Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Table of Contents

Limited time signup bonus

Through 11/30 only, you can earn 75,000 bonus miles for opening a Chase United Business Card and spending $5,000 in 3 months. This is a new card that was launched in 2020.

Annual fee

$0 intro annual fee for the first year, then $99.

Welcome bonus terms

You can receive the bonus on this card if you haven’t received a bonus on this United Business Card in the past 24 months and don’t currently have this United business card.

Note that this is a different product than the United Business Explorer card and you can have both cards and receive the bonus even if you received the bonus on that card within the past 24 months.

You can also get the bonus regardless of which United consumer cards that you have.

Card benefits

- A free checked bag for the cardholder and a companion, even on basic economy fares.

- 2 miles per dollar on United, restaurants, gas stations, office supply stores, local transit, taxis, tolls, mass transit, and ride share services.

- 5,000 bonus miles every card anniversary if you have this United business card and any United consumer card.

- $100 annual statement credit if you make 7 United purchases of $100 or more on the card.

- 25% statement credit for food, beverage, and WiFi purchases on United flights.

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Priority boarding for the cardholder and companions, even on basic economy fares.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- 2 free United Club passes every year for being a cardmember.

- No foreign exchange fees.

- Primary rental car CDW insurance in the US when renting for business purposes and in every other country for any rental purpose.

- Exclusive cardmember access to auctions that allow you to use your miles for once-in-a-lifetime experiences. A few years ago I used 25K miles for 4 field box seats to an Indians game along with the right to run onto the field before the top of the 7th inning and swipe 2nd base right off the field. Nobody could believe it as I walked around the ballpark with 2nd base. I even got it signed after the game by the Indians wining pitcher that night, Justin Masterson, who was equally shocked that I actually had 2nd base.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes.

- If you spend $12K/year on the card it will give you 500 PQPs and if you spend $24K/year you’ll get 1,000 PQPs. PQPs from multiple cards can stack together.

- United miles never expire, even if you close your card.

Business card and 5/24 info

This is a business card, but you may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that. Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field.

If you have business paperwork you can apply under your business name. Otherwise, it’s critical to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork. You can then send in bills in your own name for verification.

All Chase cards appear to be subject to 5/24 restrictions, meaning that you are not likely to be approved if you have been approved for 5 or more consumer credit cards in the past 24 months. Note that the Chase system automatically counts cards like authorized user cards and store cards as cards that count towards 5/24, but if you explain to Chase that those cards are merely authorized user cards or store cards they can manually approve you for a new card.

However, it’s important to note that business cards from most banks, including Chase business cards, do not get added to your 5/24 count of recently opened cards. That’s because business cards from most banks don’t show up on your personal credit report and the 5/24 count is based off of your personal credit report. That means that applying for these cards won’t “hurt” your 5/24 count.

Another benefit of the card not reporting on your personal credit report is that when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an business cards from banks like AMEX and Chase it’s just not reported, so you can wait until the money is due without it having a negative effect on your score. That also means if you close the card, it won’t have an effect on your credit score.

Expanded award ticket availability

The reason this card is the best airline card you can get isn’t for the spending benefits, it’s for the perks. And they are awesome.

The reason this is my favorite airline card is that the United card is the only airline card that offers expanded award ticket availability.

This increases the value of your miles significantly and in turn makes the Chase Quadfecta/Quinfecta spending strategy even more valuable.

Cardholders have access to expanded saver coach award availability (XN class), last seat standard coach award availability (YN class), and last seat standard business/first class award availability (JN class).

It’s not just slightly expanded. There is a world of difference between the availability that cardholders can access and the availability for non-cardholders.

Read more about this in the United Expert Mode post.

This availability differential applies to all domestic and international routes and makes it crucial to be a United cardholders.

ll domestic and international routes and makes it crucial to be a United cardholders.

Expanded Plan B availability

As you have better access to saver coach awards you’ll also have better ability to do Plan B awards.

Plan B allows you to redeem for saver business class awards when there’s only saver coach available! Read more about Plan B in this post.

No airline besides United offers a Plan B style award redemption.

Discounted awards for cardholders

United runs promotions offering discounts on award flights for cardholders.

They have offered these discounts for travel to Tahiti, Ski destinations, Hawaii, Mexico, The Caribbean, and more.

Here Is United’s Hidden Award Chart

United no longer publishes an award chart, but rates for United flights found in their old award chart are still correct.

United does charge a close-in mileage surcharge and they can be found in the chart below. Note that the you’ll want to book travel as 2 one-ways to avoid paying the surcharge on the return leg when it wouldn’t apply when booked separately. However if you do that you would lose your ability to take a free stopover.

Partner award rates have gone up and they can be found in the unpublished award chart below with one-way rates for flights to/from the mainland US:

| United flights | Partner flights | |

|---|---|---|

| Close-in surcharge within 7 days | 2.5K-3K miles | 1K-3.5K miles |

| Close-in surcharge 8-21 days in advance | 2K-2.5K miles | 1K-3.5K miles |

| Mainland US/Canada | 12.5K Coach 25K Business 35K Premium Business | 14K Coach 27.5K Business |

| Alaska | 17.5K Coach 30K Business 40K Premium Business | 19.5K Coach 33K Business |

| Hawaii | 22.5K Coach 40K Business 50K Premium Business | 25K Coach 44K Business |

| Mexico | 17.5K Coach 30K Business | 19.5K Coach 33K Business |

| Central America | 17.5K Coach 30K Business | 19.5K Coach 33K Business |

| Northern South America | 20K Coach 35K Business | 22K Coach 38.5K Business |

| Southern South America | 30K Coach 60K Business | 33K Coach 66K Business |

| Europe | 30K Coach 60K Business | 33K Coach 77K Business 121K First |

| Africa | 40K Coach 70K Business | 44K Coach 88K Business 143K First |

| Middle East | 42.5K Coach 75K Business | 47K Coach 93.5K Business 154K First |

| Central Asia | 42.5K Coach 75K Business | 47K Coach 93.5K Business 154K First |

| South Asia | 40K Coach 75K Business | 44K Coach 99K Business 154K First |

| North Asia | 35K Coach 70K Business | 38.5K Coach 88K Business 132K First |

| Japan and Oceania | 35K Coach 70K Business | 38.5K Coach 88K Business 121K First |

| Australia and New Zealand | 40K Coach 80K Business | 44K Coach 99K Business 143K First |

Excursionist Perk

While American and Delta have eliminated free stopovers, United continues to offer a free excursionist perk as described in this post. Just use the multi-city award search on United.com to piece it together.

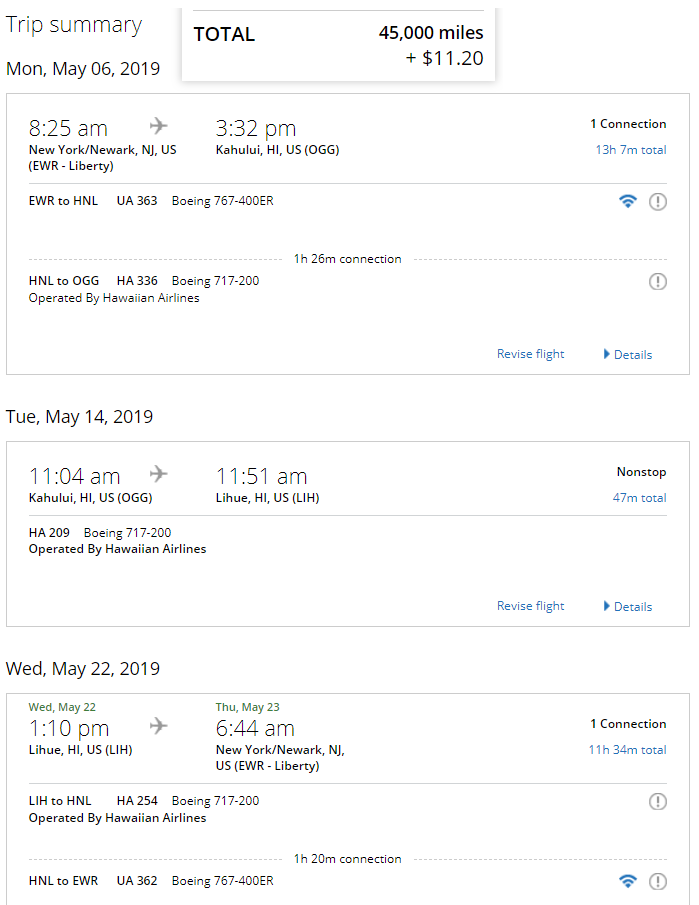

A round-trip to 2 Hawaiian Islands is just 45,000 miles round-trip thanks to the free excursionist perk:

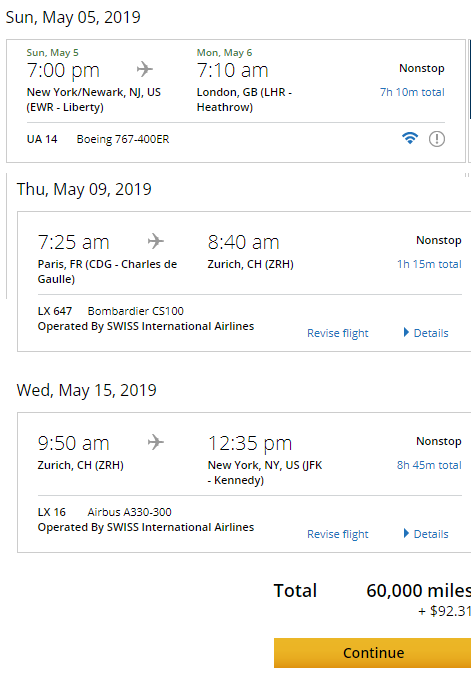

A round-trip ticket to 2 European or South American cities is just 60,000 miles round-trip thanks to the free excursionist perk:

A flight to 2 of my favorite cities in Asia, Hong Kong and Chiang Mai, Thailand is 80K miles thanks to the perk:

You’re even allowed a free open jaw in addition to the perk to really maximize your travel. For example this itinerary includes travel to London, Paris, and Zurich. You can take a train or use 4.5K BA Avios to get from London to Paris to fill the hole in the open jaw:

Of course the free stopover isn’t just useful from the US.

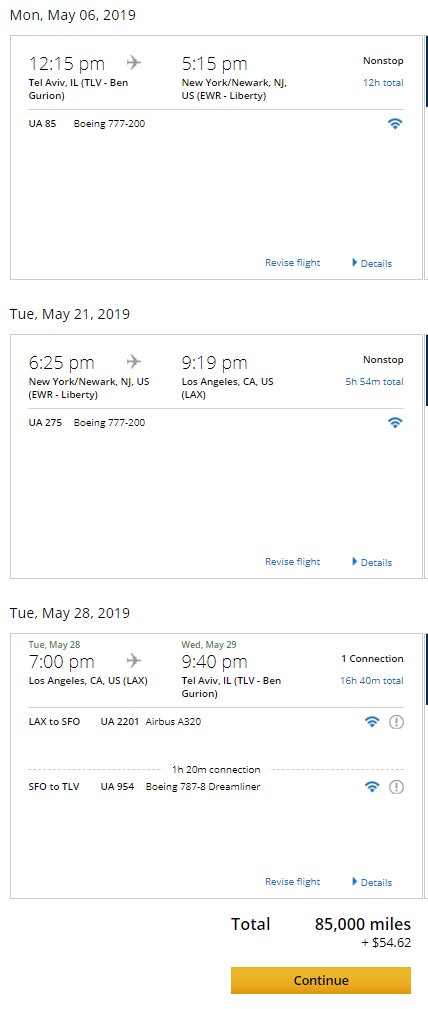

You can stopover in NYC and LA when flying from Tel Aviv to the US:

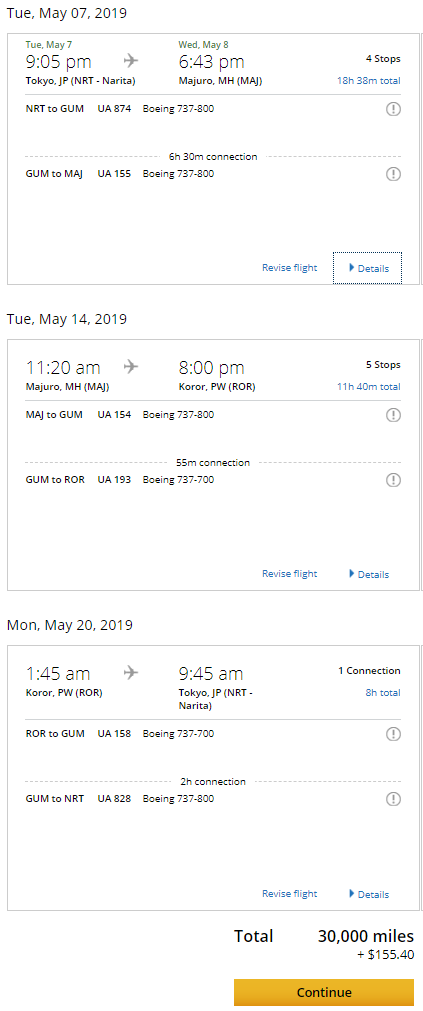

If you find yourself in Japan you can fly on the island hopper to 2 cities in Micronesia (I’ve been hankering to get back to Palau since the moment I left) for 30K miles:

Partner airlines

United has dozens of partner airlines which means lots of great award opportunities. It can be worth checking for award space on partner sites like ANA or Aeroplan.com to search for award availability and then call United to book if you don’t see availability on United.

Partners airlines include:

- ANA

- Aegean Airlines

- Aer Lingus

- Air Canada

- Air China

- Air Dolomiti

- Air India

- Air New Zealand

- Aeromar

- Asiana Airlines

- Austrian Airlines

- Avianca Airlines

- Azul Brazilian Airlines

- Brussels Airlines

- Cape Air

- Copa Airlines

- Croatia Airlines

- EVA Air

- Edelweiss

- Egyptair

- Ethiopian Airlines

- Eurowings

- Germanwings

- Hawaiian Airlines

- Island Air

- Juneyao Airlines

- LOT Polish

- Lufthansa

- Scandinavian Airlines

- Shenzhen Airlines

- Silver Airways

- Singapore

- South African Airways

- Swiss International Airlines

- TAP Portugal

- THAI

- Turkish Airlines

Will you signup for a Chase United Business Card?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

30 Comments On "Ends Tomorrow: Earn 75,000 Miles On The New Chase United Business Card!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Are these chase points or United points?

United.

If I have the MileagePlus Business card can I still get bonus with this card? Any reason to keep both?

Which version do you have? Explorer?

Explorer

Then you can get the bonus, they’re different products.

i prefer the 60k offer after $3k spend that was available yesterday

17K-19K more miles for $2K more spend is the better offer, that’s a whopping 8.5-9.5 miles per dollar spent.

i say “prefer” bec i havent yet figured out how to MS successfully. therefore, the $2k of extra organic/regular spend could go towards a SUB on another card.

Is chase approving business cards now?

https://www.dansdeals.com/credit-cards/battle-ink-cards-chase-ink-business-cards/

how long is this offer good for? i have to wait a couple months for some cards to fall off my 24 month history…

TBD.

I just signed up for this card earlier this months odds they’ll match this upgraded offer?

Not good, but send an SM and find out.

I sent them a SM and they are asking for an offer code or invitation number. Is there any response to this if all I have is the ad on this site?

Apparently from what Chase told me when I called them, they have a “Richer Premium” policy which indicates any applicants for the same product within 90 days of the better offer are permitted to have the better offer. The agent I spoke to told me he filled out a form to facilitate my getting the better offer. Hope that helps

Any clawback/shutdown risk in canceling after first year before annual fee is due?

No.

Thanks. I assume this goes for all chase cards?

What’s the difference from this card and the Explorer?

Business Explorer card had fewer spend categories, no anniversary bonuses, a $95 fee, and offered price and return protection.

Can I get the bonus again if I apply under a different business?

How does one find out what cards they had in the past if they are now closed? I know I had at least 2 united cards, but unsure if they were personal or business or explorer or mileageplus.

Call the Chase credit card department (number is on the back of any credit card or ask customer rep to connect you) and they will know.

Can you combine business and personal United points

I wasn’t approved immediately, have another United Business so I think thats why. Should I call the reconsideration department? If yes what is their number?

The united business card that had that 100k offer a few months back was the explorer? It doesn’t say explorer in the card

If i got that 100k card can i get this one too?

Is there a free version of the business card that i can downgrade to after the first year.

If I have credit on united from a cancellation.

And I rebook and pay the extra difference in fare with a united card would that suffice to get a free bag Even if original card was not united?