Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Originally posted on 8/11:

Citi Double Cash Card Limited Time Offer

Table of Contents

Citi Double Cash Card Limited Time signup bonus

For a limited time only you’ll earn $200 cash back in the form of 20,000 ThankYou points for spending $1,500 in 6 months on a new Citi Double Cash Card.

This card rarely offers any signup bonus, making this a great offer for an incredible card! It’s also the highest signup bonus for this card to date.

Citi Double Cash Card annual fee

$0.

Citi Double Cash Card signup bonus rules

As with the Citi Rewards+ limited time offer, you are eligible to receive the bonus on this card no matter what your history is or even if you already have this card.

Best of all, opening or closing the Double Cash card won’t affect your ability to open a Citi Premier® Card and get the bonus for that card.

Citi allows applications for 1 card every 8 days and 2 cards every 2 months. You can check application status at 866-252-0118 and you can call reconsideration if you’re denied at 800-695-5171.

Citi Double Cash Card earnings

This card earns 2% cash back everywhere, in the form of 2 ThankYou points per dollar spent.

That is an excellent earn rate for a flexible currency that lets you have the best of both worlds, cash or points on demand as you want it.

You can redeem those points for 2% cash back with no minimum required to cash out, or you can transfer them into miles if you have a Citi Premier® Card .

Citi also often offers discounted gift cards with ThankYou points, which can offer even more value.

If you also have a Citi Rewards+ you’ll get also a 10% rebate, up to 10,000 points rebated per year, when you redeem points!

Citi Double Cash Card zero APR on balance transfers

- Get 0% intro APR on balance transfers for 18 months from date of the first transfer.

- Balance transfers need to be completed in the first 4 months of account opening.

- There is a balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater.

Citi Double Cash Card Non-expiring points

Your Citi ThankYou points will not expire for as long as you remain a cardholder. If you transfer points to another member points will expire in 90 days.

Citi Double Cash Card Virtual card numbers

While Citi co-branded cards like their AA cards no longer offer virtual card numbers, their ThankYou cards like this card still do.

With a virtual card number you can set a dollar limit and/or expiration date to generate a one-time use credit card number so that you don’t keep getting charged for subscriptions or have your real card number stolen, among myriad other potential uses.

Citi Double Cash Card points transfers and card conversions

You can transfer Citi points to anyone, but once you transfer points they will expire in 90 days, so only do that if you’re ready to transfer them into airline miles or redeem them another way within that timeframe. You can share 100K points per calendar year and you can receive 100K points per calendar year.

You can convert any Citi card into another Citi card. For example, even if you have a Double Cash card, you can get approved for another one and then convert it to a card like Citi Custom Cash® Card which you can’t get approved for if you already have one, but you can get multiple of via product changes.

Citi Bifecta, Trifecta, Or Quadfecta

Citi has 3 excellent no annual fee cards that pair perfectly with a Citi Double Cash Card. Any of them paired with the Premier card will make for an incredible bifecta, trifecta, or quadfecta:

With the Citi Double Cash Card you earn 2 ThankYou points per dollar everywhere. You can cash these out for 2% cash back or you can combine a Double Cash card with a Premier card and you’ll also be able to earn 3 points on dollar on gas, dining, groceries, airfare, hotels, and travel agents, plus have the ability to transfer points into airline miles and hotel points. You will also get 0% APR on balance transfers for 18 months.

The Citi Custom Cash® Card offers 5 points per dollar on up to $500 in purchases in your top eligible spending category each billing cycle. This is marketed as 5% cash back, but will actually come in the form of 5 ThankYou points per dollar spent! Eligible categories include Restaurants, Gas Stations, Grocery Stores, Select Travel, Select Transit, Select Streaming Services, Drugstores, Home Improvement Stores, Fitness Clubs, and Live Entertainment. You will also get 0% APR on purchases and balance transfers for 15 months.

The Citi Rewards+® Card automatically rounds up rewards earned on every purchase to the nearest 10 points, meaning you will earn 10 points on a $0.50 Amazon balance reload, which is equal to earning 20 points per dollar spent! You will also get 0% APR on purchases and balance transfers for 15 months.

Having a Citi Rewards+® Card also gets you a 10% points rebate when you redeem points, up to a 10K points rebate per year. While the Rewards+ card doesn’t transfer points into most airline miles, if you have a Citi Premier® Card and a Rewards+ card you’ll even get a 10% rebate on mileage transfers!

The Citi Premier® Card Card allows you to transfer all of your ThankYou points into miles with many valuable programs. It earns 3 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining.

A Citi Bifecta would consist of a household that has the Citi Premier® Card and the Citi Double Cash or Citi Rewards+. The total effective annual fee would be just $95. With Citi Premier® Card and Citi Double Cash you can earn 2 points per dollar everywhere and 3 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining. Plus you can transfer your points into miles. With Citi Premier® Card and Citi Rewards+ you can earn 10 points on all small purchases and 3 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining. Plus you’ll earn 5 points per dollar on restaurants for your first year, you can transfer your points into miles, and get a 10% points rebate on up to 100,000 points redeemed per calendar year. That means you’ll effectively earn 11.1 points on small purchases and 3.33 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining or 5.55 points per dollar on restaurants for your first year. If both members in a household have a Citi Premier® Card and Citi Rewards+ then both members can each get the 10% rebate on up to 100,000 of points redeemed per year.

A Citi Trifecta would consist of a household that has the Citi Premier® Card, the Citi Double Cash, and the Citi Rewards+. The total effective annual fee would be just $95. With those 3 cards you can earn 10 points on all small purchases, 2 points per dollar everywhere, and 3 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining. Plus you’ll earn 5 points per dollar on restaurants for your first year, you can transfer your points into miles, and get a 10% points rebate on up to 100,000 points redeemed per calendar year. That means you’ll effectively earn 11.1 points on small purchases and 3.33 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining or 5.55 points per dollar on restaurants for your first year.

A Citi Quadfecta would consist of a household that has the Citi Premier® Card, the Citi Double Cash, the Citi Rewards+ and the Citi Custom Cash® Card. The total effective annual fee would be just $95. With those 4 cards you can earn 10 points on all small purchases, 5 points per dollar on $500 of monthly purchases in your top categories that month, 2 points per dollar everywhere, 3 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining, and 5 points dollar on restaurants for your first year. Plus you can transfer your points into miles and get a 10% points rebate, meaning you’ll effectively earn 11.1 points on small purchases, 5.55 points per dollar on $500 of purchases in your top categories, 5.55 points per dollar on restaurants for your first year, 3.33 points per dollar on airfare, hotels, travel agents, groceries, gas, and dining, and 2.22 points per dollar everywhere.

You can freely convert between all of these card products, as well as to most other Citi cards!

Closing a ThankYou point card means you can’t get a bonus on a Citi Premier® Card for 24 months, so you should always choose to change to another card instead of closing it. Ask the agent if your card number will remain the same so that you will still be eligible for more signup bonuses.

Point transfer options with Citi Premier® Card

If you also have a Citi Premier® Card , you can transfer points into miles. Plus you’ll get a 10% points rebate when you transfer miles or cash out if you also have a Citi Rewards+ Card!

Alternatively, you can upgrade your Rewards+ card to Premier in order to make a mileage transfer.

- Citi mileage transfer partners now include:

- Aer Lingus, via Qatar: 1K:1K

- Aeromexico (Skyteam): 1K:1K

- Air France/KLM Flying Blue (Skyteam): 1K:1K

- Avianca Lifemiles (Star Alliance): 1K:1K

- British Airways, via Qatar (OneWorld): 1K:1K

- Cathay Pacific Asia Miles (OneWorld): 1K:1K

- Emirates: 1K:1K

- Etihad: 1K:1K

- EVA (Star Alliance): 1K:1K

- Garuda Indonesia (Skyteam): 1K:1K

- Iberia, via Qatar (OneWorld): 1K:1K

- Intermiles: 1K:1K

- JetBlue: 1K:1K

- Malaysia (OneWorld): 1K:1K

- Qantas (OneWorld): 1K:1K

- Qatar (OneWorld): 1K:1K

- Singapore (Star Alliance): 1K:1K

- Thai (Star Alliance): 1K:1K

- Turkish (Star Alliance): 1K:1K

- Virgin Atlantic: 1K:1K

- Choice Privileges: 1K:2K

- Wyndham: 1K:1K

With a Citi Rewards+ card you’ll get a 10% points rebate per calendar year, making the effective transfer ratio 0.9 Citi points for 1 airline mile!

Sample mileage uses:

Turkish Airlines:

As I’ve written about before, Turkish Airlines has a ridiculously generous Star Alliance award chart.

And they don’t charge any fuel surcharges for United flights.

Here is the North America version of the chart with one-way award pricing:

| Between the US and: | Economy | Business | First |

|---|---|---|---|

| US, including Alaska, Hawaii, Puerto Rico, and USVI | Was 7.5K Now 10K | Was 12.5K Now 15K | N/A |

| North America | Was 10K Now 30K | Was 15K Now 40K | N/A |

| Western Europe (2) | Was 30K Now 55K | Was 45K Now 90K | Was 67.5K Now 135K |

| Eastern Europe (1) | Was 30K Now 50K | Was 45K Now 85K | Was 67.5K Now 130K |

| Turkey | Was 30K Now 40K | Was 45K Now 65K | Was 67.5K Now 100K |

| Middle East | Was 32K Now 58K | Was 47K Now 93K | Was 68.5K Now 140K |

| North Africa | Was 30K Now 60K | Was 49K Now 105K | Was 73K Now 160K |

| Central Africa | Was 30K Now 65K | Was 49K Now 125K | Was 73K Now 190K |

| Southern Africa | Was 45K Now 75K | Was 67.5K Now 140K | Was 100K Now 210K |

| Central Asia | Was 34K Now 60K | Was 52.5K Now 100K | Was 77K Now 150K |

| Far East | Was 45K Now 75K | Was 67.5K Now 130K | Was 100K Now 195K |

| South America and Oceania | Was 52.5K Now 90K | Was 75K Now 140K | Was 115K Now 210K |

As part of the Star Alliance, Turkish can book award travel on airlines like United and Air Canada.

You can open a Turkish Airlines mileage account online (Hint: Your password must be exactly 6 numbers or else it will give an error).

And you can book Star Alliance awards with Turkish miles here (Login and then click this link again). You can’t search for partner awards from their home page. Search for one-way at a time for best results.

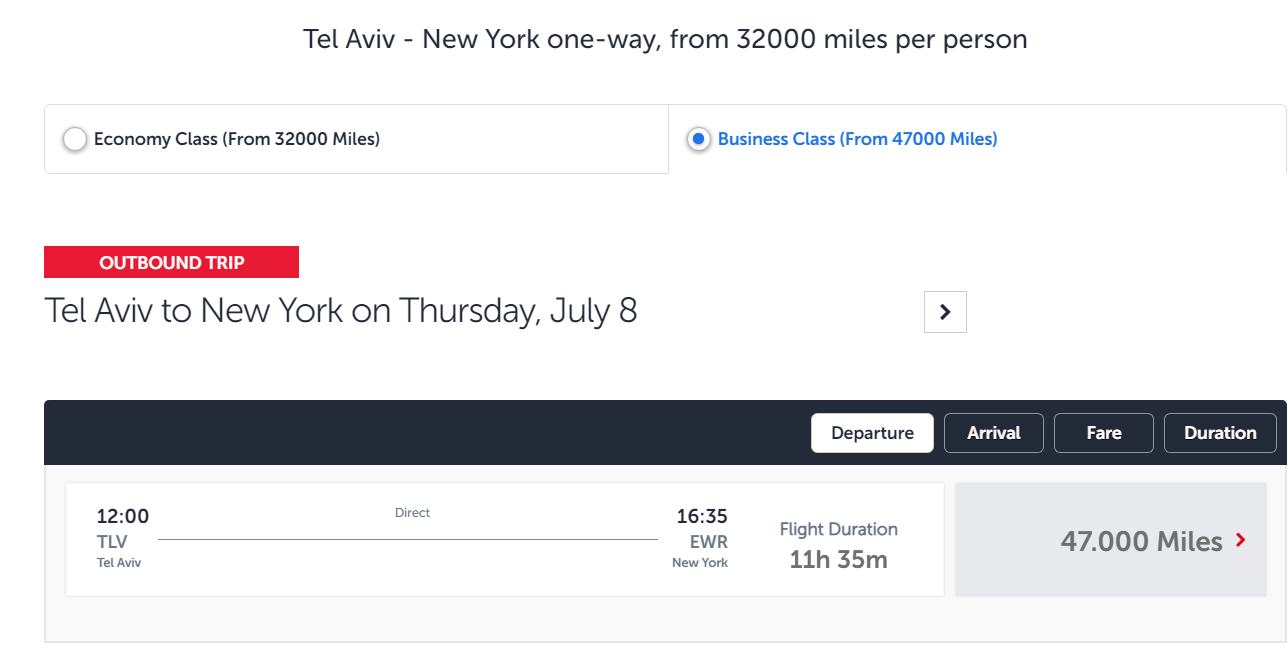

For example you can transfer miles to Turkish Airlines to fly from the US to Tel Aviv on United for just 32K points, or 28.8K points in coach after the 10% rebate with a Rewards+ card:

Or 47K points in Polaris business class (42.3K after the 10% rebate with a Rewards+ card):

There are lots of other bargains, all of which will be 10% less with a Rewards+ card:

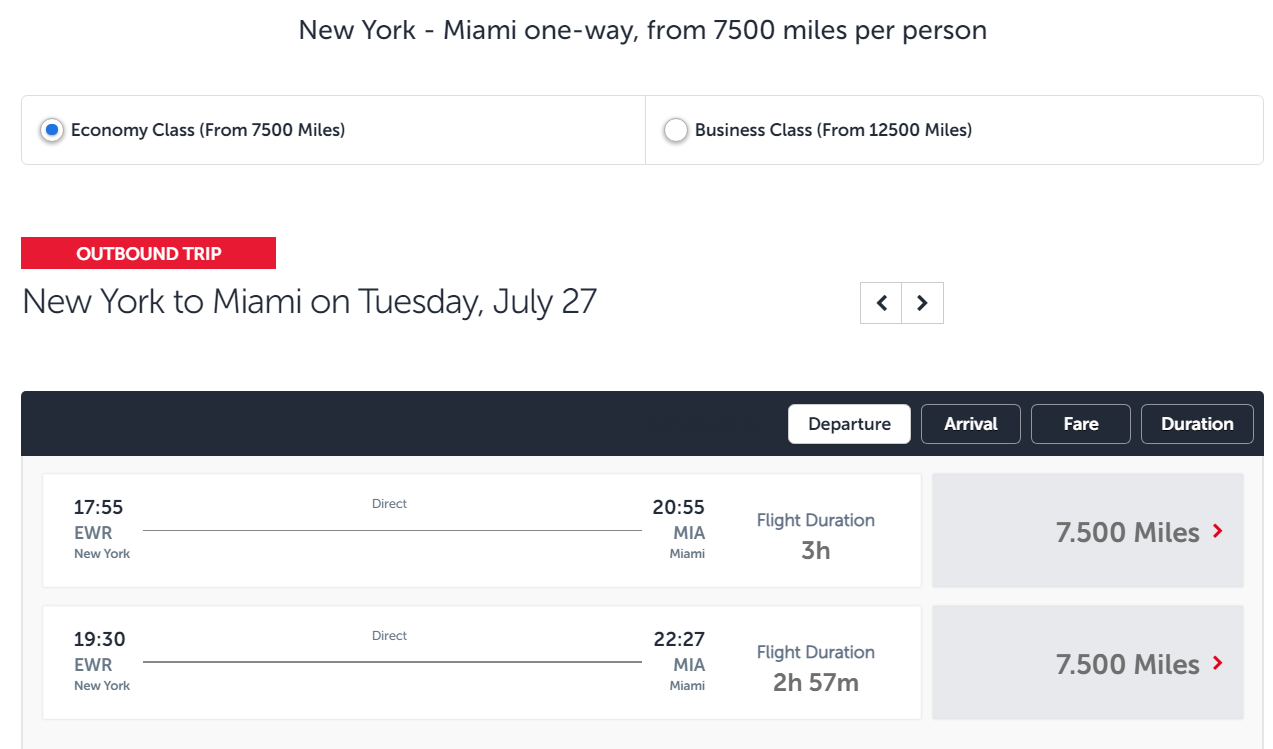

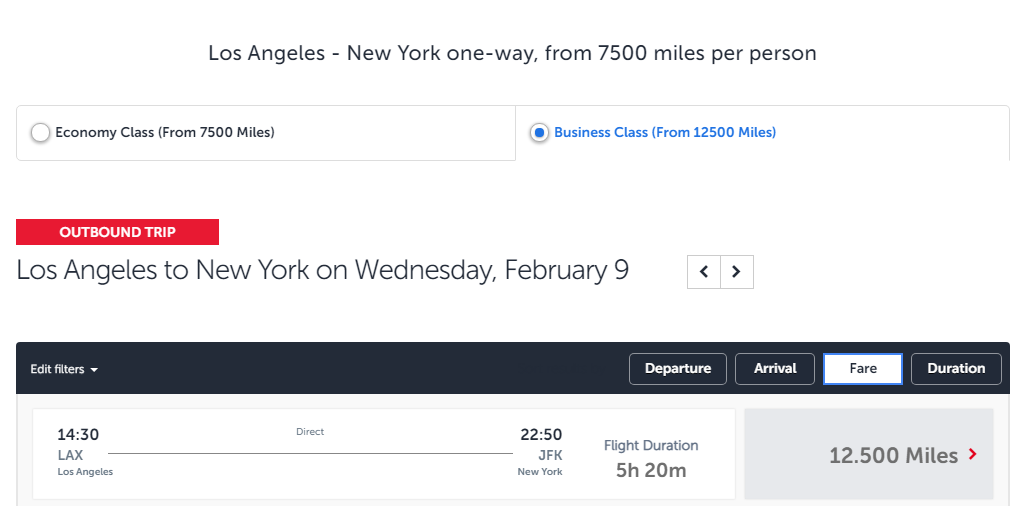

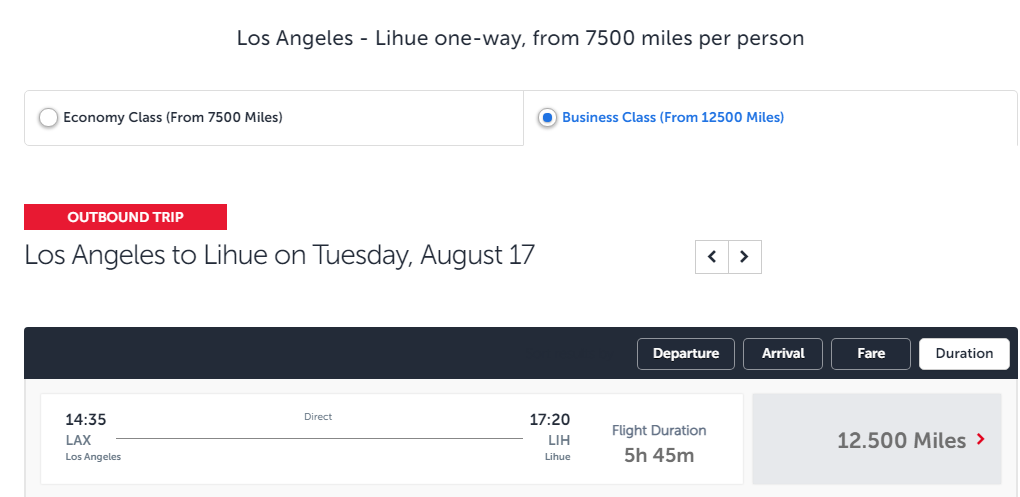

- Fly one-way anywhere in the US, including Alaska, Hawaii, Puerto Rico, and USVI, for just 7.5K miles in coach or 12.5K in business class on United with no fuel surcharges.

NYC to Miami in economy for 7.5K or business for 12.5K:

LA to NYC in economy for 7.5K or lie-flat business for 12.5K:

LA to Kauai in economy for 7.5K or business for 12.5K:

- Fly one-way anywhere in the US to Canada or Mexico for just 10K miles in coach or 15K in business class on United with no fuel surcharges.

NYC to Cancun in economy for 10K or business for 15K:

- Fly one-way to Europe for 45K in business class on United with no fuel surcharges.

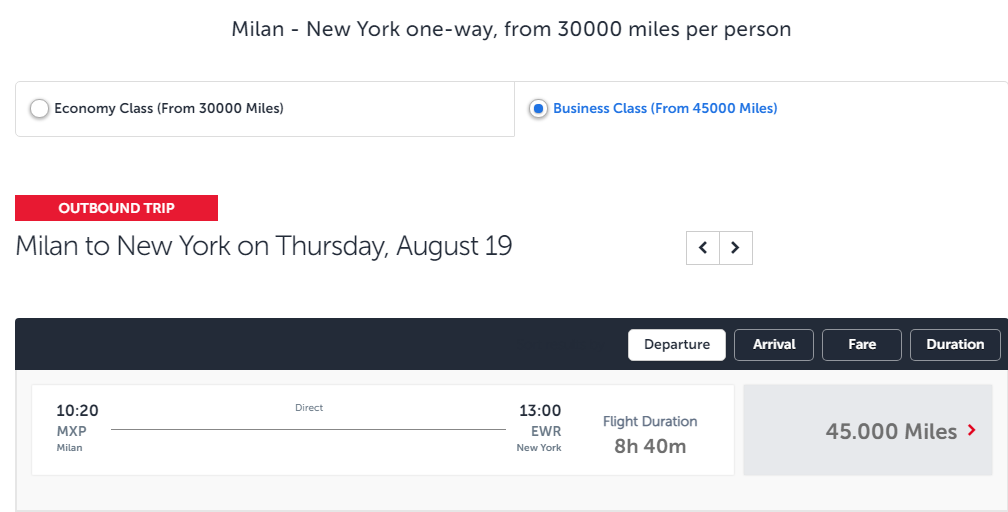

NYC to Milan in economy for 30K or business for 45K:

Qantas:

With Qantas miles you can redeem for El Al award tickets without any fuel surcharges! You read more about this option here. Plus there have been transfer bonuses in the past.

- A one-way coach ticket from NYC to Tel Aviv on El Al is 37.8K Qantas miles and there are no fuel surcharges.

- A one-way premium economy ticket from NYC to Tel Aviv on El Al is 70.8K Qantas miles and there are no fuel surcharges.

- A one-way business class ticket from NYC to Tel Aviv on El Al is 90K Qantas miles and there are no fuel surcharges.

You can also redeem for tickets on American:

- A one-way coach ticket from NYC to Tel Aviv on AA is 31.5K Qantas miles plus $323.

- A one-way business class ticket from NYC to Tel Aviv on AA is 82K Qantas miles plus $323.

Avianca Lifemiles: Awards on United start at just 6.5K miles and as low as 5.2K miles with frequent 25% transfer bonuses.

Flying Blue: Fly from Los Angeles to Tahiti in lie-flat business class for 64K miles. 37K Flying Blue miles is enough to fly nonstop on Delta between North America and Israel.

Emirates: With 135K Emirates miles you can fly round-trip in A380 Shower Class from JFK to Milan. With 217.5K Emirates miles you can fly round-trip in A380 Shower Class from JFK to Dubai.

View this post on Instagram

JetBlue: Book awards with free cancellations.

Cathay Pacific: Avoid and lower fuel surcharges on partner airlines like AA and BA. With 90K Cathay Pacific Asia Miles miles you can book a round-trip business class award between North America and Europe.

Singapore: Book highly rated premium cabin or suites on Singapore flights that are blocked with partner miles.

Virgin Atlantic: Bargains on ANA First Class suites and on Delta flights. 7.5K Virgin Atlantic miles is enough for a Delta short-haul flight and 50K is enough to fly nonstop on Delta between North America and Israel.

You only need 55K Virgin Atlantic miles to fly one-way between the US west coast and Japan or 60K miles to fly one-way between the US east coast and Japan in first class.

Dan’s Quick Thoughts:

The Citi Double Cash is one of the most versatile cards around, thanks to the ability to spend now and decide later if you want 2% cash back or 2 miles per dollar or 10% more if you pair it with a Rewards+ card.

With no annual fee and a rare signup bonus, it’s a great card to add to your wallet, though note that you will need the Citi Premier® Card to transfer points to airline miles or hotel points.

Related post: How To Maximize A Citi Quadfecta To Earn Cashback Or 2.22-5.55 Turkish, Or Qantas Miles Per Dollar

Will you apply for a Citi Double Cash Card?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

21 Comments On "Earn A Rare Limited Time Signup Bonus On The Excellent Citi Double Cash Card With Flexible 2% Cash Back Or 2 Miles Per Dollar Earnings!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

If you get this or the Rewards+ does it reset the clock for all TYP cards?

Rewards+ and Double Cash have no signup restrictions.

You can’t get a Premier bonus if you got a bonus or closed a Rewards+, Preferred, Premier, or Prestige within 24 months, so Double Cash won’t affect that either.

“As with the Citi Rewards+ limited time offer, you are eligible to receive the bonus on this card no matter what your history is or even if you already have this card.” I already have the card for a bunch of years they Will still give the bonus? Do you have to ask for it or it’s automatic?

Yes, automatic.

I think he is asking if he will get the bonus for the existing card,

to that, the answer is: NO!!!

Lol, of course. I just assumed he was asking what would happen if he opened another one.

I’ve recently found the following true on almost every credit card balance transfer offer:

The 2% back and the 0% Balance Transfer is effectively an either/or situation. If you have any balance from a 0% balance transfer and then make a purchase, that purchase will accrue interest from the date of purchase. More so, in order to be free of interest on that purchase you need to first pay off your entire balance transfer.

So, if you do a balance transfer, you may still get the 2% back on your purchases, but you’ll be paying interest on your purchases until you pay down your entire balance – including the balance transfer you just paid 3-5% to transfer.

So I can get a new card every 2 months and receive the bonus each time?

This offer will not stick around for long…

Is there a way to get the bonus if I already have the card?

Gosh, read the post.

Pandemic has been the most prolific time for me in terms of credit cards approvals but it’s coming to an end. Chase – too many cards in the last 24 months, AMEX – maximum cards allowed, now Citi has said no (for this one? :)). It’s OK, need to wait a little. they even say no to business cards.

Is the double cash better than the freedom unlimited which you earn 1.5 or the chase points is still more worth together with sapphire reserve. Thanks

Same question!

Thanks, just got approved

are there foriegn transaction fees

yes there are..3%

Got this with your link- thanks.

If i move credit from a different citi card to this one, will citi do a hard pull?

Perhaps this no longer works but…can I 3BM (or at least 2BM) this with the Rewards+ and Premier cards?

Link not working

Despite saver award availability on United, I always struggle to find availability using Turkish. I am signed in, and followed the link in the post to search for an award ticket on Turkish. Any suggestions?