Update: Offer expired!

Table of Contents

Limited time signup bonus

Until 3/18, you can earn 75,000 bonus miles for opening a Chase United Explorer Business Card and spending $5,000 within 3 months.

That’s the highest public offer ever for this card.

The $95 annual fee is also waived for the first year with this offer.

You can receive the bonus on this card if you haven’t received a bonus on a United business card in the past 24 months and don’t currently have a United business card.

You can receive the bonus on this card even if you got a United consumer card in the past 24 months or currently have a United consumer card.

Card benefits

- A free checked bag for the cardholder and a companion, even on basic economy fares.

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Priority boarding for the cardholder and companions, even on basic economy fares.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- 2 free United Club passes every year for being a cardmember.

- Miles that will never expire as long as you are a United cardholder, even if you don’t have any activity.

- Primary rental car CDW insurance in the US when renting for business purposes and in every other country for any rental purpose.

- 2 miles per dollar on United, restaurants, gas stations, and office supply stores.

- No foreign exchange fees.

- Exclusive cardmember access to auctions that allow you to use your miles for once-in-a-lifetime experiences. A few years ago I used 25K miles for 4 field box seats to an Indians game along with the right to run onto the field before the top of the 7th inning and swipe 2nd base right off the field. Nobody could believe it as I walked around the ballpark with 2nd base. I even got it signed after the game by the Indians wining pitcher that night, Justin Masterson, who was equally shocked that I actually had 2nd base.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes.

- If you spend $25K/year on the card it waives the requirement to spend $3K on United flights to get Silver status, $6K on United flights to get Gold status, and $9K on United flights to get Platinum status. You only need to fly the 25K, 50K, or 75K miles like in the good old days.

Business card and 5/24 info

This is a business card, but you may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that. Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field.

It’s important to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork.

If you’re like me and you run more than one business, you can signup for multiple of the same card for each business to manage each businesses expenses separately.

All Chase cards are now subject to 5/24 restrictions. That means it will be hard to get approved if you have been approved for 5 or more consumer credit cards in the past 24 months. Read more about that here.

However, it’s important to note that business cards from most banks, including Chase business cards, do not get added to your 5/24 count of recently opened cards. That’s because business cards from most banks don’t show up on your personal credit report and the 5/24 count is based off of your personal credit report. That means that applying for these cards won’t “hurt” your 5/24 count.

Another benefit of the card not reporting on your personal credit report is that when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an business cards from banks like AMEX and Chase it’s just not reported, so you can wait until the money is due without it having a negative effect on your score. That also means if you close the card, it won’t have an effect on your credit score.

Expanded award ticket availability

The reason this card is the best airline card you can get isn’t for the spending benefits, it’s for the perks. And they are awesome.

The reason this is my favorite airline card is that the United card is the only airline card that offers expanded award ticket availability.

This increases the value of your miles significantly and in turn makes the Chase Quadfecta/Quinfecta spending strategy even more valuable.

Cardholders have access to expanded saver coach award availability (XN class), last seat standard coach award availability (YN class), and last seat standard business/first class award availability (JN class).

It’s not just slightly expanded. There is a world of difference between the availability that cardholders can access and the availability for non-cardholders.

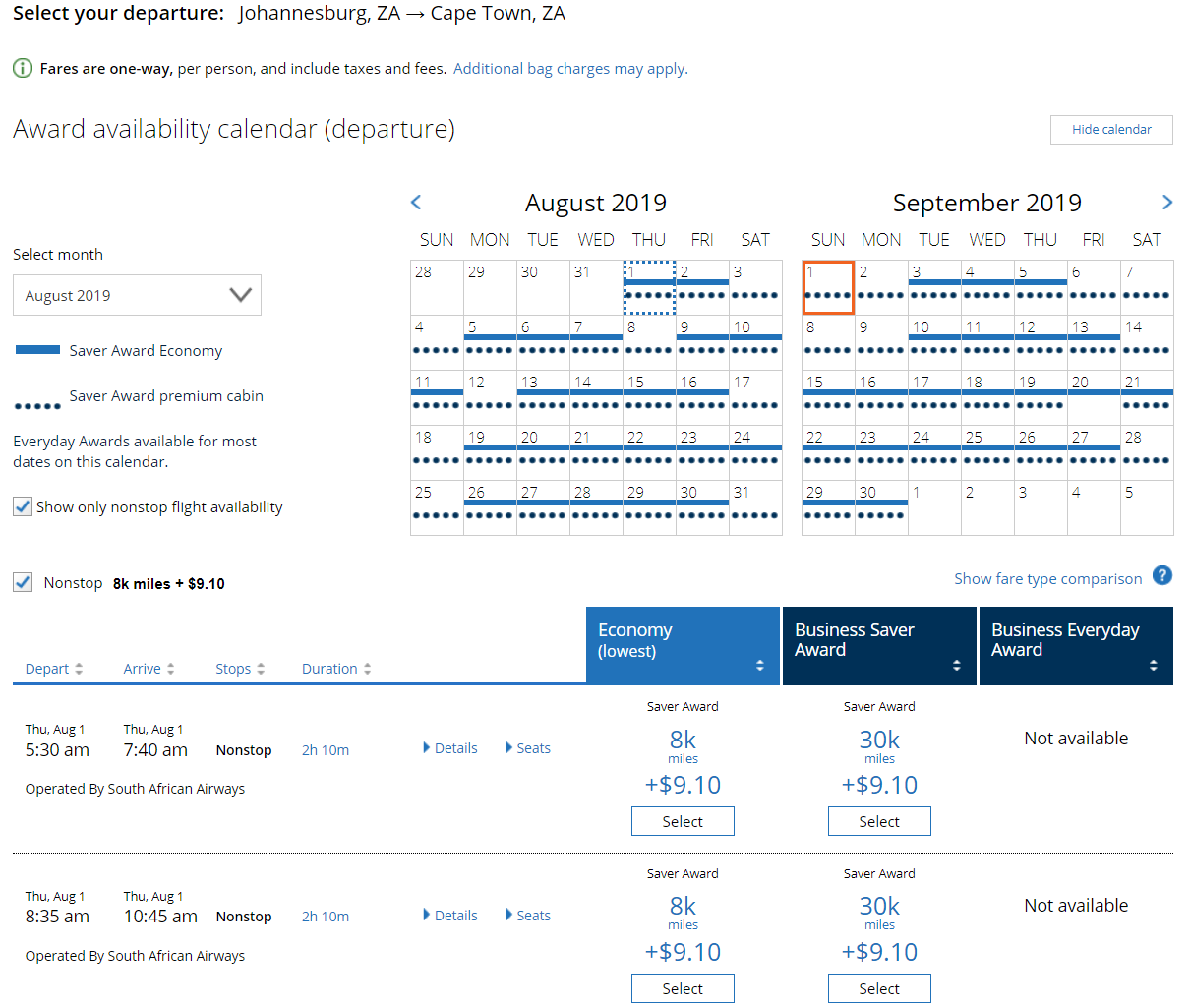

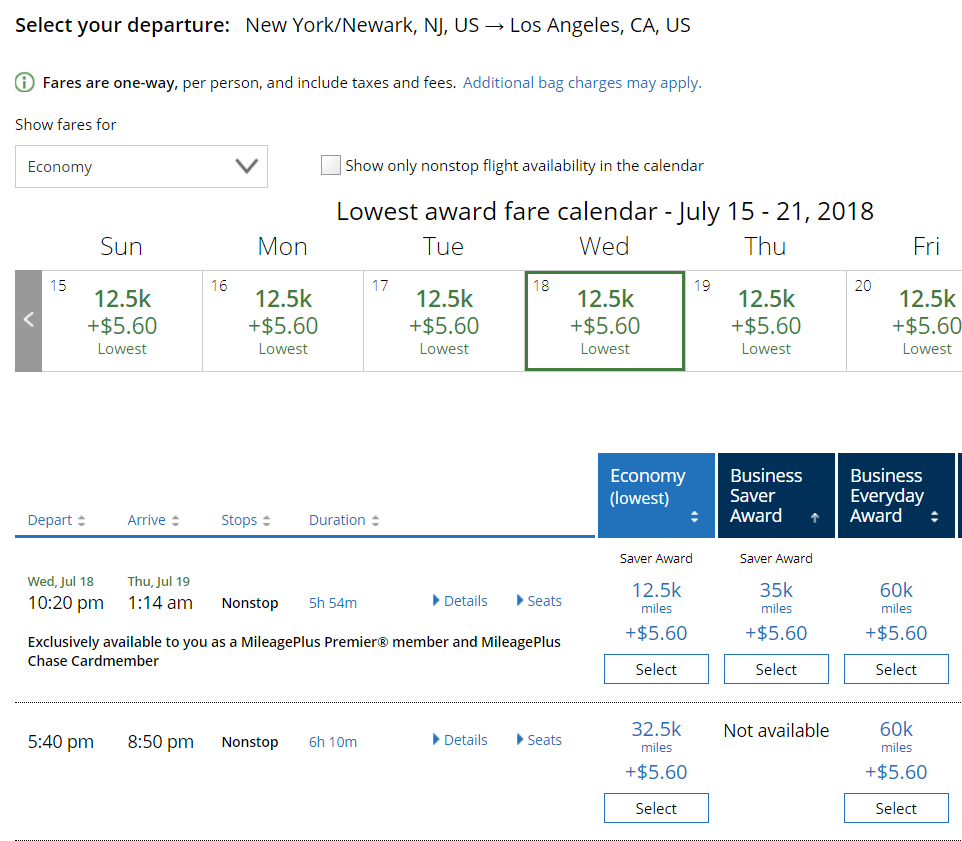

Availability calendar for non-cardholders:

Availability calendar for cardholders:

Let’s say you want to fly from Newark to Tel Aviv from August 25-September 10:

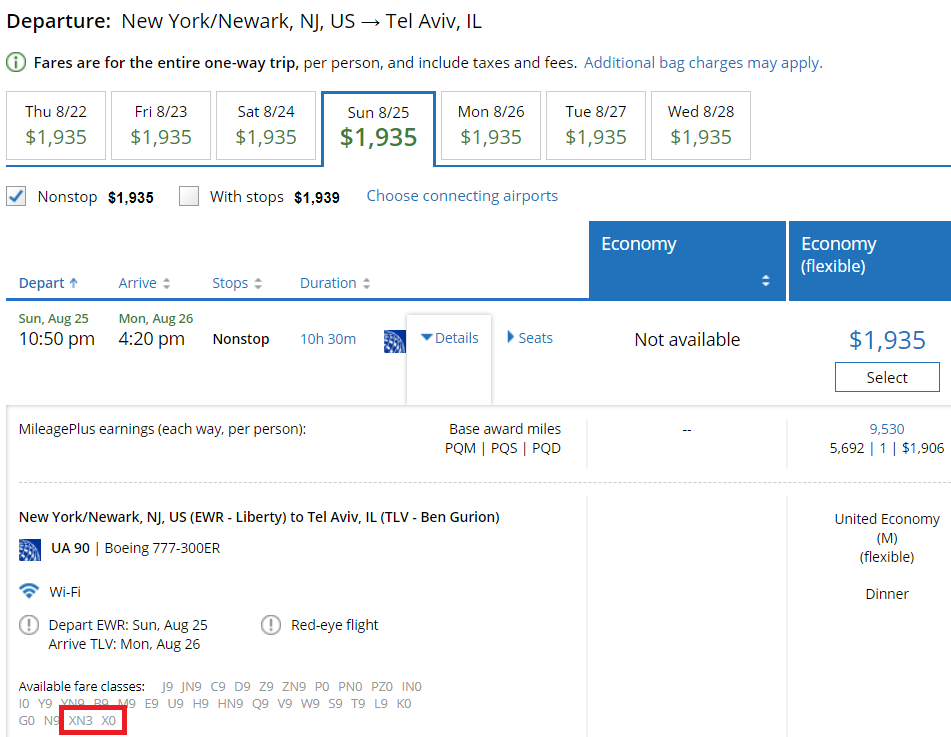

If you’re a cardholder and are logged in on United, you’ll pay 85K miles:

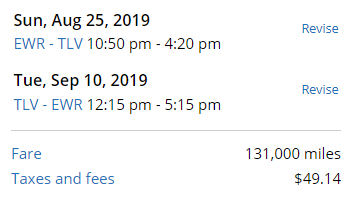

If you’re not a cardholder you’ll pay 131K miles for the same flights:

If you have read the United Expert Mode post, you know that’s because United is willing to sell 3 saver award seats in XN class to cardholders (XN9), but there are no seats in X class for saver award for non-cardholders on those flights (X0):

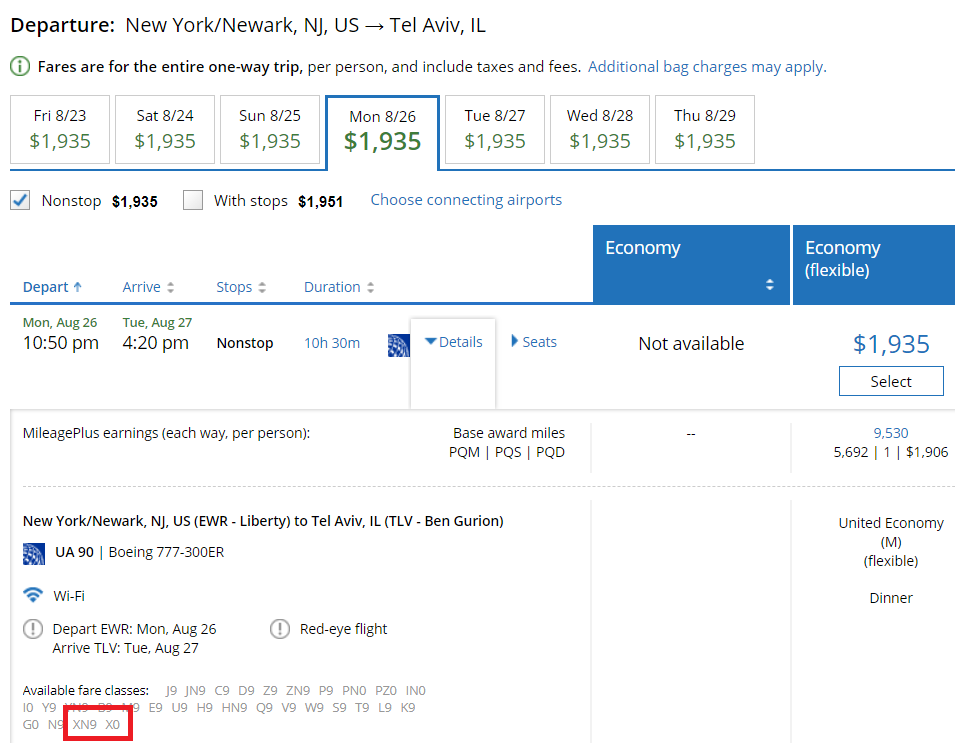

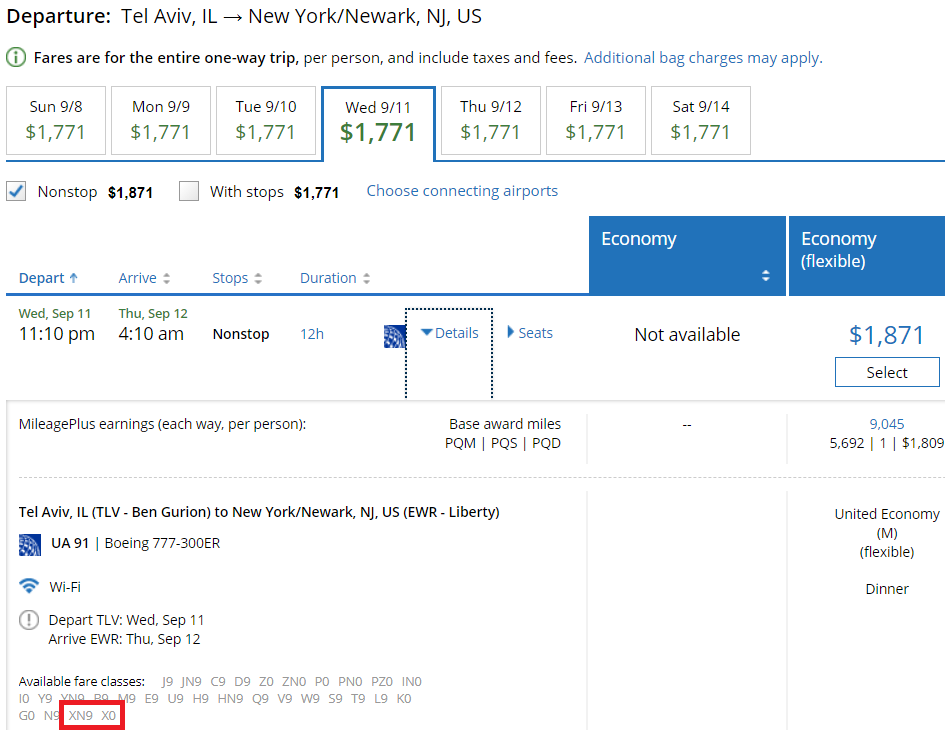

On the return flight United is willing to sell 5 saver award seats in XN class to cardholders (XN5), but there are no seats in X class for saver award for non-cardholders on those flights (X0):

Need more seats?

Travel a day later, from August 26 -September 11, and you can see that United has at least 9 saver awards (XN9) for cardholders in each direction, but there are no seats in X class for saver award for non-cardholders on those flights (X0):

This availability differential applies to all domestic and international routes and makes it crucial to be a United cardholders.

Expanded Plan B availability

As you have better access to saver coach awards you’ll also have better ability to do Plan B awards.

Plan B allows you to redeem for saver business class awards when there’s only saver coach available! Read more about Plan B in this post.

No airline besides United offers a Plan B style award redemption.

The advantage of United MileagePlus

In general I’m a big fan of United miles as they’re part of the Star Alliance, which has the best award availability of any airline alliance.

Best of all, United never charges any fuel surcharges. Other airlines like American collect massive fuel surcharges to fly on British Airways. Delta charges fuel surcharges to fly on some partners and if you originate in Europe and other regions. United will never collect a fuel surcharge and they have access to awards on 36 partner airlines which means better availability on more awards.

A short-haul United domestic award under 700 miles in distance is just 10,000 miles. That’s more than the BA 7.5K short-haul, but availability is much better, it allows for a longer flight distance, and you are allowed to have connections for the same rate, something that BA doesn’t allow.

Short-haul nonstop flights within any region outside of the US are just 8K miles:

United is also the only major US carrier that caps the mileage rate for standard awards at a reasonable rate.

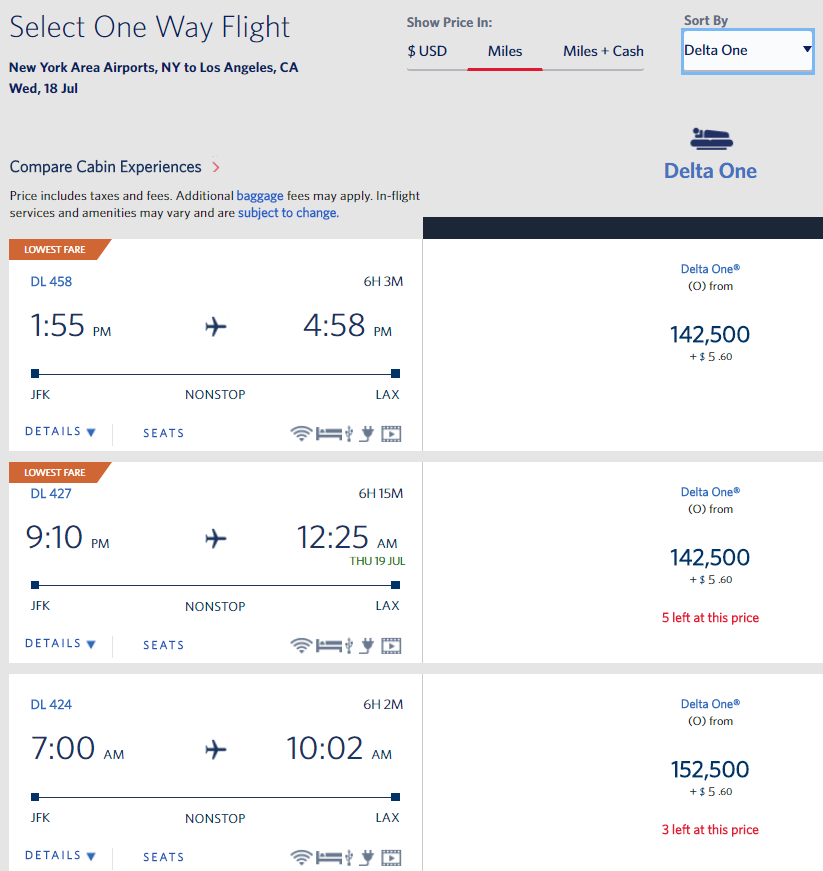

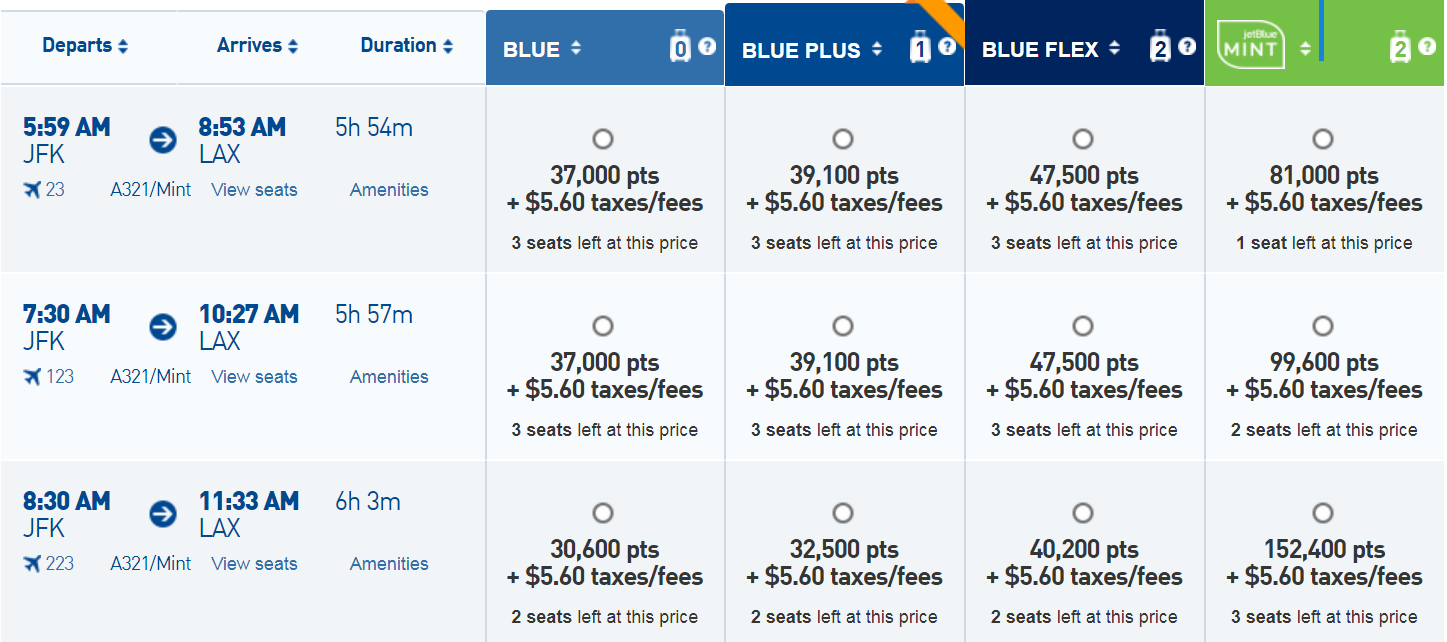

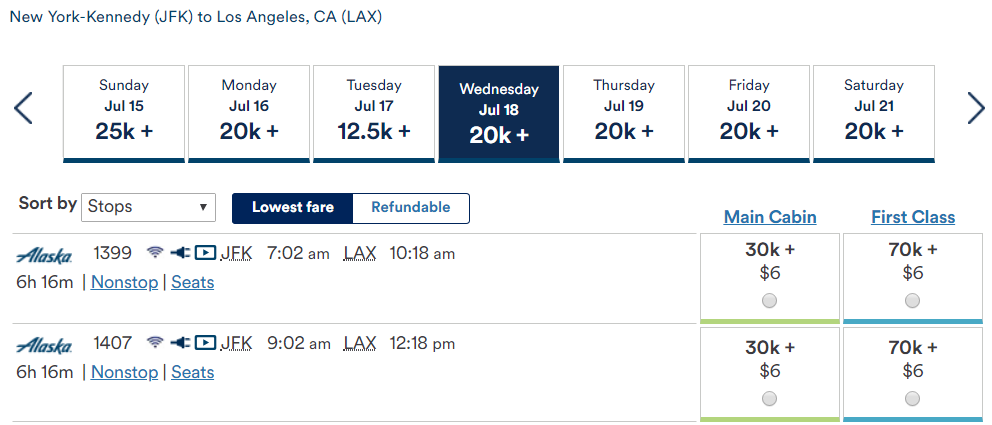

For example the last time there was a limited time offer on this card I checked on award space from NYC to LA:

American charged 82.5K-97.5K miles with their variable standard award pricing:

Delta charged 142.5K-152.5K miles with their variable standard award pricing:

All JetBlue award pricing is variable and they wanted 81K-152.4K miles:

Alaska is the only airline flying nonstop between NYC and LAX without lie-flat seating in business class and they wanted 70K miles:

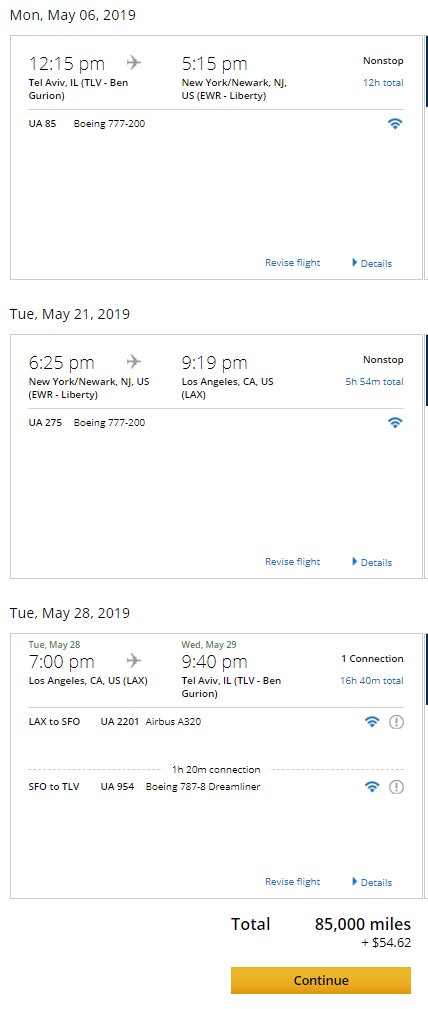

With United there was a saver award for 32.5K. Those come and go, but the standard awards on United are just 50K-60K on this route. That’s significantly less than other airlines. Best of all, cardholders can book a standard award even if it’s the last coach or business seat on the plane:

Excursionist Perk

While American and Delta have eliminated free stopovers, United continues to offer a free excursionist perk as described in this post. Just use the multi-city award search on United.com to piece it together.

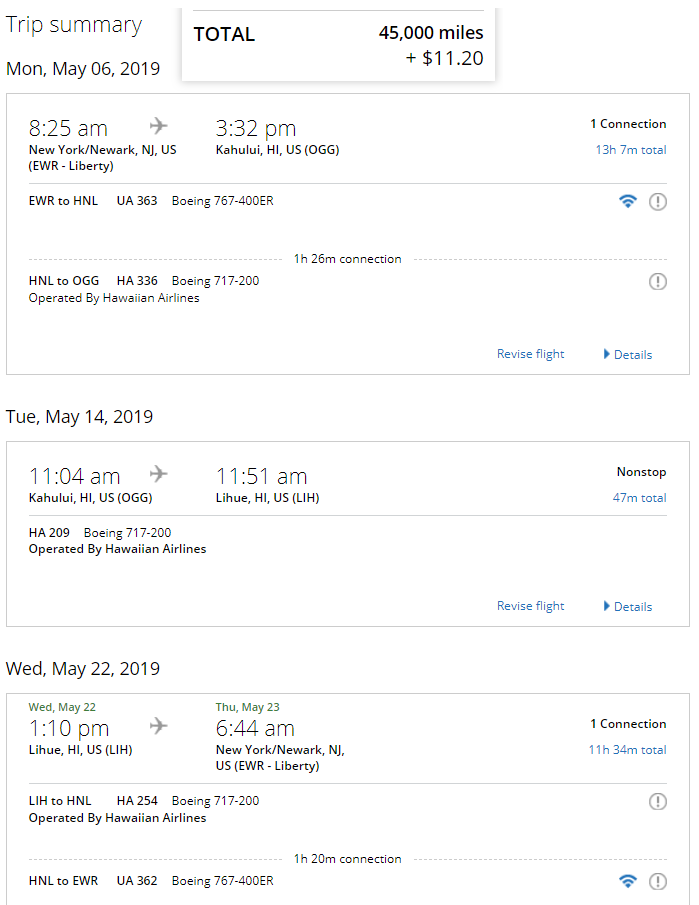

A round-trip to 2 Hawaiian Islands is just 45,000 miles round-trip thanks to the free excursionist perk:

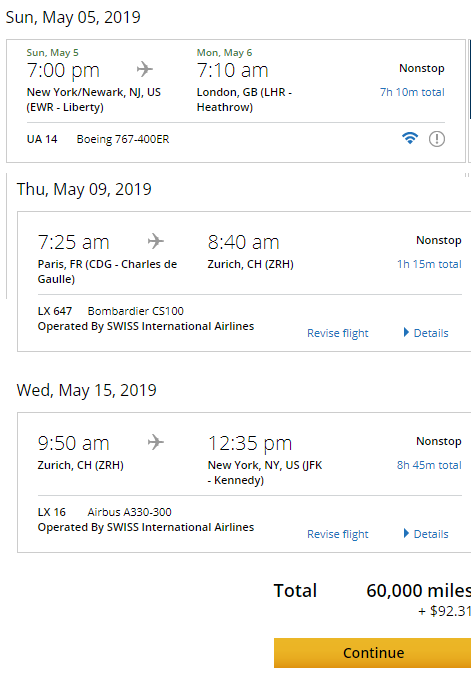

A round-trip ticket to 2 European or South American cities is just 60,000 miles round-trip thanks to the free excursionist perk:

A flight to 2 of my favorite cities in Asia, Hong Kong and Chiang Mai, Thailand is 80K miles thanks to the perk:

You’re even allowed a free open jaw in addition to the perk to really maximize your travel. For example this itinerary includes travel to London, Paris, and Zurich. You can take a train or use 4.5K BA Avios to get from London to Paris to fill the hole in the open jaw:

Of course the free stopover isn’t just useful from the US.

You can stopover in NYC and LA when flying from Tel Aviv to the US:

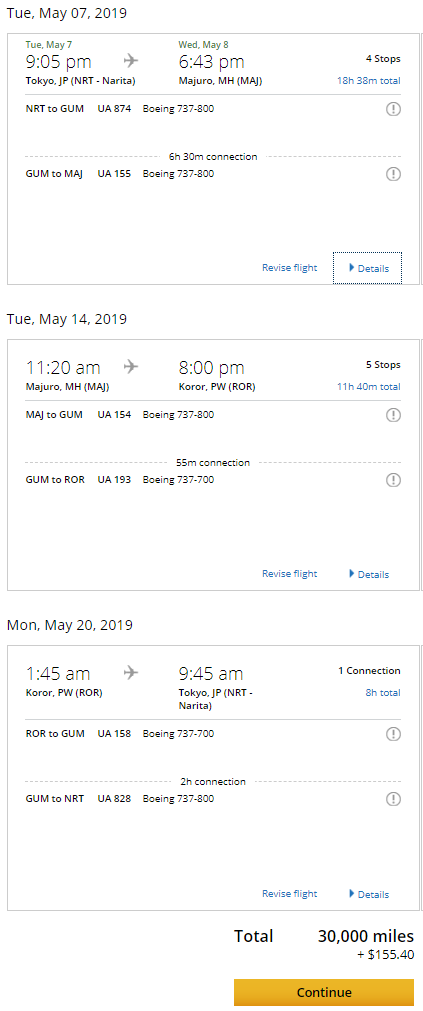

If you find yourself in Japan you can fly on the island hopper to 2 cities in Micronesia (I’ve been hankering to get back to Palau since the moment I left) for 30K miles:

Partner airlines

United has dozens of partner airlines which means lots of great award opportunities. It can be worth checking for award space on partner sites like ANA or Aeroplan.com to search for award availability and then call United to book if you don’t see availability on United.

Partners airlines include:

- ANA

- Adria Airlines

- Aegean Airlines

- Aer Lingus

- Air Canada

- Air China

- Air Dolomiti

- Air India

- Air New Zealand

- Aeromar

- Asiana Airlines

- Austrian Airlines

- Avianca Airlines

- Azul Brazilian Airlines

- Brussels Airlines

- Cape Air

- Copa Airlines

- Croatia Airlines

- EVA Air

- Edelweiss

- Egyptair

- Ethiopian Airlines

- Eurowings

- Germanwings

- Hawaiian Airlines

- Island Air

- Juneyao Airlines

- LOT Polish

- Lufthansa

- Scandinavian Airlines

- Shenzhen Airlines

- Silver Airways

- Singapore

- South African Airways

- Swiss International Airlines

- TAP Portugal

- THAI

- Turkish Airlines

Are you a United cardholder?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

178 Comments On "Less Than 2 Hours Left! Highest Offer Ever! Earn A Whopping 75,000 Miles On The Awesome United Explorer Business Card!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

@dan I just signed up for the last offer. Will it hurt for me to try this one under my LLC or since I just signed up for one under my personal name there is no chance for me to get this one? (I signed up for the other one about a week ago).

TIA

Got this card last week! Any way chase will match offer?

You gut the business card last week?

If so, send Chase a secure message and ask.

Last week I applied for the personal one now I want this one as well under my LLC.

You can get both.

Is there any advantage to the club card over this except for the no close in fees?

2 checked bags.

1.5 miler per dollar, though you can get that with Freedom Unlimited or Ink Unlimited.

Just got the personal card last week. Any way chase would match to personal?

No.

They ask me what my biz is last time, i said ebay, the rep asked me for my ebay ID and told me you only sold one item, a jeans pant in the last 24 months. It is not suitable card for you. I am not kidding, got denied. my credit score is 815 FICO

Ouch, some recon reps are tougher than others!

“If you’re like me and you run more than one business, you can signup for multiple of the same card for each business to manage each businesses expenses separately.“

Can you get the signup bonus for each business or is that once per individual?

Each business.

Can you get this card if you live in Canada

Are you a US citizen?

Yes

Applied through your link and got approved bh!

Thanks

Congrats!

#MeToo!:)

applied with ur link!

BTW, if I applied before the deadline but just got approved now, do i get the promo?

Sure!

Just want to know if I can spend on some personal items too. Or must it be business exclusive? Also my credit score is 700 do I have chances of being approved?

Ultimate Rewards or United points

United.

Oh man.. I wouldve preferred this over the personal card… Just signed up for the personal card.. And have to spend $10k over 6 months.. This offer is better

¿Porque no los dos?

wife got personal CC too…Won’t spend 25k in 6 months on cc…unless you have good ways to spend on CC? I’ve been out of game for some time….

Is there a fee for booking award flight close to the flight?

$75 within 3 weeks, though there are some workarounds.

@dan what are the workarounds that still work?….

Just had to pay the 75 dollar fee would love to know the workarounds

Dan,

Can I use my regular mileage plus number even if I’ve got previous United bonuses with a consumer card? If not what are my options?

Yes.

Applied and application went to pending status. Called (877) 260-0087 and after confirming my name, was placed on a brief hold and got an approval in two minutes. Wasn’t asked any business related questions BH.

Congrats!

I hate 5/24. just paid tuition on a bunch of cc’s now, I can’t get anymore

Dan , what’s the value of united points roughly?

1.5-2 cents each.

True, but 75k will get you a o/w biz class ticket to most United destinations, and your ROI will be well over $0.02.

If I recently signed up for a personal Chase card that puts me over 5/24 but it doesn’t appear on my credit report can I still get approved?

Update, I went for it and was approved after calling in. To be clear with the Chase personal card i just signed up for I was at 5/24, not over.

Congrats!

From United website :

“Price Protection

If a Card purchase you made in the U.S. is advertised for less in print or online within 90 days, you can be reimbursed the difference up to $500 per item and $2,500 per year.”

Does it still exist on this card?

Can you transfer your United points between family member in the same household? Thanks a lot!

No, but you can book travel for anyone.

The cdw covers only business rentals like the other chase business cards or all rentals?

Does the personal card have any advantages over this card?

Or is this card just as good and better because it’s a business card?

They each have a couple pros and cons.

Thanks.

Are they listed somewhere?

In this post and this one:

https://www.dansdeals.com/credit-cards/earn-65000-miles-favorite-airline-credit-card-take-advantage-uniteds-generous-awards/

From which credit bureau does Chase pull your credit for this card?

Depends on your state.

New york. My scores everywhere are around 800. But I’m disputing a wrong account on Equifax.

Sorry, I hope this isn’t too off topic. If so, just ignore the comment. I want to sign up for this card and the sapphire reserve, but avoid two separate credit pulls. I remember seeing some 2bm method or something like that before on this site. To just get one credit pull, do I just open the card apps in two separate browser windows and hit submit within a few seconds of each other? Any help would be appreciated!

@dan- Can I use this kind of card to track business expenses on my own- but still consider myself a sole propiator? Like if I work for a non-profit organization, and I need to travel a lot- I would rather have a separate card to track them on- all expenses would be business related. Would that make me qualified

Sure, open it with your name as business name.

Will it hurt my credit in any way if I close the card after a year? I already have to many cards with annual fees.

No effect as this is a business card.

Do they ask for your social for each business you own?

Does each business you run have its own tax id?

Is having a tax id for each business a prerequisite to having multiple of the same card?

Tax ID likely needed for multiple.

Applied (using link) using my name, approved immediately. $12K CL

(Decent income, high credit score.)

Thank you!

Congrats!

Do I get an additional 2 united lounge passes from biz and personal?

Yes.

can i get the bonus 75k even if i currently have the business club card?

Yes.

Primary rental car CDW insurance in every country.

I think you meant to say primary CDW insurance for business rentals?

Correct.

Can I link this card to my already existing United OnePass account (connected to my personal cc) or will they require me to set up a separate OnePass account (linked to this business cc) ?

Existing.

I have a credit freeze by Experian, can i still be approved?

Yes, do a temp freeze removal for a day. You can do on website in under 2 minutes.

Can I apply for this card even if I don’t have a legal business? (Have a cash only business that I don’t report can I have this card?)

Read the post?

Yes, didn’t really understand.

Please clarify.

Thanks @dan

Do I need to use this card to purchase a ticket to receive the free baggage?

Yes.

(If you’re like me and you run more than one business, you can signup for multiple of the same card for each business to manage each businesses expenses separately)

do you need different LLC or just change the name ?

Don’t need an LLC, but you would need an tax-id number.

Dan why are you not clarifying whether this card gives you primary CDW for leisure rentals?

It does not in the US.

I was added on someones United (consumer) credit card as an AU, and i see it on my credit report, does this affect my 5/24?

It may. You can call chase recon and explain that you are only an authorized user and not financially responsible for it since you are not the primary. Worked for me.

Hey Dan! I got a pending decision. Do you have the number to call? Is that the same as recon? Thanks again!

Thanks Dan!

Dan, If I have this cc and book a United ticket with United voucher, will I still get free checked bag?

got an email ”we will let you know as soon as possible” should i wait or call? if i need to call which number is best?

Dan: if I apply for the Business Card through my business, I notice it still asks for my personal SS # in the application process, does that mean it will show up as a hit on my personal credit report too?

@dan

For someone that doesn’t travel a lot would you say to get this card or the IHG® Rewards Club Premier Credit Card?

(Or something else?)

Just got approved and I’m over 5/24. I have the consumer card too. Is it possible that my UA status helps?

What are you currently at x/24?

8/24

hi, I was added on someones United (consumer) credit card as an AU, and i see it on my credit report, does this affect my 5/24?

Clicked through your link and was instantly approved. Only a measly $5k credit line for some reason, but that’s ok. Thanks Dan!

HI

is it possible to open a credit card account in Australia

Balance transfers into the account.

With the demise of SPG Credit card with a balance on it – can the balances be transferred to the card and go towards the spending requirements

for plan B – which booking class in business need to be available to confirm from waitlist ? PZ ?

Expanded award ticket availability is also for the no AF cards – is there any business card with no AF to downgrade ?

in the name of Shluchim in Edmonton,Alberta and Saskatoon,Saskatchewan thank you Dan

How long does a Business have to be open to get approved for such a card?

can u please post number to call chase if im waiting for a decision if im approved.

Thanks

Hey, the number is 1-888-270-2127.

Which credit check do they pull?

If my side business only makes a couple of thousand dollars a year, will they approve me?

Is it worth to open when you have already a Sapphire Reserve and Freedom Unlimited cards

does free baggage apply to cardholder + one companion or the entire family 8 passengers ?

do you have to pay the full amount with united card or mix united & saphire reserve

I am a yeshiva bochur so I obviously don’t have a business, can I still apply?

I applied and it says pending approval. Do I have to call?

Hi Dan:

I already have Global entry from Sapphire Reserve. Can I use the Global Entry reimbursement for my son, and get reimbursed on my card?

Also, does this card still give price protection for 90 Days?

Thanks, Mendel

Hey, I have the consumer card, got it a few months ago. I just signed up for and got accepted for this card (of course through your link), but I don’t need to keep both as they both have fees. Any reason to keep one over the other?

Its too bad United does not fly from JFK.

Hi Dan.

Just to clarify, when I’m on the application page, there are 2 spots that they’re asking me to fill out the name of the business: “Business name on card” &”Legal name of business”.

In both spots do I need to put my name and NOT my business name?

Another question, can I apply for more then one business with just putting my personal information and not the actual business details?

Joined NRG

Got 10,000 united points

Left after 6 months of rip off

NRG left Vm re why cancel and got ua points

I don’t think terms request to stay for any amount of time

Can they ask ua for points back ?

Any quick use for 20,000 ua points ?

Any way I can combine or transfer these points with Chase ultimate rewards?

I got a letter saying “too many credit cards opened in the last two years associated with you”. Called recon and was told that doesn’t matter whether it’s for personal and business, this business card count toward you. I’m guessing I have wait till my next card expires in 03/2017?

@dan, I’m about to apply for a chase business card, how would you compare the United Explorer Business to Ink Business Preferred in terms of earning points and it’s values? Do you have a comparasent chart?

@dan is there any diff between the personal card & business?

Does the free baggage work if you book a ticket for someone else and the primary cardholder is not flying with them?

Booked a flight for my wife with my United card but I didn’t fly with her. She had to pay for baggage.

I just applied and was approved for the united explorer business card. I have the consumer card for the last two years. Is there any reason to keep both?

I currently have a UA personal chase card.

Can I still get the points in my current united mileage plus account if I get this card under my business? Or will I need a new mileage plus account under my business name?

Yes, no need to open a new United account.

Okay… signed up, approved!

Now what?

A) my United account currently shows me as a “General Member”. Will that automatically change to Premier? If so, when? Also assuming that would then afford me the “expanded availability” mentioned above? Do I need to wait for the actual card? Do I need to reach the 5k spending?

b) in order to utilize luggage allowances, do I need to wait for the card (and spending?), and use it to book? Or can I book now, and just rely on the card at the airport to waive luggage fees? (once requirements met?)

You need to use the card to pay for the flights in order to get free luggage.

Thanks Janice, I’ll wait for the card before booking.

Still not sure on the expanded availability (Premier status). I’m afraid I’ll have to wait for the 75k, which means it’ll probably be too late for this flight. Oh well!

Hi dan!

I have 5/24 asst personal cards (chase and amex).

More if counting business (but u said they dont)

Any chance for approval?

hi Dan have a credit score of 725 (good ) applied 2 weeks ago for small business chase card got approved for 11k (sent me an ink as ran out of the other one I wanted they said) what’s my chances of getting approved for United Explorer Business?

Thanks Dan

If I have biz account under my ss# can I also get one under ein if it’s same biz name and address? (Yes I didn’t use my name even for sole proprietor-grandfathered in)

Dan – they trumped me down saying I have applied for too many credit cards this year?! My credit score is 841 and make a large salary. Do I call and fight it out??

If I cancel the card in the 1st year will I lose the pooints ?

Chase gave me their kiss of death for the second time in 1 year lease than a year ago. Any one know how to work around it?

does one have to buy ticket on card in order to get free baggage?

According to @Janice, yes.

https://www.dansdeals.com/credit-cards/limited-time-offer-earn-whopping-75000-miles-awesome-united-explorer-business-card/#comment-1400956

Dan, Thank you! Used your link, and then proactively called the 877 number and was approved in minutes. Specifically though, I refuse to use the “other” links for the bloggers who have become extremely political recently. Further, your information on this specific card is vast and complete. Will use your credit card links in the future.

I did not see this before I applied: “It’s important to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork.”

I made up a business name for sole proprietor ….anyway to switch to my legal name. It said they need to review my request…

I have applied & received this deal.

However they put me on the personal card for 40,000 mioles and not 75,000

I tried to complain but nobody home

What to do?

I feel like applying again?

Did anyone have my experience?

Two of my children tried to open this card with sole proprietorship & they were asked a lot of questions about the business and needed a tax stamp from the state. They just stopped the application

I currently have the regular united explorer card. Can I apply for this card and upgrade/ replace my explore for the club card? Is that “worth it?”

You can.

Depends on how you value the benefits of the club card, like 2 free bags, waived close-in fees, club access, etc.

Do I still qualify for the bonus points on this United Biz card, if I already have the consumer one from september of 2018?

Yes.

Thanks DAN!!!

Just signed up and got approved on the spot

Congrats!

@dan Dual CDN/US citizen with US address living in Canada. Tax Identification number seems to be the missing element here. How would I obtain this?

See the business card section of this post.

Just got approved. Is it worth going for another card so I don’t have an extra pull

https://www.dansdeals.com/credit-cards/ultimate-comparison-chart-chase-ultimate-rewards-cards-supercharge-earnings-creating-killer-quinfecta/

How does this compare to Ink Plus 80k offer of had to choose one?

Both are solid cards with different benefits.

https://www.dansdeals.com/credit-cards/reader-question-chase-ink-card-apply/

https://www.dansdeals.com/credit-cards/ultimate-comparison-chart-chase-ultimate-rewards-cards-supercharge-earnings-creating-killer-quinfecta/

I applied but didn’t get approval yet will it count towards getting the offer?

Yes

says pending. Will I still get the 75k when approved (offer ends in 40 min)?

Yes.

Does this come w free global entry/tsa pre check? Can’t seem to figure this out. I have the business version

Only the consumer version has that.

Thanks! I was wondering why I didn’t see a credit in my account

I have applied for the card. What happens if I’m only approved tomorrow or later? Do I still get the bonus points even the the promo has expired?

That’s fine, as long as you apply when the offer is alive.

Should the legal name of business and business name on card, both be my full name?

i was exactly at 5/24 and decided to do a “hail-Miriam” and was approved.

Wow, nice!

If I would like to apply for 1 or 2 other cards together with this one, what would be suggested?

Thank you.

Why are they asking me for my SSN? Do I give it to them?

Hi Dan. Applied and called, they said they need verification of my business, with either a bill under business name or document from the county clerk’s office. Its for a sole proprietorship under my name. Anything else I can do? HUCAd twice

Been a while since I applied for chase cards. Does 2BM still work at Chase Business (would like to apply for United Explorer Biz and Ink preffrerd)?

Thanks

Thanks Dan, I got approved at 4:27

Pending for both me and my wife… wanted to still apply for the Ink preferred as well for both of us. legit business (10 years old 1mm revenue). we both have excellent credit and we’re both well below the 5/24. should i still go for the ink preferred for both of us? or does the pending mean that the odds of approval are not in our favor?

Sure.

If you can only get one, you should be able to choose which to get approved.

UPDATE: wife called in for her app and after confirming a couple of identity questions she was approved for a healthy (25k+) CL. not so much with me.. when i called for my pending app, the landing rep literally grilled me.. lots of personal income questions, lots of business revenue, profit, projections questions, nature of business questions (in depth), etc.. after 40 minutes with her where she constantly placed me on hold, she came back that my app requires a 2nd in depth review by the senior lending team.. reason being, i already have high credit lines with them on credit cards.. she said it will likely be approved but it does need the approval of the senior lending team.. so i asked her to move 5k from my current Ink card with a high credit line and she was totally fine with that and instantly approved me with the 5k shift of credit line towards the new card..

Should i still apply for the Ink Preferred today for me and my wife or are the chances high now that i’d be looking at an additional hard pull in vain?

Thought the details would be helpful for others here..

I applied 5:15, and after spending over an hour on the phone with the lending team, and being transferred to 4 different people for questioning I finally got approved after offering to shift some of the available credit from my other cards to this new card.

They really did a deep down grilling of my income, profit, nature of the business, projections and many many more invasive questions. They definitely got stricter with the approval process than they used to be. Everything is legit by me, but even so it felt intimidating and as if I am under investigation.

I have a UA account without any card link to it, can I book a flight with miles from that account then pay the fees with this card to be able to get the free bag?

How long does it take before the expanded rewards calendar becomes available? I was approved a for the card few days ago and I see the new card in my chase profile, but when I check the availability calendar against my kids frequent flyer number they are the exact same.

Hi i signed up and got the card this week. i need ways to spend for the bonus miles? i would like to pay my mortgage with this how can i do that any ideas? thank you

Question- how does carrying a large balance on this card impact my personal credit? If I make minimal payments timely every month, but not pay it off in full, Will this card harm my score?

No effect at all.

My first transaction on this card was May 10 2019. Is this where the 3 months starts to spend $5K or from when i activated it? Thanks!

From when you’re approved. If you call or SM Chase they can give you the deadline.

TY!

I don’t want to pay another year for this. Is there a way to downgrade or transfer the points anywhere?