Update: Offer expired!

Highest Ever Limited Time Offer: Earn 80,000 ThankYou Points With The Citi Premier® Card Card

Table of Contents

Signup bonus

For a limited time only, you can signup for the Citi Premier® Card Card and earn a highest ever bonus offer of 80K Citi ThankYou points for opening this card and spending $4,000 in 3 months. Those points are worth a minimum of $800-$888 cash back, but they can be worth much more as shown below.

For example you can fly on United round-trip to Hawaii for 15K miles in coach (13.5K after a 10% rebate if you have a no-fee Citi Rewards+) or 25K miles in business (22.5K after a 10% rebate).

Or you can fly on United round-trip to Israel for 64K miles in coach (57.6K after a 10% rebate) or 94K miles in business (84.6K after a 10% rebate). That means you can potentially fly round-trip in business class after just meeting the spend threshold if you also have a Citi Rewards+.

The previous limited time offer for this card was 60K points for spending $4,000 in 3 months.

Annual fee

There is a $95 annual fee, though the points and benefits are worth far more than that.

Signup bonus terms

- You can receive the bonus on this card if you haven’t received a bonus or closed the CitiRewards+, Citi ThankYou Preferred, ThankYou Premier, or Citi Prestige card in the past 24 months.

- You can get the bonus even if you downgraded one of those cards in the past 24 months.

- You can get the bonus even if you currently have those cards.

- You can get multiple of the same exact card, so you can apply for a Premier card even if you currently have a Premier card.

- Citi allows applications for 1 card every 8 days and 2 cards every 2 months.

- You can check application status at 866-252-0118 and you can call reconsideration if you’re denied at 800-695-5171.

Non-expiring points

Your Citi ThankYou points will not expire for as long as you remain a cardholder. If you transfer points to another member points will expire in 90 days.

Card earnings

- Earn 3 points per dollar on airfare. This includes all airfare as well as charges from travel agencies.

- Earn 3 points per dollar on hotels. This includes all hotels as well as charges from travel agencies.

- Earn 3 points per dollar on gas stations.

- Earn 3 points per dollar on supermarkets.

- Earn 3 points per dollar on dining. Dining includes coffee shops, cafes, bar, lounges, and restaurants.

- Earn 1 point per dollar elsewhere.

- There are no foreign transaction fees.

Annual Hotel Savings Benefit

- Once per calendar year, you can get $100 off of a $500+ hotel stay booked via Citi.

- Reservations can be made in the primary cardmember’s or authorized users’ names.

- If you cancel a booking made with $100 you can take advantage of it again in the same calendar year.

Card benefits

- Extended warranty of 24 months on top of manufactures warranty, for a total coverage period up to 7 years and up to $10,000.

- Damage and theft protection for 90 days on items up to $10,000

Virtual card numbers

While Citi co-branded cards like their AA cards no longer offer virtual card numbers, their ThankYou cards like Rewards+ still do.

With a virtual card number you can set a dollar limit and/or expiration date to generate a one-time use credit card number so that you don’t keep getting charged for subscriptions or have your real card number stolen, among myriad other potential uses.

Citi Bifecta/Trifecta/Quadfecta

Citi has 3 excellent no annual fee cards that pair perfectly with a Premier card. Any of them paired with the Premier card will make for a great bifecta, trifecta, or quadfecta:

With the Citi Double Cash Card you earn 2% cash back everywhere, which can be converted into 2 ThankYou points. Combine a Double Cash card with a Premier card and you’ll earn 2 points per dollar everywhere with no cap, plus 3 points on dollar on gas, dining, groceries, airfare, hotels, and travel agents! You will also get 0% APR on balance transfers for 18 months.

The Citi Custom Cash® Card offers 5 points per dollar on up to $500 in purchases in your top eligible spending category each billing cycle. This is marketed as 5% cash back, but will actually come in the form of 5 ThankYou points per dollar spent! Eligible categories include Restaurants, Gas Stations, Grocery Stores, Select Travel, Select Transit, Select Streaming Services, Drugstores, Home Improvement Stores, Fitness Clubs, and Live Entertainment. You will also get 0% APR on purchases and balance transfers for 15 months.

The Citi Rewards+® Card automatically rounds up rewards earned on every purchase to the nearest 10 points, meaning you will earn 10 points on a $0.50 Amazon balance reload, which is equal to earning 20 points per dollar spent! You will also get 0% APR on purchases and balance transfers for 15 months.

Having a Citi Rewards+® Card also gets you a 10% points rebate when you redeem points, up to a 10K points rebate per year. While the Rewards+ card doesn’t transfer points into most airline miles, if you have a Citi Premier® Card and a Rewards+ card you’ll even get a 10% rebate on mileage transfers!

You can freely convert between all of these card products, as well as to most other Citi cards!

Closing a ThankYou point card means you can’t get a bonus on a ThankYou point card for 24 months, so you should always choose to change to another card instead of closing it.

Statement credit

You can redeem points for cash back in the form of a statement credit at a rate of 1 cent per point.

If you also have a Citi Rewards+® Card you’ll also earn a 10% rebate on up to 100K redeemed ThankYou points.

In other words if you spend on a Citi Double Cash Card to earn 2% back everywhere and have a Citi Premier® Card Card to cash out ThankYou points and have a Citi Rewards+® Card for a 10% rebate, you’ll can get an effective 2.2% cash back everywhere.

If you spend on a Citi Custom Cash® Card to earn 5% back in your top categories and have a Citi Premier® Card Card to cash out ThankYou points and have a Citi Rewards+® Card for a 10% rebate, you’ll can get an effective 5.5% cash back.

Gift cards

You can redeem points for gift cards to dozens of stores at 1 cent each, but Citi also runs promotions where you can get 10-20% off gift cards.

If you also have a Citi Rewards+® Card you’ll earn a 10% rebate on up to 100K redeemed and transferred ThankYou points.

Mileage transfers

Citi mileage transfer partners now include:

-

- Aeromexico (Skyteam): 1K:1K

- Air France/KLM Flying Blue (Skyteam): 1K:1K

- Avianca Lifemiles (Star Alliance): 1K:1K

- Cathay Pacific Asia Miles (OneWorld): 1K:1K

- Emirates: 1K:1K

- Etihad: 1K:1K

- EVA (Star Alliance): 1K:1K

- Garuda Indonesia (Skyteam): 1K:1K

- Intermiles: 1K:1K

- JetBlue: 1K:1K

- Malaysia (OneWorld): 1K:1K

- Qantas (OneWorld): 1K:1K

- Qatar (OneWorld): 1K:1K

- Singapore (Star Alliance): 1K:1K

- Thai (Star Alliance): 1K:1K

- Turkish (Star Alliance): 1K:1K

- Virgin Atlantic: 1K:1K

- Choice Privileges: 1K:2K

- Wyndham: 1K:1K

Don’t want to transfer miles? You can also redeem for any paid travel at a value of 1 cent per point.

You can also transfer points between any Citi cardholders to transfer points into miles.

Sample mileage uses:

Turkish Airlines:

As I’ve written about before, Turkish Airlines has a ridiculously generous Star Alliance award chart.

And they don’t charge any fuel surcharges for United flights.

Here is the North America version of the chart with one-way award pricing:

| Between the US and: | Economy | Business | First |

|---|---|---|---|

| US, including Alaska, Hawaii, Puerto Rico, and USVI | Was 7.5K Now 10K | Was 12.5K Now 15K | N/A |

| North America | Was 10K Now 30K | Was 15K Now 40K | N/A |

| Western Europe (2) | Was 30K Now 55K | Was 45K Now 90K | Was 67.5K Now 135K |

| Eastern Europe (1) | Was 30K Now 50K | Was 45K Now 85K | Was 67.5K Now 130K |

| Turkey | Was 30K Now 40K | Was 45K Now 65K | Was 67.5K Now 100K |

| Middle East | Was 32K Now 58K | Was 47K Now 93K | Was 68.5K Now 140K |

| North Africa | Was 30K Now 60K | Was 49K Now 105K | Was 73K Now 160K |

| Central Africa | Was 30K Now 65K | Was 49K Now 125K | Was 73K Now 190K |

| Southern Africa | Was 45K Now 75K | Was 67.5K Now 140K | Was 100K Now 210K |

| Central Asia | Was 34K Now 60K | Was 52.5K Now 100K | Was 77K Now 150K |

| Far East | Was 45K Now 75K | Was 67.5K Now 130K | Was 100K Now 195K |

| South America and Oceania | Was 52.5K Now 90K | Was 75K Now 140K | Was 115K Now 210K |

As part of the Star Alliance, Turkish can book award travel on airlines like United and Air Canada.

You can open a Turkish Airlines mileage account online (Hint: Your password must be exactly 6 numbers or else it will give an error).

And you can book Star Alliance awards with Turkish miles here (Login and then click this link again). You can’t search for partner awards from their home page. Search for one-way at a time for best results.

For example you can transfer miles to Turkish Airlines to fly from the US to Tel Aviv on United for just 32K points, or 28.8K points in coach after the 10% rebate with a Rewards+ card:

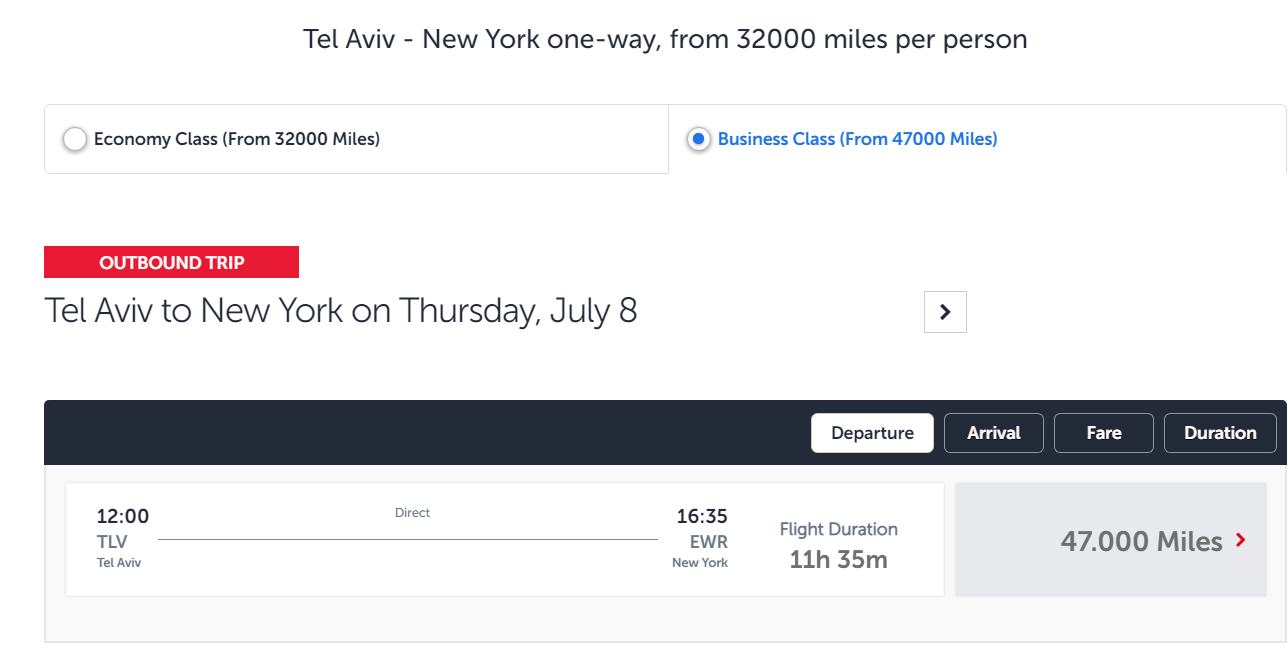

Or 47K points in Polaris business class (42.3K after the 10% rebate with a Rewards+ card):

There are lots of other bargains, all of which will be 10% less with a Rewards+ card:

- Fly one-way anywhere in the US, including Alaska, Hawaii, Puerto Rico, and USVI, for just 7.5K miles in coach or 12.5K in business class on United with no fuel surcharges.

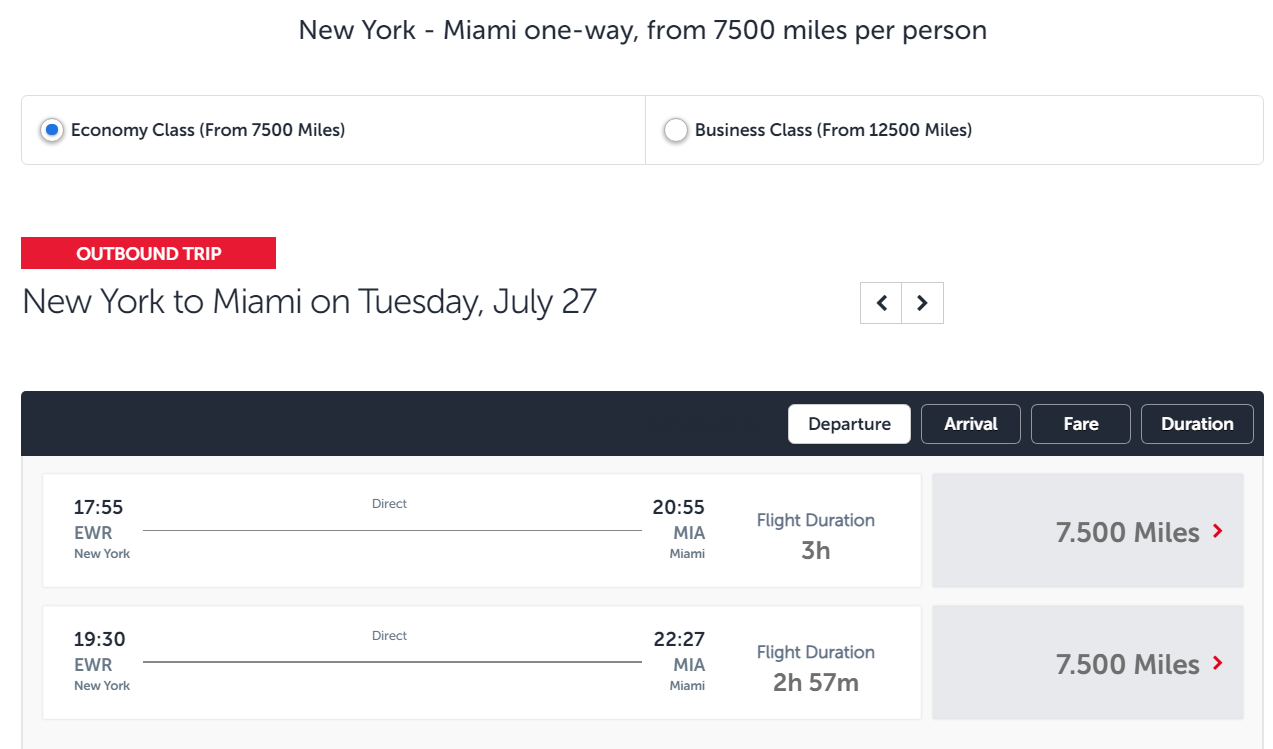

NYC to Miami in economy for 7.5K or business for 12.5K:

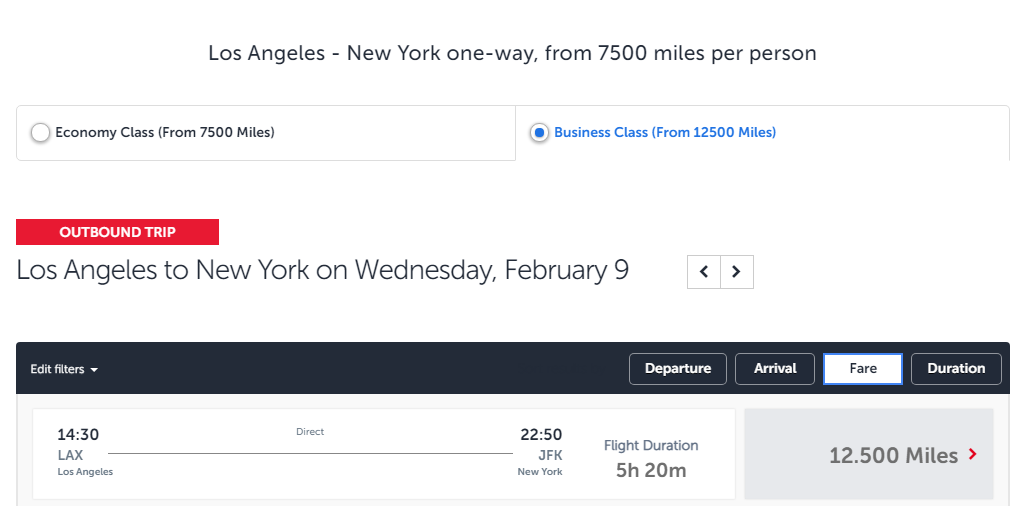

LA to NYC in economy for 7.5K or lie-flat business for 12.5K:

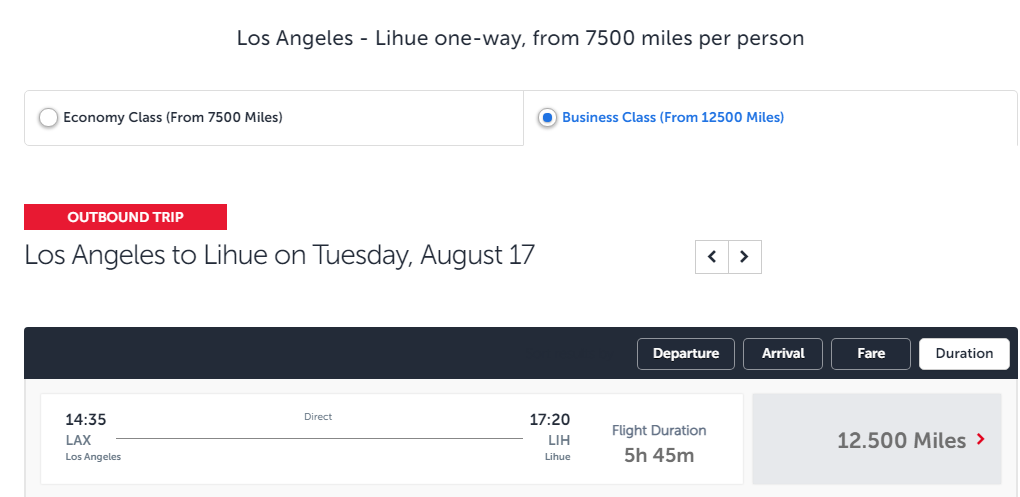

LA to Kauai in economy for 7.5K or business for 12.5K:

- Fly one-way anywhere in the US to Canada or Mexico for just 10K miles in coach or 15K in business class on United with no fuel surcharges.

NYC to Cancun in economy for 10K or business for 15K:

- Fly one-way to Europe for 45K in business class on United with no fuel surcharges.

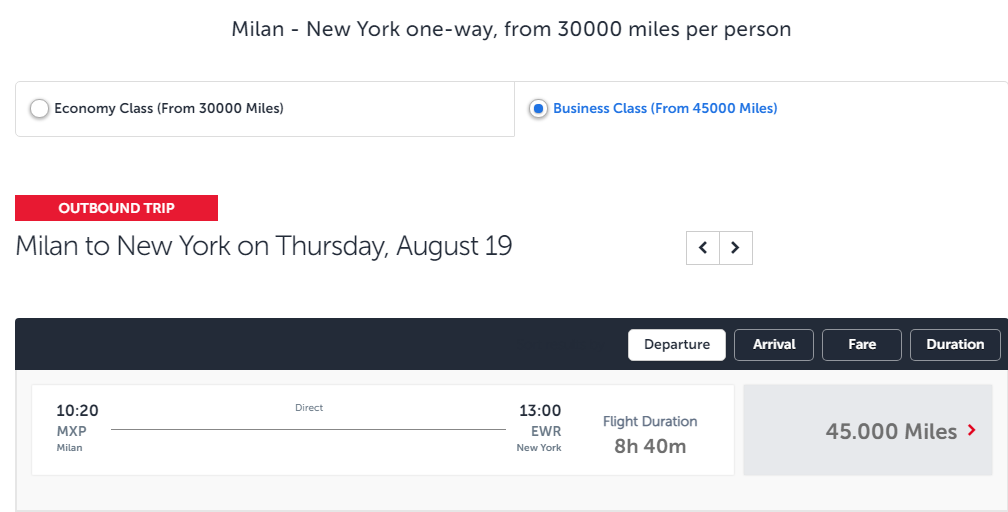

NYC to Milan in economy for 30K or business for 45K:

Qantas:

With Qantas miles you can redeem for El Al award tickets without any fuel surcharges! You read more about this option here. Plus there have been transfer bonuses in the past.

- A one-way coach ticket from NYC to Tel Aviv on El Al is 37.8K Qantas miles and there are no fuel surcharges.

- A one-way premium economy ticket from NYC to Tel Aviv on El Al is 70.8K Qantas miles and there are no fuel surcharges.

- A one-way business class ticket from NYC to Tel Aviv on El Al is 90K Qantas miles and there are no fuel surcharges.

You can also redeem for tickets on American:

- A one-way coach ticket from NYC to Tel Aviv on AA is 31.5K Qantas miles plus $323.

- A one-way business class ticket from NYC to Tel Aviv on AA is 82K Qantas miles plus $323.

Avianca Lifemiles: Awards on United start at just 6.5K miles and as low as 5.2K miles with frequent 25% transfer bonuses.

Flying Blue: Fly from Los Angeles to Tahiti in lie-flat business class for 64K miles.

Emirates: Fly in shower class with lowered fuel surcharges.

View this post on Instagram

JetBlue: Book awards with free cancellations.

Cathay Pacific: Avoid and lower fuel surcharges on partner airlines like AA and BA.

Singapore: Book highly rated premium cabin or suites on Singapore flights that are blocked with partner miles.

84K miles for a Singapore suite between JFK and Frankfurt:

Virgin Atlantic: Bargains on ANA First Class suites and on Delta flights.

You only need 55K Virgin Atlantic miles to fly one-way between the US west coast and Japan or 60K miles to fly one-way between the US east coast and Japan in first class.

Related post: How To Maximize A Citi Quadfecta To Earn Cashback Or 2.22-5.55 Turkish, Or Qantas Miles Per Dollar

Will you signup for a Citi Premier® Card Card?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

279 Comments On "Highest Ever Limited Time Offer: Earn 80,000 ThankYou Points With The Citi Premier® Card Card, Enough For 5 Round-Trips To Hawaii & More Awesome Redemptions!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Did you mean can *not* on your second bullet ?

Nope.

Sorry, I meant the second part of the first bullet.

Ok, if not, to be clear, am I eligible for the bonus although I downgraded from the Premier to Rewards+ 16 months ago?

Yes, that’s fine.

I downgraded from Prestige to Rewards+ about a year ago and Citi changed my credit card number. I was under the impression that downgrades that change your card number count as closures. Are you saying this is no longer the case, so I am eligible for the Premier bonus?

Any guess on how long this will last? I’m in the middle of a refi

Nope, sorry.

“With the Citi Double Cash Card you earn 2% cash back everywhere, which can be converted into 2 ThankYou points. Combine a Double Cash card with a Premier card and you’ll earn 2 points per dollar everywhere with no cap” If I currently have $1,000 with Citi Double cash and now transfer to Citi Premier does that mean now I would have 200,000 thank you points which now can transfer 1:1 to Jetblue or other airlines?

thanks Dan. Link to apply doesn’t seem to work

Thanks, is it working now?

Works- thanks. Now need to call to get the pending approved!

Good luck!

just signed up. anyone with DPs on matching ?

Try and let us know!

Can I use Turkish miles to book for someone else if I am not flying along?

Yes

How do I book for someone else? When booking it only gives me the option to book for myself? Do I change it after?

Call Turkish

If I downgraded from Premier to rewards+, does that constitute as closed?

No

I know this has already been asked, but I wish you had some intel as to when this offer will be over? I too would like to wait a bit before my next credit pull.

http://www.ask8ball.net/

🙂

Oh well, I opened the CitiRewards+ card in 10/2019, I guess I am not eligible for this bonus.

Better strategy is to get Premier bonuses and downgrade to cards like Rewards+.

How soon can you downgrade?

In order to book on United, there needs to be saver availability?

Yes.

Is saver from EWR to HON 22.5k? If so, any reason why I would be seeing lots of availability on UA but not on TK?

The Turkish website has always had a known bug with long-haul nonstops to Hawaii, where it only shows award space connecting through California.

Try calling, but reaching a competent agent can be a challenge.

But in this case, it’s not even showing options through California? And would this permit a stop-over in California?

I tried calling and did not get anywhere

They claimed it wasn’t available

so like you said the long haul to hawaii can be very challenging to get at these cheap rates

Got it, thanks for the heads up.

Congrats!

If I converted one of these cards to a Costco card does that count as closing ?

Is this the highest its been?

Is this situation like chase where a approval means your Going to get the bonus or not ? If not how can I confirm

“You can redeem points for cash back in the form of a statement credit at a rate of 1 cent per point”

how new is this ability to cash in at 1 cent per point? I remember in the past only UR points had that option? amex also now 1 cent/point?

these are good signs!

Somewhat new. The only valuable AMEX cashout is if you have the Schwab Plat, and that’s being devalued soon.

But yes, it’s a good thing!

How long do I have to wait to apply after downgrading my current Premier card?

Same day.

You also don’t need to downgrade as you can have multiple of the same card.

is this reccomanded or better to downgrade thanks dan

80,000 Bonus Point Offer

Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Premier® Card within the first 3 months of account opening. What is this supposed to mean? Just an error I’m guessing.

Looks like a typo.

Applied. Approved immediately. Thanks Dan.

Congrats!

What limitations/restrictions are there when sharing my TY points with spouse holding a rewards+ card (10% rebate benefit)?

You can share 100K points per calendar year. Points expire 90 days from when you share them.

What about the rebated TY points ? Meaning if I transfer to him 60k TY points for redemption and he gets back 6k TY points, do these expire or not?

Those won’t expire.

Plan is to share 60k points so can transfer to Turkish for a United redemption. However in T&C’s the following is written “ You will not receive 10% Points Back on points you redeem on Points Sharing transactions.” but I don’t know what that means.

That means you don’t get a rebate just for sharing. You need to redeem points to get a rebate.

so the recipient has 90 days to transfer to airline?

Yes.

just got approved for sapphire do you think it will impact getting approved for this card?

have over 800 credit and already meet spend with sapphire no current balances

Should be fine.

Do product changes go through instantly? If for example I have a rewards+ and double cash and I upgrade the double cash to premier, will I immediately be able to transfer points from premier to an airline?

Also, if I have rewards+ and premier, the points are linked in one account?

Why not apply for a new Premier card?

You can call Citi to link accounts.

I was thinking more down the line when I would downgrade the Premier that I get to a double cash.

Apply for another Premier 😀

If I recall correctly, the change may take a day or 2 to complete.

Well in a year I wouldnt be eligible for another premier bonus since I would need to wait 24 months between applications

Correct

I think Hawaii through Turkish is 20k miles round trip now.

The screenshots in the post were just taken today.

Weird, the link in the post going to the Turkish award chart shows North America Economy Class at 20k so I thought it had gone up. How would I get to that North America chart you screenshotted?

Dan, do you have a post about good uses of TY points? I’ve collected them and have a few hundred k, but almost never use them. And I’ve done no travel at all since Dec ’19! The only redemptions I’ve done over the last year was for some gift cards when they had a 20% (and later 10%) discount.

Several good options in this post.

Can you downgrade to the Citi Custom Cash Card and how long would you have to wait?

Same day.

You also don’t need to downgrade as you can have multiple of the same card.

But multiples of the card will cost you @$95 vs if you downgrade to a no annual fee…no?

Thanks Dan, just did your advice and downloaded my premier to rewards+, that said in about 11 days I will get the card and rewards+ benefit but the fees change and I can change my mind until 8/27. So when can I apply again for the premier? Now? In 11 days? Or in 51 days?

Like the post says, you don’t need to wait at all as you can even apply for a Premier if you currently have a Premier.

Again I ask: But multiples of the card will cost you @$95 vs if you downgrade to a no annual fee…no?

Correct, no reason not to downgrade. But it makes no difference for approval.

Ok, thanks. Thought I was missing something

I’ve previously had poor experiences with Citi cards (specifically AA) – they tended to decline a lot of charges as fraud that weren’t, and their customer service seemed noticeably worse than Amex and Chase. Does this match others’ experiences/is it still the case?

Yes, I only have the double cash for now but it’s a real problem. I get a text message “did you approve this charge? 1=yes, 2=no” And I send back 1 and then it says “OK, your charge was declined.” Uh, thanks for nothing. I thought I was going to get double cash back on my tuition but instead I got the school office really annoyed. Called customer service to have it approved and then had the same issue the next month – as if they didn’t record that I said this is an approved vendor for me. And yet when I had an actual fraud, well it’s been a few weeks since I spotted it and my case is still pending (I did get a replacement card promptly)

Just to make sure I understand, if I have a citi premier, I can apply for another one and still be eligible for the bonus? and if yes is there an amount of time I have to of waited between my last premier card and my current one??

Yes.

As the post says, 24 months from the last ThankYou bonus.

Are u saying use TY points via Turkish to get the Israel or Hawaii example? I don’t see UAL as a partner

Yes.

I applied for this card and was approved last week under old 60k bonus. Any chance they match this new offer?

Call Citi and let us know.

I just got approved for the Quest today, and just applied for the premier and got rejected for too many recent inquiries.

In how long should I try again?

Call Citi reconsideration?

Ye! And said too recent of an inquiry with in the last week.

So I asked if I apply after the week would it not be recent anymore and I didn’t get a straight answer

Hi, does this go based on when the bonus was awarded or when I applied. Meaning my current premier card was approved sometime in 6/19 but I don’t know how to check for when the bonus was awarded when I made my minimum spend? Any tips on that?

I just checked on thankyou.com and saw that my 60k bonus was awarded on 7/20/19. I’m assuming that I need to wait until that date to apply for this card again…

Sounds right.

Hi Dan

I am looking to rack up points to fly or at least get credit towards a round trip ticket to Israel.

Looking to Fly Direct Elal from Miami To TLV, is is best to redeem the points for travel credit or can i some how use these points for Elal.

As the post says, you can transfer to Qantas to redeem for El Al flights.

There is some dates that has avaibility on United saver award but they don’t come up when I search it on Turkish

Try calling.

Do you have any post on quantos and how they are redeemed for elal

The rates are in this post, just search for dates on their site.

Here is an out of date post on it:

https://www.dansdeals.com/points-travel/milespoints/roundup-qantas-program-devaluations-improvements-updated-award-chart-travel-el-al-israel/

Dan,

Can I downgrade the card to the 2x cash right after I get the bonus?

YMMV on changing within 12 months of opening a new card.

Do you have a guess as to the chances of Citi releasing a revamped Prestige card soon? It seems to me that they need to do something to compete with the recent very compelling offers from Amex on the Platinum card and from Chase on the Sapphire Preferred. Or do you think that perhaps this is their response? I know that they only let you open/close one Thank You card every 24 months, so I’m debating whether to jump on this or wait a bit. Thanks!

They appear to have thrown in the towel on Prestige.

TY points redeemed for cash back are at a value of 0.5c/point and pay yourself back 0.8c/point?

Just checked citi website but want to confirm as your post says min $800 cash back. 0.5c/point would be $400

Do you have a Premier card?

I plan on applying for one if the TY points are worth $800 cash back and not $400 but it’s not clear in your post.

It’s $800 if you have a Premier. $888 if you also have a Rewards+.

I don’t believe this is correct. Just got off the phone with Citi and they stated 200 points = $1 cash back. This would mean 80,000 sign up bonus points = $400.

Please update your post if you agree to avoid confusion.

As I always say, DROPR (Don’t rely on phone reps!)

From my Premier card:

Where is this screenshot from?

The only ty card that has 1 cent per point statement credit option is the premier?

Premier and Prestige.

Dan,

I know you mean well but do you really want to promote flying on Turkish Airlines which is owned by a government whose prime minister is an anti-Semite and who supports Hamas.

I certainly respect your opinion, but if there’s a way to fly to Hawaii in United business class for 12.5K instead of 50K or to fly to Israel in United business class for 47K instead of 75K, it would be malpractice not to let readers know.

Armed with that knowledge, people can decide what they want to do. But I find that very different than flying Turkish Air. Mind you that pre-COVID, Turkish was the 2nd largest carrier into Tel Aviv, with more than a dozen flights a day. So clearly many Israelis and Jews are not making that calculation.

Perhaps I should have said promote anything about Turkish Airlines. In any event, you are right that people can decide what they want to do. Maybe self-respect should be more important than saving a few bucks.

Are you actually helping Turkish Air by taking advantage of them to fly on a United plane for a third or less of what it would cost using United miles?

Zac,

Turkish Airlines does not do the mileage deals out of the goodness of their heart. They are making money from them. Likewise, they are not flying to Israel because they love Israelis or Jews. They are doing it to make money. The point I was making is we should not do anything which helps our enemies.

Trying to figure out cash value redemption options for the sign up bonus before applying. Are the 80k points worth $800 (1c/pt) like your post says or $400 (0.5c/pt) like the Citi website says?

https://www.dansdeals.com/credit-cards/limited-time-offer-earn-80000-thankyou-points-citi-premier-card-enough-5-round-trips-hawaii-citi-quadfecta/#comment-1537554

I just transferred TY points this week to Qantas, and they transferred instantly

For the citi rewards+ can you repeatedly add $.50 to your Amazon balance unlimited amount of times?? Earning 20 points on everything on Amazon?

Yes.

Uriel, can you elaborate on what you mean so I can do the same thing now that Dan said yes?

Just applied and was denied (first denial ever). Called recon and they said I had to wait until the letter came in the mail with reasons to reconsider. HUCA’d and got someone else who gave me all the reasons and wouldn’t reconsider. Asked for a supervisor who also wouldn’t reconsider. I have an excellent credit score and never missed a payment before. The reason for denial was having too much revolving credit and not using credit enough. Apparently paying off 99% of my bills before the statement prints is actually hurting me.

“too much revolving credit and not using credit enough”

is the in respect to your Citi credit only or overall credit including those from other banks’ cards?

Overall. I only have one card from Citi and have a 10k limit on it.

Hi, I wanted to know if I would get approved if I opened my first credit card in January, which was a discover and everything is perfect so far?

@Dan If i closed my last citi premier on 7/1/19 can i apply now and get the bonus, or does “24 months” now include the whole of July 2019? Or does it look at the last date of the final statement? thanks.

Can I get this card if I have the Citi AAdvantage platinum select card?

Yes

Thank you.

I got a Premier over 24 months ago.

When I chatted to Citi today, they told me that I could not get this bonus, if I opened the same card within the last 48 months. Did I misread something?

Reps make mistakes. All the time.

OK, I applied, and got the “we need to consider this. Will see.

When did you last get a TY point bonus?

How soon after applying for this (and getting approved) can you close/downgrade an existing prestige card (4 years old)?

I’d wait until you get the bonus to be safe.

End date for offer?

Can i sell this points like chase points? or Its only for flights?

I applied using your link, got a not approved. Rep told me, to wait for the letter, then call for a reconsideration.

Denied. Not enough credit usage. Any ideas?

I got the same. Very strange.

Interested in Dan’s input on this as his advice has always been to pay off bills before closing date leaving just a few dollars but this seems to be the reason for denial by Citi.

Same here. Very high credit score. Was under 5/24 and the Citi timing limits when I applied. Always pay the full balance on all cards on time. Apparently being a good customer is a negative with Citi. Only have 1 Citi Business AA CC i’ve had 7 years, always paid on time, never any issues. Punishing us for having good credit? thanks. interested to hear some insight on this if possible.

Same here!

Just applied thru the link, got the the msg “You will receive a notification with details regarding our decision in approximately 7-10 day” i called they said I need to wait it out.

Anyway to get this done quicker? have excellent credit score and have not applied for any citi cards in the past.

Got denied. They said my score wasn’t high enough, but then told me my score was a 819, from a range between 250 to 900. Does Citi have a reconsideration number?

Don’t waste time with reconsideration I am Citigold and they still denied even w their bs not enough usage reason high credit score

Applied with your link. Approved immediately. Thanks Dan.

Congrats!

Applied and approved immediately. They pulled Experian – 3/24 and 2 hard pulls in the last 6 months. 25 year relationship with Citi – Credit cards only.

Congrats!

i tried applying. got rejected for two many accounts opened recently. i only opened chase cards. is there anything i can do?

Call 800-695-5171.

End date for offer?

I have two credit cards the Bank of America travel rewards and chase sapphire preferred. How do I know if it’s a good idea or not to get a third card? What would be the negatives in doing so?

can you apply for this card while holding this card as a second card. context, I currently hold this card for 4 plus years.

Just got approved through your link.

Will the card come before the end of the week? Can they expedite the card?

Approved through your link.

Miss those weekly roundups. Hope they come back soon!

Is this better worse or same bang for your buck than chase sapphire reserve? Preferred? Amex business gold? Is there a benefits compare feature on the dd site? TIA

I applied in the end of July when the bonus was still only 60k.. I didn’t get to spend the $4000 yet, is there any chance they should match the offer for 80k?

did United saver availability get pulled from their website? not seeing it anymore

70-80k Thank You Points every 2 years with a new Peremier card, and downgrade of the old one could be a nice new $95 tradition

Do you like this card better than the Saphire Reserve or Preferred? If I have them and a Freedom unlimited, what benefit would be to add two Citi cards now?(Is it just the 80,000 points?)

when do they charge the annual fee ?

I have been denied in the past for this and other citi cards my credit score is excellent should I bother trying again?

Dan,

I have the premier and they do not allow me to redeem (even for eligible purchases, eg groceries) for 1 cent per point. Anything I’m doing wrong??

Thanks

https://www.thankyou.com/cash.htm

dan i have a hard time to find reward options star alliance partners on turkish site like united for some reason its not showing noting even i go from ur link after loging in, anything u can help me

I signed up for the premier card with the 60k bonus offer a week before the 80k offer was published, I still didn’t spend the $4000 to receive the 60k, could I downgrade now the card for a rewards+ and then apply again for a premier in order to receive the 80k bonus?

Declined immediately (these reasons came in a few days later bia email):

• Your credit report shows a high amount of unused credit compared to your

available credit lines.

• Your credit report shows too many bank or national revolving accounts.

Immediately after decline, applied for Citi AAdvanntage card with 65,000 points bonus, and was approved.

Guess the rules are more strict for Premier card than others.

When does the 80k bonus points expire for new cardmembers? I am trying to meet the spending threshold for another card first, but do not want to wait too long and miss out on this offer…

Is there any way to apply for both the Premier and the Rewards+ simultaneously to get the bonus on both cards?

I got approved, using your link!

Question: I now have 2 citi premier cards.

Would it make sense to downgrade the older one if I have points on it that I am saving (ie: would my points remain active due to the new card or would they still need to be used up before they expire if the old card is cancelled?).

Thanks!

Sure, downgrade to a Rewards+ is a no brainer. Points stay active.

FYI and no idea if it’s 100% true or not, but Citi (multiple reps from their benefits center, not general hotline) claims that the extended warranty covers purchases made abroad (i.e. Israel), unlike Amex. If you have the Prestige, the $1K cellphone coverage is also good abroad (i.e. non-American cell service), but Amex’s version is also confirmed to be be valid abroad.

@dan

So based on this post I should not buy gift cards from Office supply stores using my ink!

But I should buy $0.50 gift cards and generate 20points/dollar on Amazon??

If you have the card and the time, sure.

Applied with your link. Approved immediately. Thanks Dan.

Does an approval mean that I am eligible for the SUB?

One thank you card was closed by Citi recently due to inactivity. Does this prevent me from getting the bonus? Thanks!

When does the signup bonus post, when i spend the first 4000 or only when the statement closes? Thanks

Can I add a family member as an AU and then transfer to their AA account?

My rewards+ card was shut recently due to inactivity. Will i still be eligible for this bonus? Any way to tell before pulling my credit?

any idea? @dan

What’s a good/smart use of these points?

so I have about 100k points, is this best used to transfer to an airlines FF as you described above? or cash out?

How do I get 5 roundtrips to hawaii, I have over 100k miles, but even when I search for availablility on Turkish airlines that should be 7.5k miles each way, every US location gives me the message.

Flight not found on the selected date and route. You can search for a new flight by changing this information. If you are searching for a repatriation flight you can get more information via Turkish Airlines Call Center.

Are you using the special Star Alliance link in the post?

Otherwise, try calling.

yes I did, first it told me that I can only book a flight for myself

“You can issue the first ticket only to your name in order to verify your membership. Subsequently, you can issue award tickets for other persons as well.”

Then it gave me the error message above when I reduced it to one ticket.

is this maybe because I have zero turkish airlines points, would I need to transfer citi miles first to even search for this ?

My rewards+ card was shut recently due to inactivity. Will i still be eligible for this bonus? Any way to tell before pulling my credit?

Dan how do I book a United flight and Turkish Airlines I can’t find it please help me

Can I apply to this card and then apply for the rewards+?

I have a lot of thank you points on my searscard – like 200k – no one wants to buy them because they can’t use them for flights. Can I open on eof these cards & transfer the Thank You points to this card to sell them? I heard that people will buy miles from the premier card.

Anyone know if you can citi points transferred from husbands to wife’s account if 2 seperate accounts opened up?

My understanding is you can transfer but have 90 days to use the points

hi, i just tried to apply and i got deneid, my credit is great, any special terms to get approved?

Hey Dan,

I currently have the Citi dividen card. If I can get approved for the Premier card, can I add the points I earned from my dividen card to the Premier card?

Thank you!

Anyone have sucess through the reconsiderations departement? I was denied – the reason given was I have too much credit comapred to credit used. I applied in summer – Any chance of getting them to change their mind?

is there any wat to speed up the pending process?

Hey, if I apply for multiple cards and get approved multiple times, will I get the sign up bonus multiple times?

Does this card provide rental car insurance?

Is the 10% per calendar year?

Also Downgraded to cash in Dec 2019 applied in Oct 2021 said not eligible because closed an account within 24 month as product change is considered closing. After speaking to supervisor, said they will escalate it. waiting for letter.

1

Applied in Oct 2021 and they just told me that not eligible for bonus as I closed premier account in dec 2019. I didnt close it, I downgraded then to double cash. After speaking with supervisor she said system not allowing to change she will escalate it and I should receive letter of decision. Anyone else have such issue?

can I downgrade this card to a no annual fee?

and if yes will I lose my points when I do so?

I want to apply for an d use the ne credit card for BF/Cyber Monday spending. Does this card (or other card with nice sign on bonus) allow you to receive the CC number immediately to start using or do you ahve to wait ~2 weeks for it to come in the (snail) mail?

if card was closed 1year ago i can’t get bonus?

if card is still open has to be 24 months since last bonus?

I know this is an open ended question. I am looking to get either another chase or this type of card or the signup bonus. Which is more valuable points wise (if both had equal point bonuses). Is this offer good enough to get or a is chase points more versatile and overall better to retain. Please feel free to reply with a link, i am sorry if its been aaa. (Asked and answered).

I currently have sapphire preferred…

Always good to have more point transfer options for when you need them.

Hey Dan,

How do I search for business class on the Turkish Airline Star Alliance page?

Dan: is this option only available for a personal card. Can I apply through my LLC business as well?

Do we have any idea when the Limited Time Offer will end?

Unfortunately, the Turkish online Star Alliance booking interface has been broken since August, see Flyertalk Wiki here: https://www.flyertalk.com/forum/showwiki.php?t=1726019

For those that don’t want to follow the link to the wiki, here is the relevant portion:

Since August 2021 the online *A ticket payment flow is broken (“continue” button does not appear on the credit card entry page) so transactions cannot be completed. No known workarounds

If I am already a premier holder, how can I get this deal?

You are allowed to have more than 1 Premier card.

Would my points be linked?

Yes

Got approved thanks Dan!

Does this card have secondary rental car insurance?

Will I get 3 points for foreign grocery shopping?

Hey, Should one sign in their Citi bank account to apply for this card?

No difference.

Hey Dan,

I had my citi premier for almost a year. I do not want to pay the upcoming annual fee. If I downgrade to a free citi card will points transfer?

No.

“ You can redeem points for cash back in the form of a statement credit at a rate of 1 cent per point.”

Can’t seem to find this on the application page. Just want to confirm that I can get a statement credit Nd not just points for gift cards.

Confirmed with my own card.

How do I do that?

Don’t see the option?

Also is it better to redeem for miles?

Thanks Dan

I had a ThankYou Preferred which Citi shut down 11 months ago due to inactivity. Does this disqualify me from this bonus?

Am I only able to book international through turkish? I tried domestic in the us and its saying there aren’t any flights. Any ideas?

You need to use the Star Alliance search link in this post.

Or call them.

How long does it usually take for Thank You points transferred to Turkish Miles & Smiles account to show up in my account?

Do they tell you if you’re ineligible for the offer, like Amex does?

I keep getting an error message when trying to book from NYC to MIA

or NYC to West palm beach on the Turkish airline website. Do I first need the miles in my account or am I still able to do searching without it?

I really want this card but I’m not sure if I’m eligible, is there any way to tell forsure without doing a credit pull first?

Will they say before they pull this offer?

Not usually.

I’d apply now if you want it.

Have you been told this offer is ending soon?(approved via your link btw) I saw reported elsewhere this is the new standard bonus…

Thanks and congrats!

Yes, confirmed as ending soon and will be going lower.

will chase count this toward the 5/24? And if i book through turkish on united, can you cancel at any time and have the points redeposited? And where do the points go? united? turkish? Thanks!

Can you fly on United or American with these points?

Yes.

Thanks. Got approved

Which partner airlines do I need to use?

Cathay, Etihad, Qantas are all good options for American flights.

Avianca, Singapore, Turkish are all good options for United flights.

Thank you

Anyone else having log in issues to citi. It keeps taking me to activate screen.

Anyone know which credit bureau they check, so that can unfreeze it first?

after i get approved i can close my old citi premier?

I’d wait until you get the bonus points.

We have received your application and further processing is required. We will contact you in approximately 7-10 days regarding our decision.

Next step?

I didn’t call, they called me now to verify address and DOB and was approved, I will get the 80k since I applied on Jan 9, correct?

Sure

I was denied for too many open accounts and too many recent inquiries. I have only had 1 inquiry in the past 2 years – a Marriott card in 2020.

Any advice – does reconsideration work?

You are too responsible financially for citi. Bank is looking for someone who keeps balances and pays interest.

Hi, I have Rewards+ card from November 2019. Not sure when bonus points were posted from that signup. Any way to see? Will it warn me if i don’t qualify for bonus, like when applying with Chase?

Can you apply for a business?

Have mostly stayed in the Chase/Amex world (reserve, preferred, blue, etc.) and looking to open a new card- Can’t decide between the Premier 80K bonus and the Capital one venture X 100K. Seems like Venture X gets more benefits and 20K more points, but higher yearly fee. Citi lower annual and ability to bi-fecta. I’m stuck! Any recommendations?

Do you have any idea how much time we may have left? I’m technically past the two year mark from my last Citi Premier bonus, but ideally I would like to apply in a few days so that I have a small buffer for Citi’s ancient IT rules.

I’d love to know as well

Instant approval BH $11K CL. Expected bigger CL but not crying!

820 score doesn’t work for citi:)

what does the 7-10 days response usually mean?

It means you ain’t getting it. Try HUCA.

How do I find out if it’s 2 years from closing the card?

I’m debating between this and the amex offer below. Which is better for regular day to day?

https://www.dansdeals.com/credit-cards/get-300-welcome-bonus-6-back-groceries-0-intro-annual-fee-valuable-return-protection-blue-cash-preferred-amex/

Dan, just signed up and instantly approved! Whooa!

Congrats!

How much would I get in miles/$ if I don’t have any other Citi cards?

I got approved for the card, but in the confirmation email, there was no mention of the 80,000 sign up bonus. Will it automatically apply after spending $4000 within three months?

Normal.

If you used the link in this post, yes.

K Dan I did it your daily postings worked…- now gotta spend 4k

If i get approved now, will Citi give me the card number right away or I need to wait for the card?

Just got this card, ty! I never do this. Fine print says Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+®. I was thinking to open a Rewards+ card also. What’s the way to do this without forfeiting the 80,000 TY points?

“If you cancel a booking made with $100 you can take advantage of it again in the same calendar year.” What does that mean?

Dan,

I got the Premier card for the sole reason of having options to send my kids to and from Israel for their yeshiva’s and schools. I now have enough thank you points to do that, but can’t seem to find any saver awards Or availability on the Turkish airlines website for star awards for United. It either shows me Turkish airlines flights or Lufthansa flights for between $200 and $400 in addition to the points. Mostly though there is nothing available and what is available cost between $200 $400 each way.

Any tips to find united saver Awards? Or how to use these points in another way to go from ord-tlv?

Help

I always get this error when trying to search Turkish awards. “Flight not found on the selected date and route. You can search for a new flight by changing this information. If you are searching for a repatriation flight you can get more information via Turkish Airlines Call Center.” what am I doing wrong?

does anyone have a screen shot of this offer?

Hi Dan,

I did this sign up bonus and recently transferred my points to star alliance. When trying to book a domestic flight (NYC to Miami) I am consistently getting an error saying no flights found. I used the link you provided ( you can book Star Alliance awards with Turkish miles here ) It still doesn’t seem to work. Any tips? Thank you!

Citi isn’t giving me the 10% reward. I have both the Rewards+ and the Premier cards. Ive already made 2 transfers from my premier but They say its only by redeeming the reward on my rewards+ .

Help Dan

Are they linked to the same TY account?

No they are not. I didn’t know that they needed to be.

Is Turkish Airlines by far the best redemption here? Or are there any others worth considering?

Dan, my year with this card is coming to an end. What’s the top 2 cards to downgrade to( my wife and I both have one)

Will the points be worth the same if we downgrade?

Any ideas dan?

i applied for the card and got the pointes, can you please help me with how to book the buisness class ticket to TLV. when i go on citi website, it shows that you have to pay an addtinal $3,500.00. how to you get it done for just the 84k in points?

Hi Dan I got this card with the 80k offer. They told me I can only downgrade to Costco card if I want card w/o fee. Is there another option for me? Is it that bad to close card? Bc I don’t shop cosco at all and I don’t wanna pay fee. Thanks Dan