DansDeals will receive compensation if you are approved for a credit card via a link in this post. Terms apply to American Express benefits and offers, visit americanexpress.com to learn more.

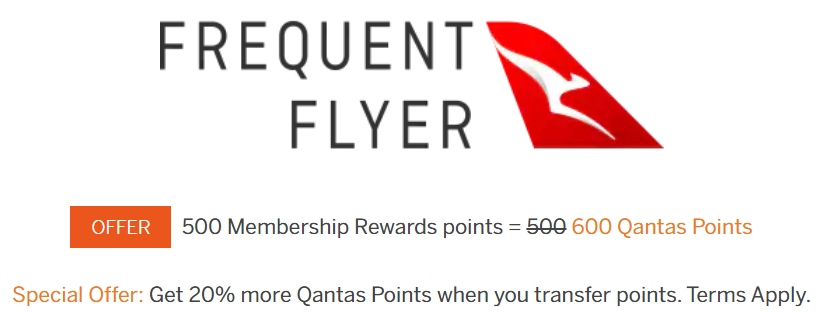

Check To See If You’re Targeted For A 20% Bonus For Transferring AMEX Points To Qantas

Login to AMEX via the link above and you can see if you are targeted for a 20% bonus when you transfer AMEX Membership Rewards points to Qantas. If you are targeted it will show a 500:600 transfer ratio. Otherwise you’ll see the usual 500:500 transfer ratio. The offer may expire at any time.

You can also currently get a 25% bonus for transfers from Citi to Qantas through 2/22.

As you can see from this miles expiration post, Qantas points won’t expire as long as you earn or redeem 1 mile every 18 months.

Qantas now partners with Air France/KLM Flying Blue for more reward flight options, though they add fuel surcharges for those flights.

You can use 37.8K Qantas points in coach, 70,800 Qantas points in premium economy, or 90K Qantas points in business for a one-way ticket on El Al between NYC and Tel Aviv without fuel surcharges, but El Al does block some of the space on the route:

Additional reading:

- Everything You Need To Know About Booking El Al Awards With Qantas!

- How Bad Is El Al’s Blocking Of Business Class Award Space For Partner Airlines?

Are you targeted for this promotion?

HT: Nick

![[United Update] Israel Flight Change Policies And Next Bookable Flights For Major Airlines](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

Leave a Reply

7 Comments On "Check To See If You’re Targeted For A 20% Bonus For Transferring AMEX Points To Qantas"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Where can I see the complete chart for what Qantas charges on flying blue flights? Also is it possible to get on any airFrance operated flight ?and whats the best way to find award space and book .thanks!

I am having all sorts of trouble with Qantas. It’s really hard to communicate with them. Sometimes SMS works sometimes Twitter is better. Anyway … Dumped 350k MR into Qantas and now regret … As usually had to listen to DAN and not transfer just because it’s available.

You can book me flights for a discounted price

No problem. Just send me your SSN and banking account info

Not quite

I transferred over a million amex points to qantas and I totally regret it. I did it basically for the EL AL flights, but there is a fraction of the availability on points as there is on EL AL directly (and of course just that is hard to find). I strongly suggest anybody thinking of transferring because of elal to think again.

Qantas no longer sells EL AL, they do sell AA direct to TLV, however, the taxes/fees they charge is more than what it costs to buy a ticket without points. I’m stuck with 175k points with Qantas based on my bonus transfer back when they had this targeted offer.

Any suggestion here?