United mortgaged their MileagePlus program for a $5 billion loan. American recently did the same thing for AAdvantage for a $5.8 billion loan.

Those transactions aren’t concerning. They will help the airlines maintain liquidity to survive COVID-19 until travel picks back up. United will have a $17 billion war chest by the end of the 3rd quarter, and unless there is a new round of CARES funding, they will start laying off employees then to match the airline size with demand.

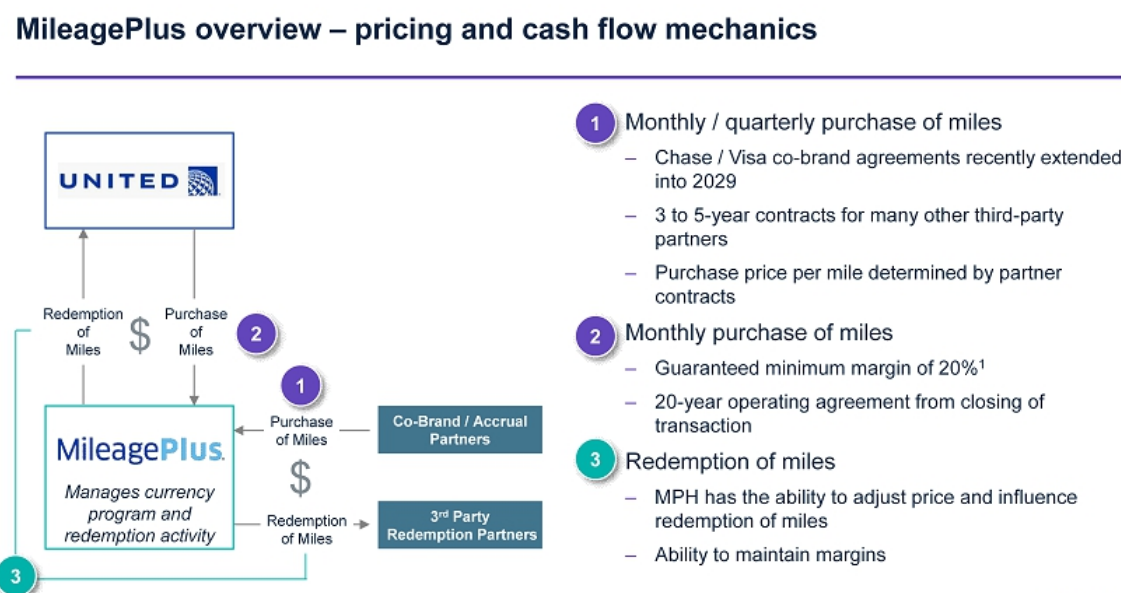

Interestingly, the loan was structured by Goldman Sachs, Barclays Bank and Morgan Stanley, and not by JPMorgan Chase, though perhaps that’s due to the conflict of them being the largest buyer of United miles.

United’s Form 8-K shares several interesting factoids about the airline and MileagePlus.

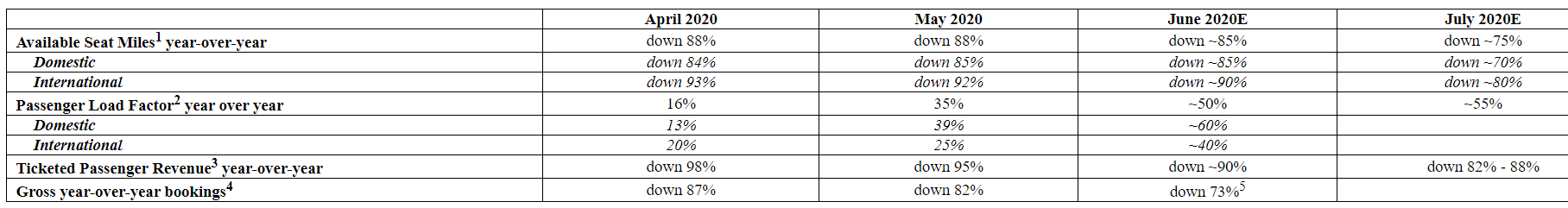

United capacity and available seat miles will be down 75% from last year. That’s a risky strategy as other airlines are not cutting that many flights in July.

Indeed, JetBlue is going on the offensive in response to United’s heavy flight cuts with the launch of 30 new routes that primarily focus on Newark. United may strongly regret their decision to cut so many flights…

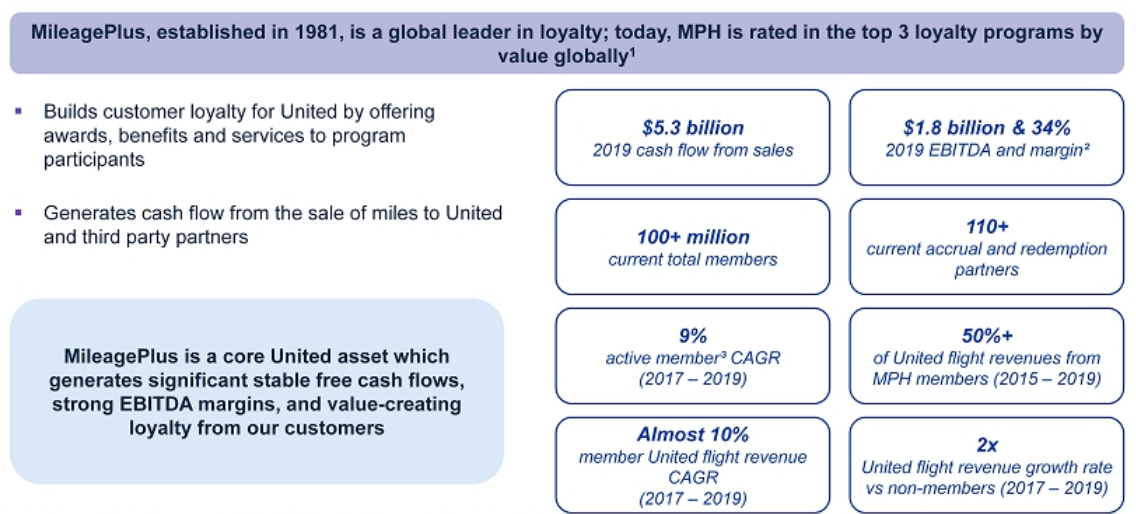

United shares that they make a whopping $5.3 billion from selling miles, of which $1.8 billion is profit. They have over 100 million members, but only 9% of them are active members:

Here’s where the creative accounting comes into play. While once upon a time mileage programs were just about awarding loyal flyers, they have morphed into real profit centers for airlines.

During an interview with an El Al Matmid executive in 2014, I pointed out that El Al seemed to treat the program as a cost center and the executive scoffed at trying to copy US airlines programs to make Matmid more profitable. One thing is certain, El Al would never be able to mortgage Matmid to raise the funds they need today.

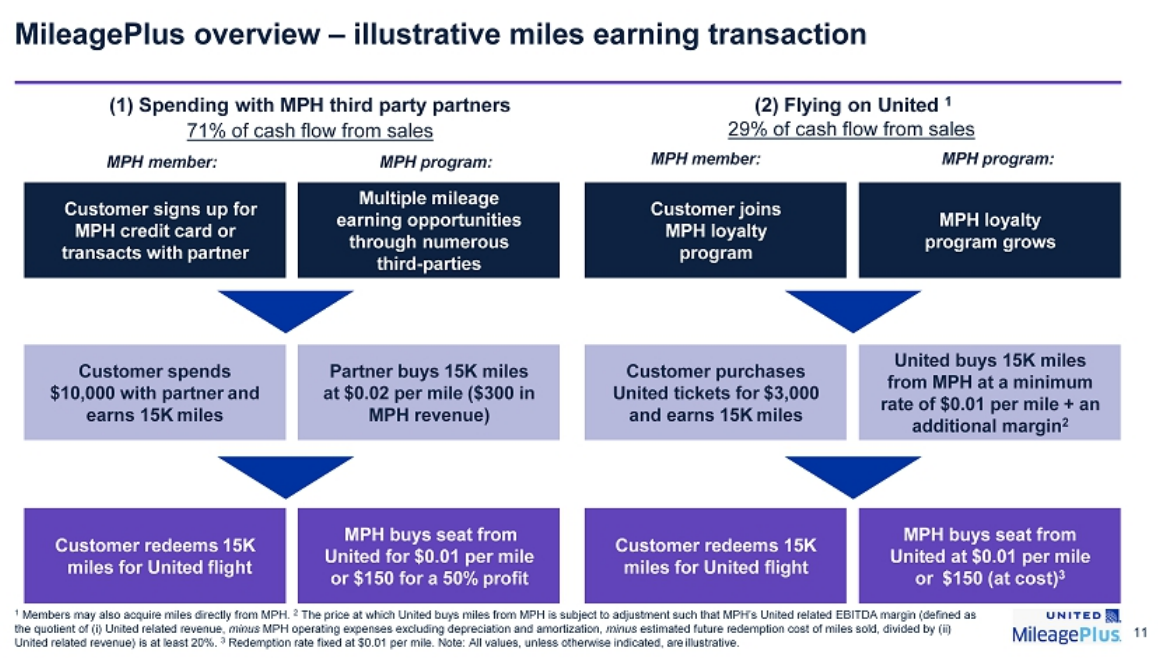

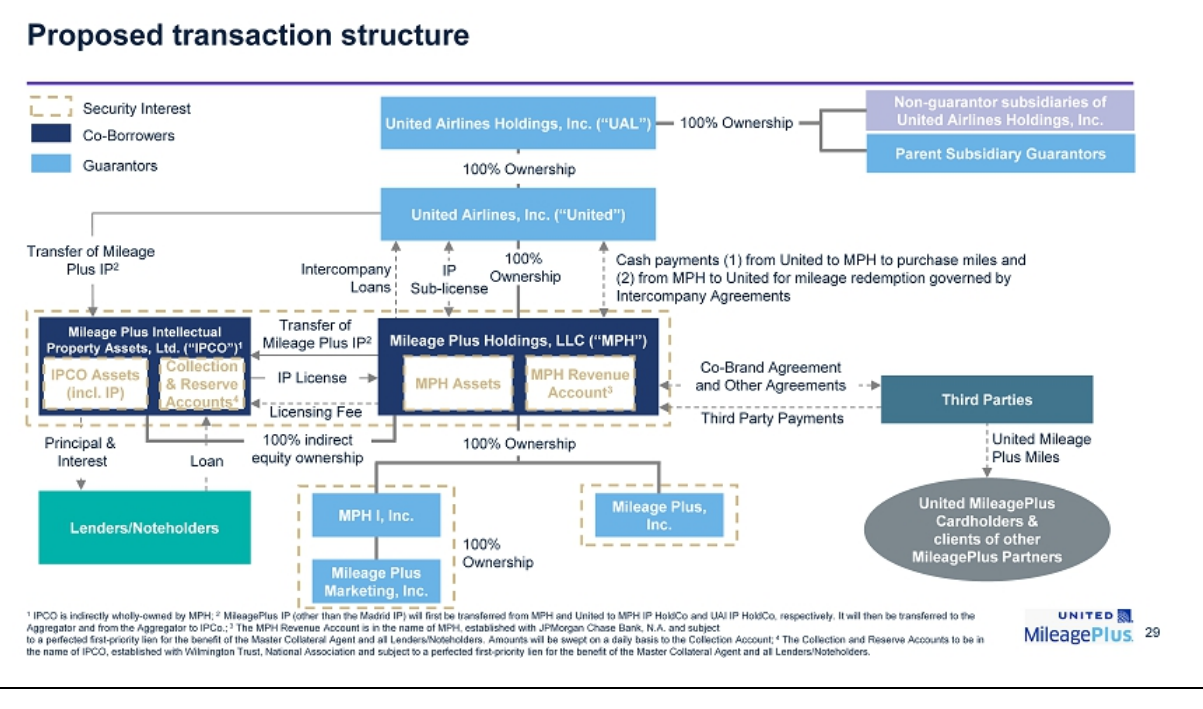

United set up MPH (MileagePlus Holdings) as a wholly owned subsidiary. United buys miles from MPH for flyers, but that makes up just 29% of the cash flow from miles sold. 71% of the miles sold are to outside companies, primarily JPMorgan Chase.

Most miles are then used for travel on United flights.

United gives some examples of mileage sales. In the example, United pays MPH at least 1.2 cent per mile and partners pay MPH 2 cents per mile. When a customer redeems miles, MPH pays United 1 cent per mile.

Does Chase actually pay 2 cents per mile? It’s impossible to know, as these numbers are just for illustration. Odds are that they pay less than that amount, but on the other hand, banks are willing to pay a premium to get exclusivity, and airlines have a lot of leverage to sell that exclusivity. I once heard from a Citi credit card banker that they pay AA 1.8 cents per mile, so anything is possible I suppose.

Even if you make a redemption where you get a value of 5 cents per mile, it still doesn’t cost United or MPH more than 1 cent per mile, and that’s how mileage programs are lucrative for all parties involved.

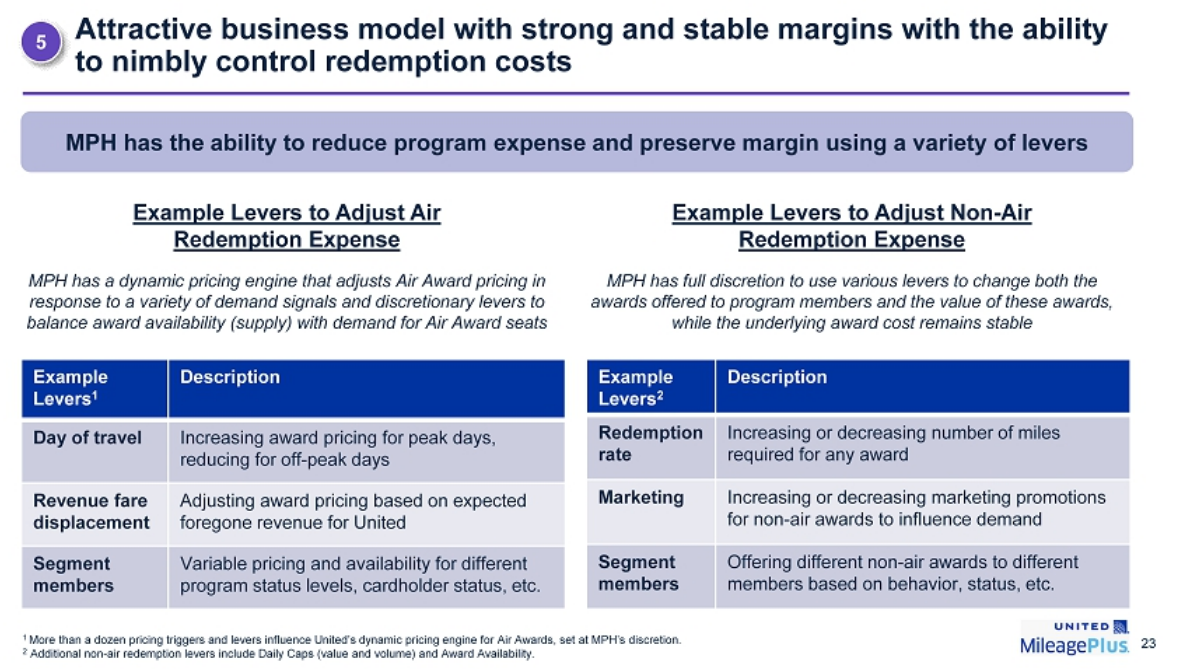

United notes that the great thing about their program is that they are in total control of the cost of redemptions. Then again, devaluations can turn people off of the program, which would lower the value of the program…

I’m not quite sure how San Francisco can make up 7% of the over 100MM MileagePlus members, considering that the entire San Jose–San Francisco–Oakland, CA Combined Statistical Area only has 4.7MM people and 7% of the program would mean multiple accounts for every single resident of that region. Same goes for several other cities listed.

I guess they’re just talking about 7% of the 9% of members who are active? That would mean 630,000 active members in San Francisco, which seems far more plausible.

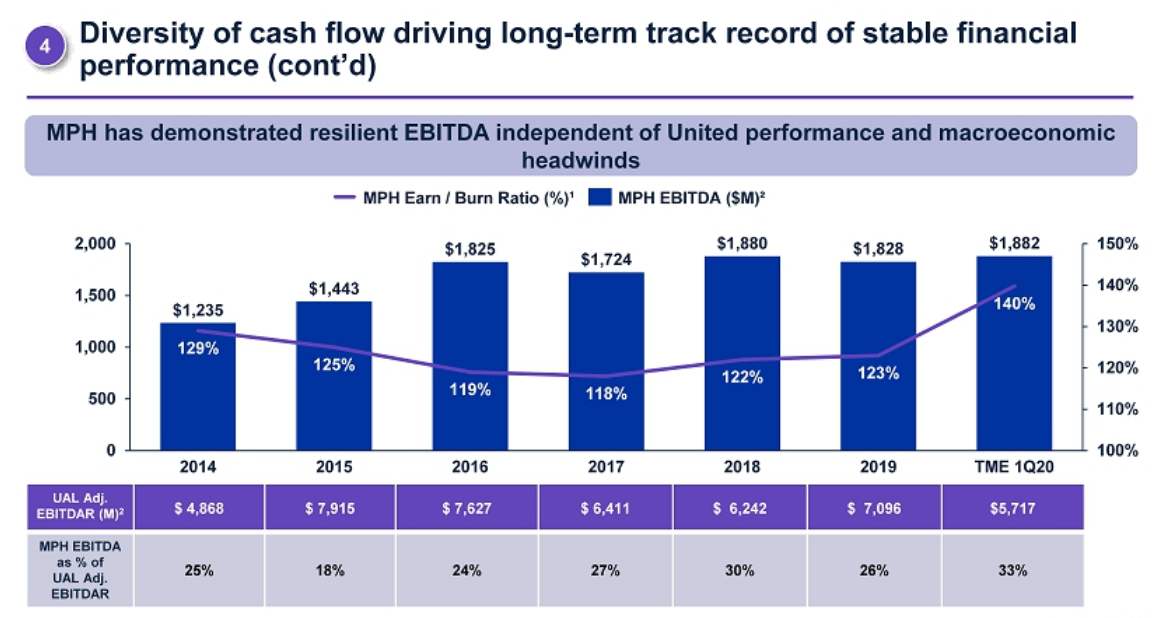

United notes that MPH profitability is strong even during downturns. Though to me it says that there’s not much growth in MPH profitability despite years of devaluations.

Maybe United wants to roll back the devaluations several years, as it doesn’t seem to have made MPH more profitable anyway. 😉

United brags about dynamic award pricing and the leverage it offers them for pricing. They ignore that they have lost customers that used to use a United credit card due to the lack of transparency into award pricing.

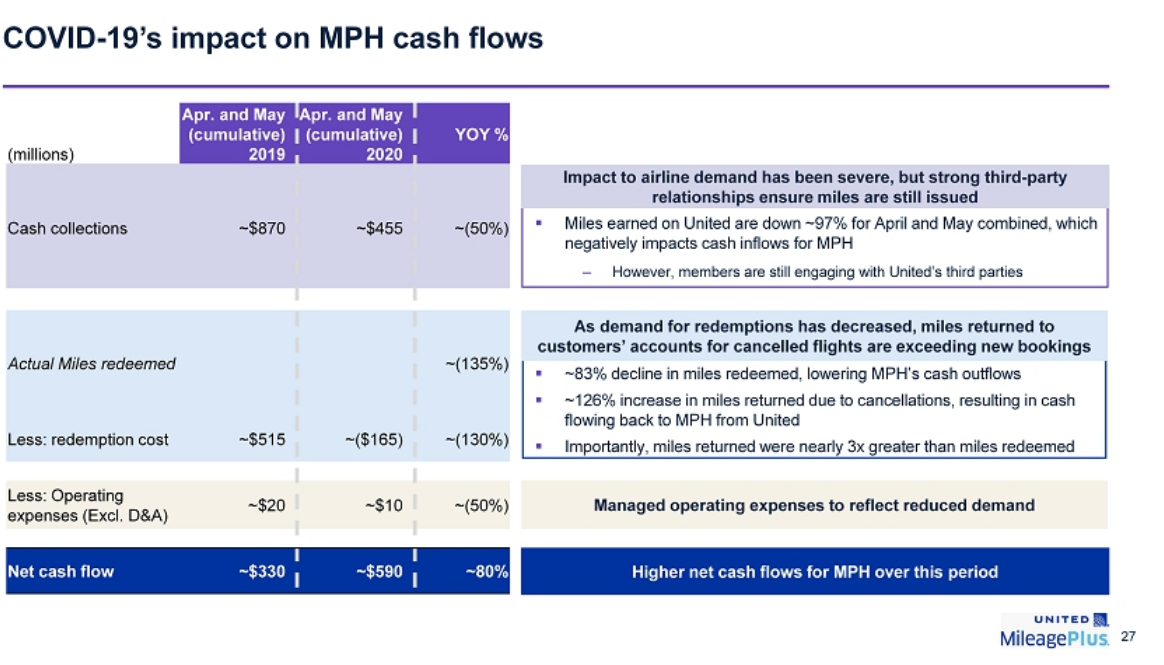

Unsurprisingly, mileage earnings from flights are way down, but so are award redemptions.

For a while, United refused to refund United award tickets that were cancelled, but they eventually decided to offer free refunds. Thus, United can claim that there was a 126% increase in miles returned and that miles returned were 3x greater than miles redeemed.

That change in policy may have hurt United, but it made things look better for MPH and United’s ability to leverage MPH:

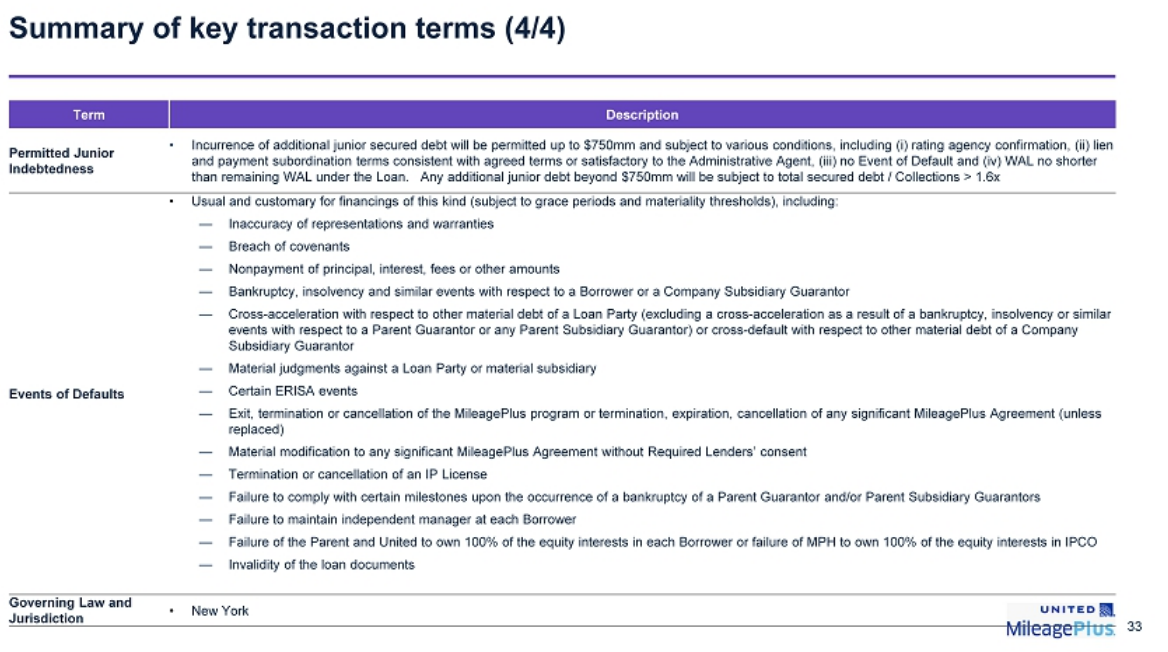

The bankers and lawyers certainly earned their keep in creating this structure!

If only a devaluation was considered a material modification that required consent…or maybe it is?

Which parts of the presentation do you find interesting?

![[United Update] Israel Flight Change Policies And Next Bookable Flights For Major Airlines](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

Leave a Reply

17 Comments On "United’s Creative MileagePlus Accounting Gets Them A $5 Billion Loan, It Also Gives Us A Fun Insiders Look Into Their Program"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

I think you’re mistaken with regards to the 9% figure. It’s not the % of active members, it’s the CAGR of the active members throughout the period.

you reported on a leak from United that Apple makes up a large chunk of their China flights.

Perhaps 7% refers to active members of 7% of miles earned?

Or many workers who telecommute have their accounts registered at the office they come to for meetings once a year? Is it legal for Apple to take all their employees miles since they pay for the flights?

Not just Apple – many large companies around the area

There are lots of possibilities, but the graph itself just says member’s geographical location.

Now my head AND my wallet hurt…

Thanks for trying to simplify, Dan. I guess I’m just not zoiche…

To me this just seems like a bunch of fancy accounting… not sure how they can get such high valuations, seems like this will all collapse one day once they file bankruptcy.

1. Are there actually a large number of people that purchase miles directly from United?

2. Is JP Morgan not aware that United constantly devalues the program

1. No, it’s mostly miles sold to Chase.

2. They are but they seem unwilling or unable to use that leverage.

Gotta love the createive financial engineering at play here. Interestingly, the levers that I’ve used with all of the devaluations is to just not fly them, get their cards, or even transfer my Chase points into their program. It’s worthless. At the same time, I’m pretty exclusive with SWA domestically and buy the biz fare on the foreign airline for better service globally. I used to be top tier with AA and UA, but no longer. Will be interesting to see how long the multi-B valuations continue. I’m not seeing it long term unless there are fundamental changes.

Same here-WN domestic, buy Int’l Bus on foreign airline. Take cash back for all but big bonus spend. Better service going overseas (and domestic), and no more hunting for flights, long layovers and “mixed cabin” junk itineraries.

You can’t decal cash. At least UA can’t.

I am not sure I understand how they value their costs when calculating profit on miles.

Is 1 cent their average cost?

If so their selling price is really inflated.

Klutz kasha:

United and MPH seem to be engaged in collusion? Unfair buissness practices:

For example: United will devalue mileage value in order to generate higher profits for MPH.. and other similar examples.

It’s on thing if it was all United. But as two separate entities it makes it very problematic IMHO

Who do you think owns MPH? Dansdeals readers?

It’s very clear from the org chart that United owns MPH.

“Ability to control redemption costs”

Collusion between these two corporations, causing financial loss to the banks that purchased the miles and their customers….

The bigger the corporation the more you could get away with…

Hey Dan, I was trying to find the same form that American find but I couldn’t find it. Do yo happen to have that link? would be really interesting to see what they write there

They wont file it. It’s for a Cares act loan

https://americanairlines.gcs-web.com/node/38436/html

The most recent third-party appraisal has estimated the value of these assets to be between $19.5 billion and $31.5 billion, a significant portion of which will be pledged as collateral to support the CARES Act loan.