Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update: The Capital One Venture X Rewards Credit Card Business Card offer to earn up to 500,000 miles will be ending on March 11th!

This offer can end anytime today, so if you want to take advantage of this incredible offer, you should apply right now!

Limited Time Offer: Earn Up To 300,000 Bonus Miles (Half A Million Total Miles!), $300 Travel Credit, 10K Bonus, Enhanced Priority Pass+More From The Capital One Venture Rewards Credit Card X Business Card!

Table of Contents

Limited Time Signup bonus:

Capital One has just launched a limited time offer for its Capital One Venture Rewards Credit Card X Business Card. The expiration date of this offer is unknown.

- You will earn 150,000 bonus miles after spending $20,000 in the first 3 months.

- As you earn at least 2 miles per dollar spent, that’s a total of 190,000 miles after spending $20,000.

- You will earn another 150,000 bonus miles after spending another $80,000, for a total of $100,000 in the first 6 months.

- As you earn at least 2 miles per dollar spent, that’s a total of 500,000 miles after spending $100,000.

That’s a significantly better offer than the launch offer of 150,000 bonus miles for spending $30,000 in 3 months.

190,000 miles can be used for $1,900 of travel reimbursement and 500,000 miles can be used for $5,000 of travel reimbursement, but they can be worth much more via transfer partners!

Note that Spark Cash Plus cardholders are unable to apply for Venture X Business. However, existing cardholders of other Spark cards are eligible to apply. If you do close your Spark Cash Plus card, you will become eligible for the Venture X Business Card.

Don’t have that kind of spending? The consumer Capital One Venture Rewards Credit Card X Rewards Credit Card offers 75,000 bonus miles for opening the card and spending $4,000 in 3 months. As you earn at least 2 miles per dollar spent, that’s a total of 83,000 miles after spending $4,000. Read more here.

The consumer and business Venture X cards are very similar, however there are some key differences as described below.

Annual fee:

$395

Credit reporting:

Unlike most other Capital One cards besides the Spark Cash card, this card does not report spending on your personal credit report, so a high utilization rate of your credit line will not hurt your credit score.

It also means that it won’t hurt your Chase 5/24 count.

Charge Card with no preset spend limit:

This is a charge card has no preset spend limit. It is a pay in full card with no APR as your balance is due in full monthly.

It can be easier to make big purchases with this card than with traditional credit cards that have a hard credit limit.

Annual travel credit:

Receive a $300 annual travel credit every cardmembership year for all travel booked through the Capital One Travel portal, where you can book flights, hotels, and car rentals. Those credits can be applied multiple times until you spend $300.

The credits now discount the price at the time of booking and if you maximize this credit, this card’s effective annual fee is just $95.

Anniversary bonus:

Cardholders will get an anniversary bonus of 10,000 miles every year that they have the card. Those miles are worth $100 towards travel or gift cards, but they can also be transferred into 10K airline miles where they can be much more valuable. At a value of 1.5 cents per airline mile, that’s like another $150 back every card anniversary.

Between the $300 annual travel credit and the 10,000 mile anniversary bonus, the annual rewards are worth more than the card’s annual fee!

¿Por Qué No Los Dos? (Yes, You Can Get Both)

As this card is easily profitable to open for the signup bonus and then keep open for the annual card anniversary bonuses, it’s a no brainer to open a Venture X Business Card in addition to a Venture X Card.

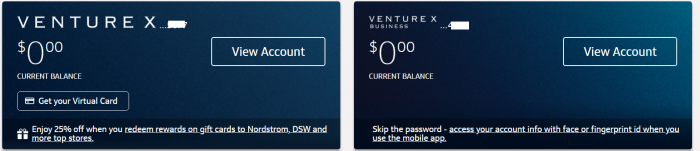

I have the Venture X and was approved the Venture X Business as well!

It showed up immediately in my account as well after clicking on online setup:

Global Entry/Pre-Check Fee Refund:

It costs $78 to apply for a 5 year TSA Pre-Check membership which makes flying pleasant again. Shorter lines, no need to remove your shoes, belt, jacket, or hat. You can keep your laptop and small liquids inside your carry-on. And you go through a good old fashioned metal detector instead of assuming the position in the body scanner. If you charge it on your card the fee will be refunded.

It costs $100 to apply for a 5 year Global Entry membership which lets you bypass the customs line. If you have Global Entry you also get TSA Pre-Check for free.

If you charge it on your card the fee will be refunded. You can get refunded for this charge once every 4 years.

You can read more about the differences in this post.

My whole family has Global Entry and it sure makes traveling a whole lot easier!

Capital One Lounge and Capital One Landing Access:

Capital One now operates lounges in Dallas/DFW, Denver, and Washington DC/IAD.

I loved being able to shower, use the prayer and relaxation rooms, try out the Peleton, and enjoy free snacks and premium beer and cocktails while connecting in DFW.

A new lounge will be added soon in Las Vegas and Capital One Landing locations will be added soon in LaGuardia and Washington/DCA.

Venture X Business cardholders get unlimited free entry and can bring 2 guests for free. You need to have a departing or connecting flight within 3 hours to use the lounge.

Unfortunately, unlike with the consumer Capital One Venture Rewards Credit Card X Rewards Credit Card, additional cardmembers don’t receive free entry.

Lounge access for Capital One Venture Rewards Credit Card and Capital One Spark Miles for Business cardholders is $45 per person per visit. Those cardholders also get 2 free visits in 2024, but that benefit goes away after this year. Lounge access for everyone else is $65 per visit. Kids under 2 are free.

Lounges feature grab and go food with to-go bags for your flight, fully stocked bars with local beers and craft cocktails, coffee bars, work zones, exercise rooms with Peloton bikes and yoga mats, nursing rooms, kids rooms, soundproof relaxation rooms, luggage lockers, multi-faith prayer rooms, and shower suites!

Enhanced Priority Pass Membership:

Venture X Business cardholders get a complimentary Priority Pass lounge membership. Priority Pass lounge membership allows you to bring 2 guests with you into over 1,300 airport lounges.

You can also visit a Chase Sapphire Lounge for free once per year.

You can enroll in Priority Pass here.

Best of all, while consumer Capital One Venture Rewards Credit Card X Rewards Credit Cardholders do not receive Priority Pass retail airport offers with a per person credit, Venture X Business cardholders do receive this credit via its enhanced Priority Pass membership!

In Cleveland, that means getting a $28 per person credit every time you stop at Bar Symon. With 2 guests, you can load up on $84 of free snacks and drinks, and they’re happy to pack it up to go.

In many airports, you can take advantage of snacks to go, massage chairs and spa service at Be Relax Spa, at gaming lounges, or at other restaurants and shops with free spending credits. You can find non-lounge and lounge offerings via the Priority Pass website.

Having access to Priority Pass retail airport offers adds a ton of value to this card offering!

Plaza Premium And Virgin Atlantic Lounge Membership:

Venture X Business cardholders get a complimentary Plaza Premium lounge membership with 2 free guests. You just need to show your credit card to gain access to these lounges.

These include highly rated Virgin Atlantic Clubhouses in JFK, San Francisco, and Washington DC.

Card earnings:

- 2 miles per dollar everywhere.

- 5 miles per dollar on flights booked via Capital One Travel, plus get a refund if Hopper by Capital One Travel says to buy a flight and the prices goes down within 10 days. Cardholders can also freeze the price of select flights for up to 14 days!

- 10 miles per dollar on hotels and rental cars booked via Capital One Travel.

- There are no foreign transaction fees.

Spend Threshold:

You’ll need to spend $20,000 on this card within 3 months for 150K bonus miles and another $80,000 in 6 months for another 150K bonus miles.

You can pay your federal taxes for a 1.82% fee. If you overpay your taxes you can request a refund or apply it to your next year’s taxes. If you paid $98,213 in taxes you would pay $1,787 in fees and earn 500,000 miles!

See this post for more ideas on meeting a credit card spend threshold, including property taxes, local income taxes, and other bills via Paypal with no fees.

Excellent MLB Redemptions

Capital One cardholders have access to exclusive tickets to special events such as All-Star Week, the MLB Postseason, and the World Series presented by Capital One.

Plus, you can redeem just 5,000 miles (or $40 cash back) for ultra-premium MLB seats in every ballpark, for every game. There are 4 tickets available for every game at that rate. The best time to buy is when each month’s games go live, which are posted here.

I have gone to games with amazing seats in NYC, DC, LA, Anaheim, Cincinnati, Cleveland, Dallas, Houston, Pittsburgh, San Diego, and San Francisco, and hope to go to many more to complete my 30 ballpark tour using my Capital One miles at an excellent value!

Getting $200 seats for 5,000 miles is a great deal!

Premier collection hotel access

Venture X Cardholders have access to The Premier Collection of hotels.

Those hotels will qualify for the card’s $300 travel credit and 10x points per dollar, plus you’ll get a $100 experience during your stay, breakfast for 2, free WiFi, upgrades, early check-in, late checkout, and you will earn standard elite credit, elite benefits, and hotel points.

Flight booking perks

Cardholders get access to airfare perks like the ability to get free price drop credits, get alerted about price drops, and the ability to pay a nominal fee to freeze airfare prices or get a refund on airfare for any reason.

Discounted travel offers are also available for Venture X cardholders.

Excellent card benefits:

This will be a World Elite Mastercard with benefits like:

Primary and additional cardholders get benefits like:

- Primary rental car CDW insurance, for rentals primarily for business purposes

- Cell phone insurance, up to $800 per claim if monthly bill is charged to card. $50 deductible applies.

- Price protection, up to $500 per item for price drops within 60 days, up to $2,500 per year.

- Delayed baggage coverage for bags delayed over 4 hours, up to $100 per day for 3 days.

- Rideshare protection for items lost in a rideshare car up to $750 per ride.

- Trip cancellation and interruption insurance, up to $1,500 per trip.

- Extended warranty of 1 extra year, up to $10,000 per item.

- Lost or damaged luggage insurance, up to $1,500.

- Travel medical services coverage, up to $2,500 per person.

- Travel Accident Insurance, up to $1,000,000 per person.

- Purchase protection for items damaged or stolen within 90 days, up to $10,000 per item.

Business vs Consumer card:

The Capital One Venture Rewards Credit Card X Business card and the Spark Cash business card don’t appear on your credit report. That’s good for several reasons.

First of all they won’t count against your 5/24 count for opening new Chase cards. Only cards on your report that have been opened within the past 24 months count for that.

Second, when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally, it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an AMEX business card it’s just not reported, so you can wait until the money is due without it having a negative effect on your score.

Third, if you close a business card it won’t ever have an effect on your score.

You may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that.

Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field

Use points for paid travel reimbursement:

You can redeem your points to pay yourself back for any travel related expenses (airfare, hotels, car rentals, cruises, ride sharing, etc) or book new travel at a value of 1 cent per point. There’s no need to book via any portal, just pay yourself back for part or all of a purchase!

500,000 miles would reimburse $5,000 in free travel!

Airline and hotel transfer partners and transfers to other cards:

You can transfer points from Capital One into these programs at the following ratios:

- Aer Lingus (1:1 via BA, No alliance)

- Aeromexico (1:1, SkyTeam)

- Air Canada Aeroplan (1:1, Star Alliance)

- Air France/KLM Flying Blue (1:1, SkyTeam)

- Avianca LifeMiles (1:1, Star Alliance)

- British Airways Avios (1:1, OneWorld)

- Cathay Pacific Asia Miles (1:1, OneWorld)

- EVA (2:1.5, Star Alliance)

- Emirates (1:1, No alliance)

- Etihad (1:1, No alliance)

- Finnair (1:1, OneWorld)

- Iberia (1:1 via BA, OneWorld)

- Qantas (1:1, OneWorld)

- Qatar (1:1 via BA, OneWorld)

- Singapore (1:1, Star Alliance)

- TAP Air Portugal (1:1, Star Alliance)

- Turkish Airlines (1:1, Star Alliance)

- Virgin Red/Virgin Atlantic (1:1, SkyTeam)

- Accor Hotels (2:1)

- Choice Hotels (1:1)

- Hilton Hotels (1:1.5 via Virgin)

- Wyndham Hotels (1:1)

You can also combine miles between Capital One miles cards online, transfer cash back into miles online, and you can transfer miles to any Capital One cardholder by calling Capital One!

A nice perk is that after the 1,000 mile minimum transfer, you only need to transfer points in increments of 100, meaning you have fewer leftover points compared to other bank transfers.

- Air Canada awards start at just 6K miles on United, making for excellent bargains!

- Avianca Lifemiles awards start at just 6.5K miles on United. Or save up for the 194K miles you’ll need for a round-trip first class flight in First Class from the US to Tel Aviv on Lufthansa with access to their amazing first class terminal during your connection with a Porsche transfer to your plane.

- Turkish Airlines has an incredibly generous award chart, with bargains on United like domestic awards, including Hawaii, costing just 7.5K miles in coach or 12.5K miles in business class! Tickets to Israel cost just 32K miles in coach or 47K miles in business class!

- 7.5K Virgin Atlantic miles is enough for a Delta short-haul flight.

- 8.25K British Airways Avios are enough for short-haul flights worldwide.

- 37K Flying Blue miles is enough to fly nonstop on Delta between North America and Israel.

- 120K Aeroplan miles is enough for a round-trip business class award between North America and 2 European cities.

- With 90K Cathay Pacific Asia Miles miles you can book a round-trip business class award between North America and Europe.

- With 180K Qantas points you can fly round-trip in El Al business class between NYC and Tel Aviv with no fuel surcharges.

- With 102K Emirates miles you can fly in A380 Shower Class from JFK to Milan.

- With 163.5K Emirates miles you can fly in A380 Shower Class from JFK to Dubai.

- You can book Vacasa private homes for just 15K Wyndham points.

- And endless other possibilities!

Dan’s Quick Thoughts:

This card seems like a no-brainer thanks to the annual credits that more than cover the annual fee.

The signup bonus is especially lucrative, if you can meet the minimum spending requirements.

In some ways, the card falls short of the consumer Venture X card. It doesn’t offer additional users free lounge access or some with perks like Hertz status. However, that may be outweighed by the enhanced Priority Pass which allows non-lounge credits, plus spending won’t be reported on your personal credit report and the card won’t count against your 5/24 count.

Assuming you take advantage of the annual credits, there is essentially a net-negative cost for all of the card’s benefits, like Capital One lounge access, enhanced Priority Pass lounge access, and more.

With the ability to reimburse yourself for any travel purchase and the option to transfer points to valuable airline partners such as Turkish, where you can fly anywhere in the US50 for just 7.5K miles in coach or 12.5K miles in first class, spending on the card is valuable and doesn’t require jumping through hoops with multiple cards as with other banks to earn 2 transferrable miles per dollar everywhere.

The signup bonus is just gravy on top of those benefits!

Will you signup for the Capital One Venture Rewards Credit Card X Business Card?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

137 Comments On "Last Chance! Only Hours Left To Earn Up To 300,000 Bonus Miles (Half A Million Total Miles!) Via The Highest Ever Signup Offer From The Capital One Venture X Rewards Credit Card Business Card!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Plaza premium lounge no longer works with Virgin Atlantic clubhouse in jfk terminal 4

Should work with PP from 8am-130pm.

Correct, but until a few months ago, it was part of plaza premium lounge and you could go the whole day…

On international flights only remember. Which most are only at night.

How hard is it to get approved?

Last month, when my credit score improved to 785 on the CreditWise service that was available through CapitalOne, I applied to upgrade to the Venture card. Turned down. Credit report didn’t show that I had paid off most of my credit card debt and closed half the accounts. Also, the score that Capital One uses for its own purposes showed only 735. So I canceled the Capital One card. I can still use their website to access my CreditWise report, which shows my score at 817. Turned down again. Is this any way to run a bank?

This card was originally launched under the “Spark Plus” moniker in 2022 before being revamped into the Venture X Business. The opening bonus then was 250k points after $50k spend (350k after 2%), so this is about double the points for double the spend. Nice!

No, Spark Plus is a separate product and earns cashback instead of miles.

I have a spark business card, can I apply for this card?

If it’s Spark Cash Plus, no.

If it’s any other Spark card, yes.

I have the spark plus you mention to close it and the you’re eligible for the venture business. How long do you need to wait from closing the spark plus to be eligible to apply.

Any DP how long to leave between closing spark cash plus and opening a venture x business?

Tell us more about closing current Sparks Cash cards. Can you request a product change ?

That seems amazing, but how do you spend 100,000 in 6 months.

Precisely, its not so amazing at all for the retail guy. If I was running a business with hundreds and thousands of dollars in monthly expenses and presumably millions in revenue why would I be putzing around trying to make a few hundred thousand Capital One points?

I’m sure that’s juts what the CEO of a company has time to waste on i his CC points so he can save on a free hotel night.

For all the Talmudic pilpul on this site, some of this quite stupid.

Actually, big business owners are some of the most dedicated to points and miles.

The creator of Whatsapp almost called off the sale if they couldn’t wrap it up before he missed his Lufthansa First class award ticket!

And many business owners at programs I’ve spoken at have been the most interested in the seminars. They get annoyed at the petty questions as they consider their own questions more consequential!

That Flyertalk post was legendary!

Anyone with a big business that doesn’t use at least a 2% card is leaving money on the table…. $5000 is enough to convince someone like that to bother with opening a card, which may also lead to switching banks.

“Venture X Business cardholders get a complimentary Priority Pass lounge membership. Priority Pass lounge membership allows you to bring “2” guests”

I have entered lounges multiple times with as much as 5 guests free with my personal venture x priority pass, Unlike the amex platinum priority pass that charges a fee automatically to your amex account for every additional guest after 2 guests.

Is the business venture x different?

I’ve heard that as well.

My guess is this is the same as the personal card, but officially there’s a limit of 2, so they can always start charging for more than 2 guests if they feel like it.

Well lately anytime I hit a PP lounge they say unless you are Flying on a certain flight or certain hrs (not at this time) then you cannot access

can u get this card when you have the spark business miles card?

Yes

Thank you for applying for a credit card issued by Capital One®. Unfortunately, after reviewing your

application, we cannot approve your request at this time.

The reason(s) for our decision are:

• Based on your application information, the balance on one or more Capital One accounts has

exceeded the credit limit

Should I call them?

Maybe pay it first ? 🙂

If one has a spark cash under one EIN and applies for this as a SP, will that work?

isnt there anything better for 100k spend (say opening a few other cards)?

Sure, the recent Chase Ink $6K / 90k offer comes out way better. But you’ll have to open 5 cards instead of 1. This is a lot simpler for the guy spending $1Mil+ per year.

Anyone have data if you can pay taxes with this card? I’ve had trouble using some business cards for taxes @dan?

Tried via Paypal if the card directly didn’t work?

FYI you cannot get more than one business venture x, even for 2 businesses:

Unfortunately, after reviewing your

application, we cannot approve your request at this time.

The reason(s) for our decision are:

• Based on your application information, too many accounts of this type

I opened this card 2 weeks ago, can I still get this promotion?

Call and ask and let us know.

just got of the phone with them and its a “No”, they wouldn’t approve me for the new promotion even if i got approved for this card only 2 weeks ago,

Any advice?

I’m in the same exact situation. Opened two weeks ago. Just got off the phone, it was a no go.

Another fun thing I found out – the pay vendor option in the business account is not available until 90 days after account opening. So if you were planning on paying vendors to hit the signup bonus spent you’re out of luck.

Does anybody have experience closing a newly opened card and reapplying? There’s no way I’m hitting that $30k spend without the ability to pay vendors with the card.

OP, I have the consumer CP1X, just got approved on the business CP1X. Do I have to transfer existing miles to business side first if I plan to downgrade the consumer CP1X? I see both of the consumer and business CP1X on my online profile now, but only 1 rewards miles account. I assume even if I downgrade, my miles should be safe in the same account that my business CP1X takes over afterwards? Thanks in advance!

You have to transfer the miles first. You can do that online. I imagine the 2nd rewards account will populate soon.

What credit score do you need to get approved? (Would a 740 work)?

Do you need to have over a certain annual income to get approved?

No way to know without applying.

Im pretty sure capital one business cards are reported to credit score

Not Venture X or Spark Plus.

I just applied and they did hard pull !!!!! On all 3 bureaus

Hard pull has nothing to do with the card reporting spending.

“You can also visit a Chase Sapphire Lounge for free once per year” is this only on the business or even on the personal venture x?

Both.

So, what are the views on how long to wait after closing the Spark Cash Plus and applying for this one?

Can you get the card number right away like Amex? Because I know there is no expediting new C1 cards, and I have a large purchase in the next day or 2

Im looking to buy a new car now from the dealer, but im assumming the dealer would not take a credit card for 20k or more, any info on how to reach the spending?

You can certainly pay with a card, it’s just a matter of negotiating that.

Does anyone know if they have a reconsideration line ?

Yah you call the dumb rep and they write the reconsideration to the back team . Google the number

Just did that Is there any shot it works?

How long do i have to wait after canceling my spark plus to apply for business venture X?

Anyone try yet?

Try and let us know 🙂

I will, letting a week pass

Tried to open BVX a week after closing spark plus and denied. Will try again in a few weeks if offer is live. Sticking to ink premier for now

I tried 3 days later and wasn’t approved. Tried again 2 months later and was…

Can You transfer points from Venture x to spark plus thereby getting better cash back if needed?

No, you can transfer cash to miles, but not miles to cash.

Weird thing about this card is that it has no preset spending limit (but you can’t spend what you want). To get started on the 100K spend, spent $2400 on health insurance and then tried to put through an $8K charge. Latter declined. CSR recommended waiting until the first payment posts, pay it, and then try the second. Guess cycling is recommended? There is a “confirm purchasing power” field where you can try to determine how much you can spend on a given time. No more than 4 attempts to enter amounts per day.

Does this Priority Lounge Pass get me into the Dan Lounge at BG in TLV ? Is there an additional fee?

Thanks

Yes.

No.

Amazing writeup, I just got the card through your link. Question: since the card has no preset spending limit, is there a way to know in advance if a charge of $X will be approved (like how Amex does with their “Check Spending Power” link on the Platinum card)?

Congrats and thanks!

On the capital one site you can check for a purchase approval as with Amex.

Thank you, Dan! I found it under Account Service >> Control Your Card >> Confirm Purchasing Power.

Can you sign up for Capital One Spark Cash Plus if you got the venture x business card?

how the heck does one generate 100k of spend without going broke?

I have an old Spark buissnes card

Also called Spark Pro

It’s not getting reported on personal credit report

Will I qualify for this card?

Anyway to get this without a actual business like the chase if ya I’m in for me and p2

thanks Dan & JJ I got approved

and you can do the same thing like chase

If I have a spark plus under 1 LLC can I apply for the venture x on a different LLC?

Yes y not its 2 difrent llc

incorrect. amex and capital 1 go by owner not by company name

Are you assuming or you know?

I currently have the Spark Cash and the personal Venture X. I wanted to apply for this and according to this article, I would have to close the Spark Cash card before applying. I called Capital One and they mention that there is no restrictions on having both cards. So I’m just wondering if I went ahead to apply for it, if the application determines that I have the Spark Cash, it would tell me that I’m ineligible before pulling my credit?

Spark Cash is fine. Spark Cash Plus is the problem.

Sorry, I have the Spark Cash Plus, the card that’s green.

if i cancelled my spark plus – how long should i wait to call in for reconsideration ?

Dan!

Thanks for your great deals. ALWAYS!

I had the old Spark business card and closed it last year,

Now I am in the middle of applying for this card, and this came up:

*****, we couldn’t approve you for the Venture X Business card you applied for, but we think the Spark Miles Select card could be a great fit for your business.

When you’re not approved for your first choice of card, we consider you for similar cards. We can approve you for Spark Miles Select but still need to verify some of your information, which we’ll do after you review your terms and accept your offer. You don’t need to submit another application.

thanks again!

Any point in getting this one?

will it help me get approved for the Spark, I can do a lot of spending, any way to pull this through?.

Hi @Don,

I applied about 2 weeks ago and got declined. I think its the first time I got declined for a CC, My credit score according to Capital one is 764 (Transunion), I have a 100% on time payment record and I have no credit pulls for a CC for more than a year and 1 before that. I called in Capital one if I can ask for a reconsideration but hey said If they submit a reconsideration it would go only through their automatic system and a human would not look at it and it will also result in another hard pull on my credit. Is their an alternative way to get it reconsidered?

Hi Dan,

I would appreciate if I can have your input on this.

Thank you!

@Dan?

Can I sign up for this if I have the old spark 2% (it’s not a charge card but rather a credit line card) but perhaps became the new spark cash plus card?)

Yes.

Can business miles be combined with personal miles (like the JPMC cards)

Yes

Will they remove the “non-lounge credits” mid AF year like they did to the venture x? Or as soon as I open my card will they put the Account under review? Or how about take forever and multiple calls to issue travel credits like it took for the Airbnb Credits. I dont trust this bank – not to mention their sly high interest account which just stopped going up and you had to open a new account..

“Note that Spark Cash Plus cardholders are unable to apply for Venture X Business.” I Called Capital One and they advised me that you could apply for the venture X Business when you have the Spark cash plus card.

You certainly can apply.

You just won’t get approved. 😀

Can you get approved for the Spark Venture X Business card if you are a secondary holder of a spark cash plus card?

Yes

If I can’t apply for both and I have where to spend $100k, Which one is better to apply for, the Venture x Business or the Spark?

Both have good deals.

Will AU receive the same benefits? Specifically priority pass. Free to add? No ssn?

Yes

When booking an award ticket using Avios do I need to fly with them or can I book it for them and not be on the ticket

Can book for others.

Dan,

I have both cards the Blue and green capital one spark business cards, Can I apply for this one?

It depends exactly which Spark card you have.

Can I Apply for this card if I already have it?

I also have a Spark Miles Select

What about under another LLC?

Just a random redemption that I found with Wyndham. It looks like a brand new kosher hotel, with a Shabbat elevator in S. Florida. Who knew there was this points option in the US? They have availability even over Hannukah week (which coincides with New Year’s this year). @Dan maybe you can redeem there or have JJ do a staycation and post a TR for us. 🙂

https://www.wyndhamhotels.com/dolce/hollywood-florida/dolce-hollywood/overview?brand_id=DX&checkInDate=1/26/2025&checkOutDate=1/31/2025&useWRPoints=false&children=0&iata=00093763&adults=1&rooms=1&referringBrand=GR&cid=PS:zsju9peakxhpg0c&loc=ChIJpzH_x2-p2YgRaLi3db561wc&sessionId=1708709555&corpCode=1000008323

Does the venture x personal card PP work at bar Symon just as the business card?

Please disregard the question as I see it’s answered in post

I just applied and got approved. How long does it take to receive the actual card in the mail? Would they expedite it if I called them?

Can i ask what’s the best credit card to apply for if im planning to spend 13,000 on Airbnb in the next month?

Capital one venture x priority pass no longer gets retail credit at restaurants or other shops. That was dropped a while ago. Is it back on this card?

Yes, it was only dropped on the consumer card.

Applied and approved.

Now how to decide which card to use, after initial spending, for everyday business expenses between Amex Platinum, Chase or this new Capitol One Venture X…

Hi Dan, I applied for this card using this link and I got approved but when the decision letter came I saw it’s for a different card the business spark with only 50,000 points. what would you recommend I should do?

Hi, I applied for the venture, regular consumer card, plus a business spark on the same day. The letter I received for the denial on both of them that was already pending application. Reconsideration team was helpless. does capital one not allow two cars at once if so, how do I clear it up and get reapproved at least for one of them?

Is there a difference between Capital One priority pass and American Express Platinum priority pass

2 comments on this card:

1. My card limits me to 10k spending – that’s my spending limit. So it’s difficult to use. My spending limit is 35k on the personal card.

2. Points are hard to use. Fares on many of the airlines are much lower on the airline website. Haven’t tried seeing value on transferring points.

Dan, what are good solutions to these issues?

1. Sometimes Capital One allows credit reallocation. Can’t hurt to ask.

Have you tried using the purchase approval option? That will let you request to make a purchase above your credit line. Otherwise, just pay the card back to gain credit.

2. Capital One Travel has a price match guarantee. But you can also just book on the airline site and use the miles to pay yourself back! Or you can transfer miles to airlines and hotels.

Thanks Dan. Very helpfull.

Just got declined (have perfect payment history, credit score of 790+), reconsideration a think with Capital One? Any tips?

If the benefits more than outweigh the AF, doesn’t it make sense to get 2 cards (spouse, child,etc) which is an easier path to 300,000.points ($150,000 x 2)?

Did I see a comment about using the $300 annual credit for the Venture X and Venture X business somehow in one transaction? My wife has the personal Venture X trying to figure out if I should apply under my name or hers. if I can combine the travel credit, I would put it under her name to make one reservation and get both credits..

They can be combined under the same login account.

how are they combined under the same login? if I have personal and business and use the portal to rent a car, I will have an option to use both credits? until now when I used the portal they credited me without indicating I was using the $300. I made a reservation and they credited $300. How do you pull both $300 for one reservation?

Thanks Dan.

first I got declined because I did it right after closing the spark, waited a few days and just got approved

how many days?

Is the 500k over?

300K bonus+200K from spending $100K=500K

Just applied and denied ! Not sure y , but they do hard pull on all 3 bureaus personal when applying

Any way to speak with recon @ Cap1?

Denied the Biz X but offered a Sparks CC with 20K line instead. Rep can’t explain why.

can you confirm that if I apply during the offer period, get denied and later get approved after the offer is expired, I qualify for the points offered when I originally applied?

Yes, that’s always the case.

Thanks so so much Dan!!

Got approved instatlly!

On topic:

I keep on getting ads about this:

Mastercard® Black CardTM by a company named luxurycard.com,

Is this real & ligit?

and is it worth as they claim:

2% VALUE FOR AIRFARE REDEMPTIONS2

1.5% VALUE FOR CASH BACK REDEMPTIONS2

$100 ANNUAL AIRLINE CREDIT

I searched all forums on DD, Can you please navigate me around this one?

Not a good deal.

You can get 2% cash back with no annual fee:

https://www.dansdeals.com/credit-cards/earn-rare-limited-time-signup-bonus-excellent-citi-double-cash-card-flexible-2-cash-back-2-miles-per-dollar-earnings-2/

You would have to be insane to spend $500/year to get that only for airfare.

Had to be so!

I never saw you reffering it and trust you on that one!

However any simple explanation as to why its a no no, to live & learn?

Hi when signing up for these credit cards, just to get the bonus points what do you suggest doing with the credit cards after getting the points if we don’t want to keep them open and have to pay a yearly membership fee?

how problematic is it to cost these credit cards after earning the bonus points and transferring them to a diff account in order to avoid having too many cards open and annual fees?

Missed this! should I apply for 150k or wait?

wondering the same

Amex does not do any hard inquiry on a new card if you have an active card already.

Does Capital One do the same or is there a hard inquiry on each and every application?

Is it possible to get 2 Venture X business for different businesses or 1 VXB and 1 VX consumer?

How about I have already a VXB can I get a Spark cash plus Business? Does it matter if I am a user on my wife’s SCPB?

Applied for the Cap1 VentureX Business and the first 3 months spend window just ended without hitting the $20k because the big project I planned to put on the card got delayed. Should happen within the next month and will be around $220k. Is there anyway to still get the full bonus or have you heard of Cap1 making exceptions with larger spends? And will I even get the second threshold bonus if I don’t complete the first?