Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Originally posted on 5/24/19:

Today is 5/24 day, a sad day for mileage junkies.

For many years it was easy to open hundreds of credit cards and rack up millions of miles and there were lots of easy ways to spend and earn miles. I’ve burned through 8 figures of miles flying around the world in first class and am still sitting on 8 figures of miles thanks in large part to the good old days.

Then the banks started cracking down.

In March of 2014 I broke the news that AMEX consumer cards went to a one signup bonus per lifetime system. In reality it’s more like once in 4-7 years. The good news is that you can apply for a card and if you get a popup telling you that you won’t get a signup bonus you can still cancel the card application. In 2016 AMEX extended that to their business cards.

On about 5/24/15 Chase made the 5/24 rule to limit credit card signups. They made it very hard to get approved for a Chase Sapphire or Freedom card if you have been approved for 5 cards from any bank within the past 24 months.

On about 5/24/16 they expanded the 5/24 rule to include most of their credit cards and since then it’s been expanded to all of their cards.

The worst part about 5/24 is that you can’t even get a card that you want for the benefits while forgoing the signup bonus, as AMEX allows.

The good thing is that you won’t get a credit card inquiry if you are rejected due to 5/24.

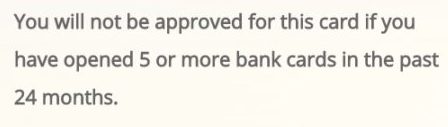

While the policy is unofficial, it did show up on the Sapphire Reserve application very briefly, though it was quickly removed:

5/24 doesn’t look at card applications. It only counts the number of credit cards (on the single report that they pull) that have been opened within the past 24 months. The report that Chase pulls can vary from card to card and state to state.

You can get all 3 of your reports (Experian, Equifax, and Transunion) for free on annualcreditreport.com to see how many cards you have that have been opened within the past 24 months.

If you’re just starting with credit cards, you’ll want to start off with Chase cards that may be harder to get later on due to 5/24. A card like Chase Chase Sapphire Preferred® Card® Card is a great way to transfer Chase points into miles. You can read more about it here and you can read about creating a Chase Quinfecta here.

Chase has several great business cards as well that are subject to 5/24, though it’s worth noting that business cards from AMEX, Barclaycard, BOFA, Chase, Citi, and USBank don’t show up on your report and don’t count towards 5/24. Spending on these cards also won’t affect your credit score as they’re not on your report. Business cards from Capital One (except Spark Cash cards opened after 10/1/20) and Discover do show up on your report and will affect 5/24.

That means you can signup for business cards and not worry about that setting you back for the next time you want a Chase card.

Authorized user cards are where things get tricky. If you are an authorized user on someone else’s card, the system automatically counts those cards towards your 5/24 count. Even if you call reconsideration, they will turn you down for 5/24 based on having authorized user cards that were opened in the past 24 months. However if you tell the reconsideration rep that you aren’t financially responsible for the authorized user cards then they will not count them towards 5/24. If you have any issues you can ask for a reconsideration supervisor and tell them that you aren’t financially responsible for the cards. You can HUCA if you are still denied due to authorized user cards.

Store cards that are only good for use in a single store are also tricky. The system will count them, but you can explain to a reconsideration rep or supervisor that the card can’t be used anywhere but that store and then they won’t count towards 5/24.

Before calling reconsideration, be sure to know exactly how many cards you have opened in the past 24 months. That way when a rep tells you that you are at 9/24 you can ask for a manager and explain that authorized user cards and store cards should not count. Be sure to remember to stress that you aren’t responsible for the authorized user card!

Do you try to stay under 5/24 to get approved for more Chase cards? Or do you not even try to stay under 5/24 and focus on cards from other banks?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

83 Comments On "It’s 5/24 Day; What’s Your Chase 5/24 Strategy?"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Playing 2-player version, will take turns going on/off 5/24 as needed.

2 player version is why I got married at 23 😉

Lolol!

Dan,23 is old for marriage, isn’t it?

You must be joking

Please! We all know he had to accumulate miles to pay for the ring. Stop it already.

Dan

What can I do with avios points?

I dont travel international and I mostly use my miles to fly my son home from Calif for yom tovem.

And mostly via United to Newark as I’m in nj

Thank you for any help

Jacob

Fly American or Alaska domestic?

You need to call BA to fly Alaska domestic using Avios. They fly from LAX nonstop to Newark and JFK.

You could sell them.

We are still trying to figure out the best strategy for our family we have a mix od personal and business cards but will soon be traveling very frequently from Japan to stateside (3-4 times a year) and what to maximise our points. Any suggestions on where to start?

How can one be not financially responsible for an authorized user? That seems quite illogical. If that authorized user fails to pay, won’t the bank come after the original card holder for payment? And if the original card holder doesn’t pay the charges racked up by the authorized user, won’t it show up on the original card holder’s credit report?

You have it backwards. The AU is saying they are not responsible for the cardholder and that the AU card should not be counted as part of 5/24.

Dan, I think you should try re-wording it, because I understood it the way he did too.

Me too

5/24 can still be circumvented via a targeted offer ONLY IF YOU HAVE A SET APR!

This offers can be found in branch or online

“Selected For You”/”Just For You” Offers.

As always YMMV

Any update on the british devaluation?

Expect things to cost more 10-30% more Avios.

before 5/24 how often could you recycle the same card on chase?

As often as you wanted on many cards.

I GOT ON AMEX BIZ GOLD 2ND TIME AFTER 2-3 YEARS

Store card one of 5/24, not approved including HUCA

Is there store card valid anywhere or only at the store?

Try more HUCA and ask for a manager.

It is a Target store card, will try again but manager said it is a line of credit and is counted.

I’d still HUCA some more.

From my experience HUCA by reconsideration depot dont work beacuse thay say that you spoke to someone about this application and it was turned down you can try to reapply… Dan. What do you say ?

Always try to start talking and give your argument before they put you on hold to see what’s doing. Then they know what you want as they read the old history and your argument makes sense.

Hey, i have the Sapphire Preferred and want to downgrade it… i called chase they said i can chose freedom, freedom unlimited (which i have) or the regular Sapphire which apparently you can no longer sign up for,.

i already have a freedom unlimited, and i was wondering if i should get another one or the regular Sapphire, anyone can shed some light on the benefits of the Sapphire and what i should get?

thanks

Get the Freedom.

i figured i would sign up for that and get the sign up bonus?

You can apply for it and get a signup bonus and then downgrade the Sapphire Preferred to a 2nd Freedom, allowing you to earn 5x on $3K/quarter instead of $1.5K/quarter.

Got it. So I’m assuming there is zero advantage to having the regular Sapphire card? (For example if I don’t think I will take advantage of the 5x)?

Regular sapphire earns 2 points per dollar on dining, 1 point on everything else, freedom flex and freedom unlimited earn 3 points per dollar on dining… And I’m assuming that if you ever want to apply for another sapphire preferred you would need to product change again, because you can’t have 2 sapphire cards

You can’t get the reg. freedom via signup anymore, only via downgrade. You can still apply and get the bonus on the Freedom Flex even if you have a regular freedom.

obviously the only way around it seems to be business cards however i think many people have a worry of being shut down totally by chase for abusing the system now that they are focusing on it.

on a similar note with the ada\option of more and more airlines to dynamic pricing for redemptions( witness lufthansa today) you are getting squeezed on both ends It’ harder to rack up the miles and harder to get the aspirational redemptions.

Honestly somebody starting out now even if he would be as savvy as dan (admittedly extremely difficult) would find it difficult if not impossible to replicate his successes

If someone is not a frequent flyer (2 or 3 round trips per year and usually NYC to Florida) does it really make sense to play these credit card games? Many non-businesses such as yeshivas, shuls, charities, and government agencies now tack on credit card processing fees which offset any points you may get. I find that people tend to get in over their heads by overspending on their cards and end up paying more in recurring interest charges than they earn in points.

Define game?

You can rack of lots of points by opening up cards strategically and putting spend on cards where the rewards far exceed the costs.

Of course if you’re paying interest that will wipe away the earnings.

@dan, does AUs on your account count for 5/24 ??

Not for you.

Applied for Chase ink (biggest points offer) and they sad they will get back to me. Anythink what I could do to be approved?

I only have 3 cards and 2years credit

Wait. Good things come to those that wait. Don’t call until denied.

i always thought its worth it to call in to get the process expedited in your favor, why do you say its better to wait?

I shudder to think that they might one day extend the rule to 5/48

Dan

Can I fly Alaska airlines with Avios?

yes, if you call BA

Not necessarily. Alaska flights are showing up in Avios searches for over a month now.

I’m in the 5/24 but one of my cc was close right after opened and the other is a bestbuy cc (that actually works every where) there is a chance to call for reconsideration ?

If they extend it to 5/48 when will they release the rules on 6/1?

how many chase cards can i get approved for at once?

Here’s a question: so i am not even at 5/24 with chase and applied for the Hilton Amex and they said i could apply but could not qualify fit the signup offer due to my history with amex. I closed one starwood biz and one delta plat. Does anyone know if there is a way around this or hire Amex decides this?

if your are say 4/24 you can try to apply for 2 or 3in one day which sometimes works

Hi Dan,

Dan,

I just applied for a chase ink business cash card. I’m a therapist and wrote “sole proprietor” and applied with my name and social as tax ID. Is it a bad sign if they said they have to look into it more? I haven’t opened or named myself as authorized user on more than 3 cards in the past several years and my credit is excellent.

Normal.

dan what about having one spouse stay under 5/24 and just apply for business cards while the other goes all out foregoing future chase cards

Do closed accounts within 5/24 or accounts open more than two years ago qualify for 5/24?

Does the au count if the au was within 5/24 or the primary account was opened within 5/24?

It’s been well over 4 years since I signed up for my Chase Sapphire Reserve so I’d like to sign up again to get another welcome bonus. How do I got about that? Do I have to cancel my existing one first? If yes, can I apply for a new one immediately or is there a waiting period?

Thanks!

You can downgrade it to a Freedom or Freedom Unlimited card, wait 3 days, and then apply for the Sapphire Reserve.

More info:

https://www.dansdeals.com/credit-cards/earn-60000-points-chase-sapphire-reserve-card-highest-signup-offer-since-launch-offer/

Thanks for clearing that up!

Loving the chase ecosystem; currently combining a 5X groceries FU with CSR to buy gift cards for amazon, southwest, Marshalls, etc. Racking those UR points 🙂

my question is:

I know transferring UR is best value, but lets say I wanted to use the travel portal with a Reserve. Do I lose member perks such as late checkout, free wifi etc when booking OTAs like chase/expedia portal?

Thanks in advance

Yes, you generally do lose out on hotel elite benefits. That’s why it’s better to use Pay Yourself Back for dining, grocery, or home improvement purchases:

https://www.dansdeals.com/credit-cards/wow-highest-ever-signup-bonus-earn-80000-points50-grocery-credit-chase-sapphire-preferred-card/#Pay_yourself_back

How do you get 5 points per dollar on the freedom unlimited?

1st year on a new freedom unlimited

Thanks Dan!

+1 about the Pay yourself Back; highfliers/value maximisers may scoff but when combined with ancillary costs of luxury hotels or not valuing a business class ticket at a marginal benefit much higher than coach, pay yourself back is the best value for me.

On a related note, I hope i ain’t gambling on Primary coverage by renting a car with a reserve though the portal. the price was good and the ability to prepay with free cancellations was too good to pass up. I have had too many unpaid car rentals cancelled for this summer what with rental shortages and all. The language of user agreement suggest points will still count as reserve purchase, but paid with a mixture of cash and points just in case.

David:

there was a sign up bonus 5x on groceries first first year (up to 12000 in spend). got it last September, was hoping to get my wife one when my year was up, but it is no longer available

Hey at Dan, this week I was banned from Chase as they decided to end the relationship with me. I have done absolutely nothing wrong I have not manufactured any points. I haven’t done anything illegal but it seems like there is nothing left to do. I appealed with Chase executive office and my appeal was denied. I now need to start with the brand new system such as with American Express. Do you recommend any cards?

Authorized user card are counted unless you say the magic words “not financially responsible”? What’s the logic behind it? Don’t they know already that authorized users are not financially responsible for the card?

If I’m at 5/24 will Chase automatically decline me for one of their business cards?

Does anyone know why my wife got the Amex pop-up for the Delta card even though she never had one? (Maybe she did as an authorized user years ago but definitely didn’t get any bonus). It said something like “based on your history… would not be eligible for the bonus”, is it possible she’s not eligible based on the opening and closing of other Amex cards?

Yes. If too many cards etc they can deny for a brand new card that you never got

Is there a easy way to look up when a card was last opened?

Credit karma

@Dan Iv been a sapphire reserve card card holder since day 1 and want to get the sign up bonus for the preffered will my annual fee be prorated on the reserve if I downgrade to open the other card and will I be losing any benefits from the reserve card if I reopen it a few months down the line now that it wouldn’t be from 4+ years ago or benefits will stay the same $450 AF……

Please explain why 1.5 pay yourself back with csr is better than a 2% cash back card. Thanks

If, for example, you put all your spending on the chase freedom unlimited at 1.5 points per dollar, and then transfer your points to the sapphire reserve and redeem them for 1.5 cents per point, you will end up with 2.25 cents per dollar (1.5 x 1.5).

Thank you. So it’s only better if you combine points. I think its better to get 2% across the board without the 595 annual fee ..

…if you only plan on using pay yourself back, as opposed to transferring the points to airline/ hotel points, which is one of the benefits of the sapphire reserve, and if you have no use for the other benefits.

$550 fee minus $300 back on any travel

hi, i need a free card that offers car rental insurance. which card serves me better, chase or amex?

will it help if I close one of my credit cards so i would have only 4/24?

Hi Dan, you wrote the following above:

“Business cards from Capital One (except Spark Cash cards opened after 10/1/20) and Discover do show up on your report and will affect 5/24.”

If I already have a Capital One Spark that was opened prior to 10/1/20 is there a way to not have it reported on my credit report or would I need to cancel and reapply? (I would prefer that it didn’t show up in regards to the statement balance/credit utilization not 5/24) TIA

If i have additional users under my account do they count towards my 5/24?

No, it counts towards theirs.

Is it a guarantee that it can be wiped from their 5/24.

Can it help the au credit if I add them to the venture x card if I don’t give them their social?

Just commenting that because of me opening up business cards with mainly amex I already dropped below 5/24 and got my first chase card in over two years. I thought that I was at 5/24 since my Helzberg account would count as a credit card account. However it seems it did not as I was instantly approved for chase ink business card. Amex has this new feature where it shows me my credit score and history from transunion for free and it had summary of accounts and inquiries in the last two years. it said 4 accounts. I investigated the hezlberg account and sure enough it says account type ‘charge account’ whereas the other cards said credit card. I believe chase is probably using this linformation to determine eligibility and since it us only valid to use at helzberg then it is not marked as credit card hence not part of 5/24 account.