through. Upon completion of that phone call, Chase website showed the new account and I enrolled in the quarterly offer immediately. Is this the situation that the post refers to that waiting two to three days to apply for the Sapphire Preferred is sufficient? If the old Sapphire Preferred Visa is used during the next 60 days, do those purchases get 5x if they fall into the quarterly category?

Is there some way Chase points can be used for El Al flights to Israel? Thanks