DansDeals will receive compensation if you are approved for a credit card via a link in this post. Terms apply to American Express benefits and offers, visit americanexpress.com to learn more.

Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update: Offer expired!

Originally posted on 8/1:

Welcome bonus and card highlights:

- Delta SkyMiles® Platinum Business American Express Card:

- Receive 50% cash back in the form of statement credits on purchases made directly with Delta with your new Card within the first 3 months of Card Membership, up to $500 back. This includes tickets, food or drinks on a Delta flight, baggage fees, tickets, upgrades, change fees, club entrance fees, etc. You’ll also receive 50,000 bonus miles after spending $3,000 in the first 3 months of card membership.

- If you spend $25,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles. If you spend $50,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles.

- This card includes an annual Companion Certificate that is valid for a round-trip Economy Class Companion ticket within the 48 contiguous United States. Residents of Hawaii, Alaska, Puerto Rico or the USVI must originate from there to the 48 contiguous United States and have an address on their SkyMiles account in Hawaii, Alaska, Puerto Rico or the USVI.

- Terms and restrictions apply, see rates and fees here.

- $195 annual fee.

- Delta SkyMiles® Gold Business American Express Card:

- Receive 50% cash back in the form of statement credits on purchases made directly with Delta with your new Card within the first 3 months of Card Membership, up to $300 back. This includes tickets, food or drinks on a Delta flight, baggage fees, tickets, upgrades, change fees, club entrance fees, etc. You’ll also receive 30,000 bonus miles after spending $1,000 in the first 3 months of card membership.

- $0 annual fee for the first year, then $95

- Terms and restrictions apply, see rates and fees here.

Welcome bonus terms:

You can receive the bonus once for each of these cards. You will get an ineligibility popup if you have had the card or if AMEX determines that you have opened and closed too many cards.

Benefits offered on these Delta cards:

- Offer a free checked bag for the primary cardholder and up to 8 companions on the same reservation. You do not need to book tickets on your Delta card for this benefit, you only need to have your Skymiles number in the reservation. That allows you to buy airfare on a card that offers more points per dollar on airfare.

- Have no foreign transaction fees.

- Offer Zone 1 Priority Boarding on Delta flights for the primary cardholder and up to 8 companions on the same reservation so that you won’t have to gate-check your carry-ons.

- Offer free priority boarding along with a free carry-on and checked bag even on a Basic Economy fare. That can equal major savings on domestic and international basic economy deals.

- Offer 2 Delta miles per dollar on flight purchases from Delta.

- Offer a 20% savings in the form of a statement credit on eligible pre-purchased meals, in-flight purchases of food, alcoholic beverages and audio headsets, and movies, shows and video games accessed via Delta’s seatback in-flight entertainment system, on Delta-operated flights.

- Waive the Medallion Qualification Dollar requirement to reach Silver, Gold, or Platinum Medallion status if you spend $25,000 on the cards in that calendar year. Eligible Purchases will be combined across multiple Delta cards of the primary cardholder if those accounts are linked to the same SkyMiles number. Note that the Diamond level spend waiver is now a whopping $250,000.

- Offer $29 per person discounted SkyClub lounge access for the cardmember and up to 2 guests. Children under 2 are free Reserve cardholders can also bring in unlimited children at the $29 rate.

- Offer free additional cardholders (up to 99 per account). Additional cardholders are each eligible for American promotions like AMEX Offers.

Spend Threshold:

If you need a little help to meet the threshold, you can pay your federal taxes for a 1.87% fee. If you overpay your taxes you can request a refund or apply it to your next year’s taxes.

My local natural gas company allows me to prepay up to $1,000 on a credit card for a $1.65 flat fee. That’s a great way to earn miles and help meet a spend threshold. My electricity supplier allows me to pay with a credit card for free as long as I am enrolled in autopay.

American Express benefits:

The cards carry American Express’ awesome top-notch protections that are light-years better than any other banks. Most other banks always look for a way to get out, but that’s not the case with American Express.

- If you need to return an item up to $300 and a store won’t take it back due to a time limited or final sale policy, AMEX will gladly refund you thanks to return protection. The vast majority of the time you’ll even be able to keep the item, but if you do need to send it back the return shipping will be free. That’s a far more generous policy than any other bank offers. This benefit is valid for $1,000 of returns per card per calendar year.

- If a store charged a restocking fee to return an item then AMEX will cover it, up to $300/item, as part of their return protection coverage.

- You get up to 2 additional years of warranty coverage (matching the length of the manufacturer’s warranty) and if you have any issue in the extended warranty year they’ll pay to have it fixed or refund your entire purchase price without a hassle. This benefit is far more valuable than warranty benefits offered by other banks!

- If you need to dispute a charge there’s nobody who makes it easier or as pain-free as American Express does. It’s the easiest dispute resolution process in the industry by leaps and bounds and you can do it all online.

- If your item is stolen or broken within 90 days you’ll be covered.

- AMEX cards now cover car rental insurance in Israel.

- AMEX cards offer free Shoprunner membership for 2nd day free shipping and returns from dozens of stores.

See this post to see just how amazing some of the AMEX protections can be.

Business vs Consumer card:

AMEX business cards don’t appear on your credit report. That’s good for several reasons.

First of all, they won’t count against your 5/24 count for opening new Chase cards.

Second, when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an AMEX business card it’s just not reported, so you can wait until the money is due without it having a negative effect on your score.

Third, if you close a business card it won’t ever have an effect on your score.

You may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that. Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field.

Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field

It’s important to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork.

Best Uses Of Delta Miles:

I have mixed feelings about Delta miles or “Skypesos.”

Traditionally they have had terrible saver award availability. However that has improved of late and it’s now significantly better than American’s availability, though it’s not as good as United’s.

Delta miles also never expire.

However Delta doesn’t publish award charts anymore as they feel than an uneducated customer is their best customer. That’s beyond frustrating.

They don’t charge a close-in award fee, but it can be tough to find saver award space available within 3 weeks.

However there are still plenty of good uses of Delta miles, especially as American’s award availability has gone down the drain.

Delta has also lowered the cost of some domestic saver awards from a flat 12.5K to as low as 5K, depending on the route.

They frequently run flash sales. Earlier this month I flew to Amsterdam for just 49K Delta miles each way in DeltaOne Business Suites:

You can read the Amsterdam trip report and my thoughts on Delta A350 suites here.

Here are some examples of routes that can now be booked for just 10K miles round-trip:

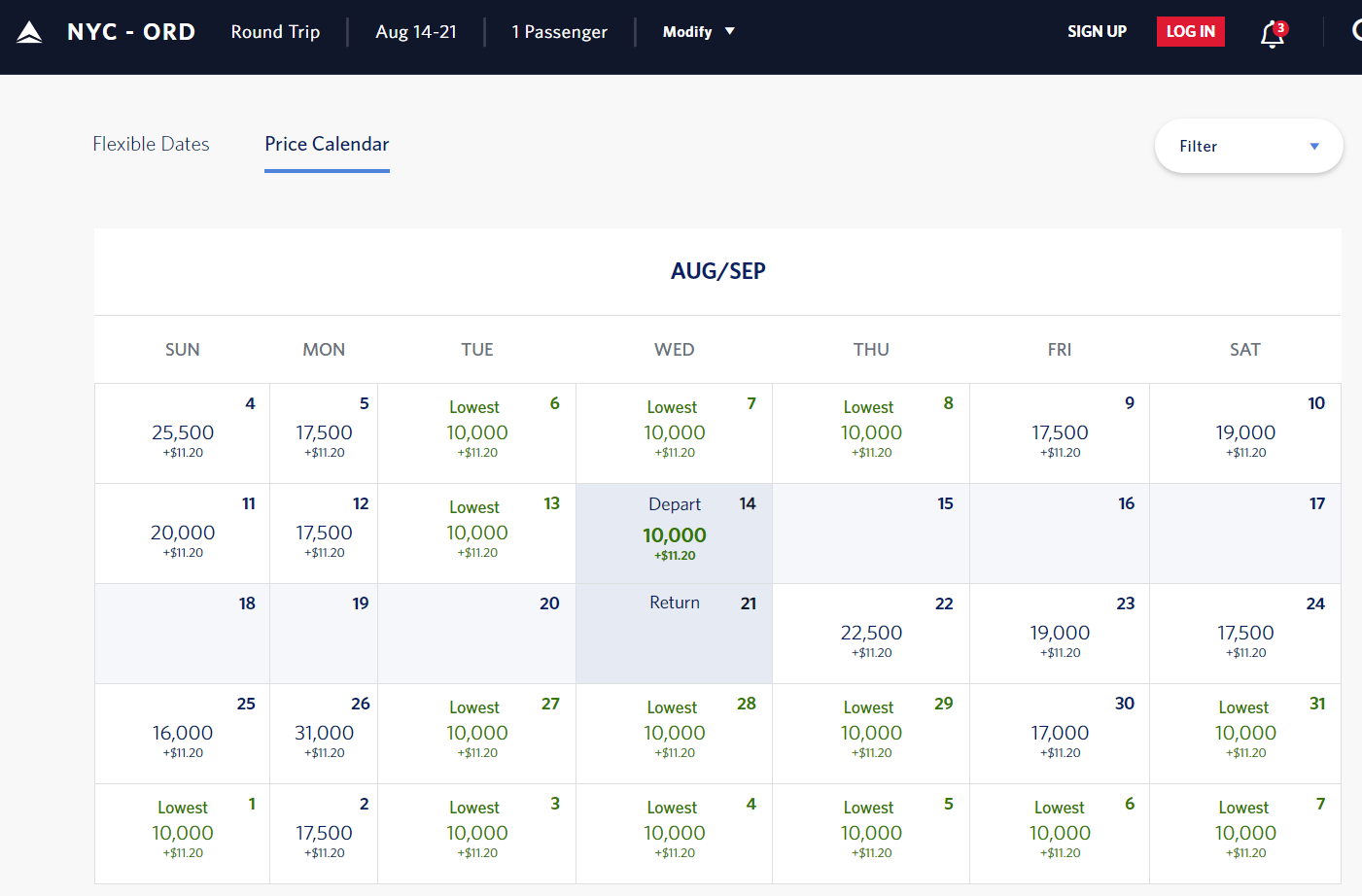

NYC to/from Chicago:

NYC to/from Cleveland:

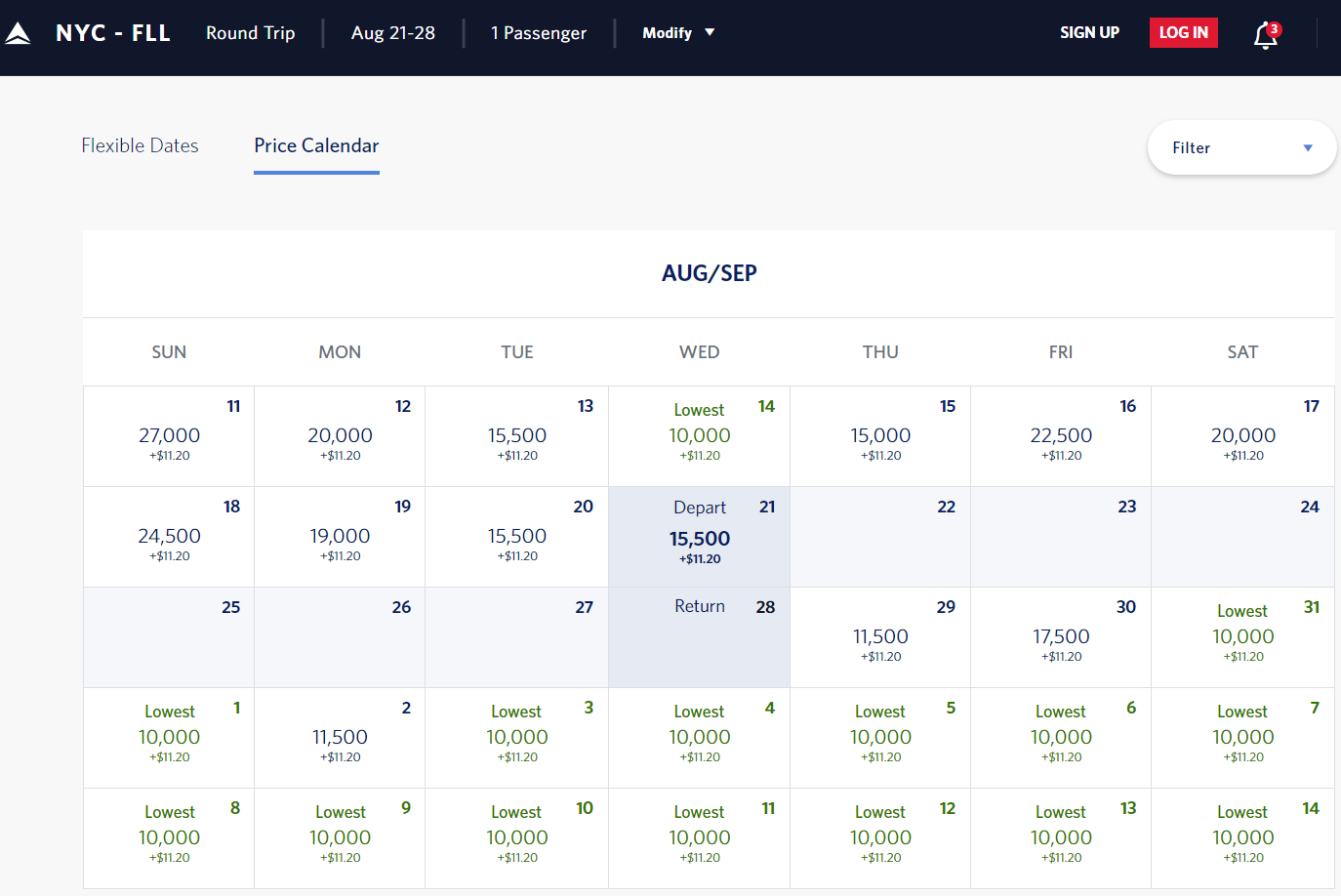

NYC to/from Fort Lauderdale:

NYC to/from Orlando:

Los Angeles to/from Las Vegas:

Los Angeles to/from San Francisco:

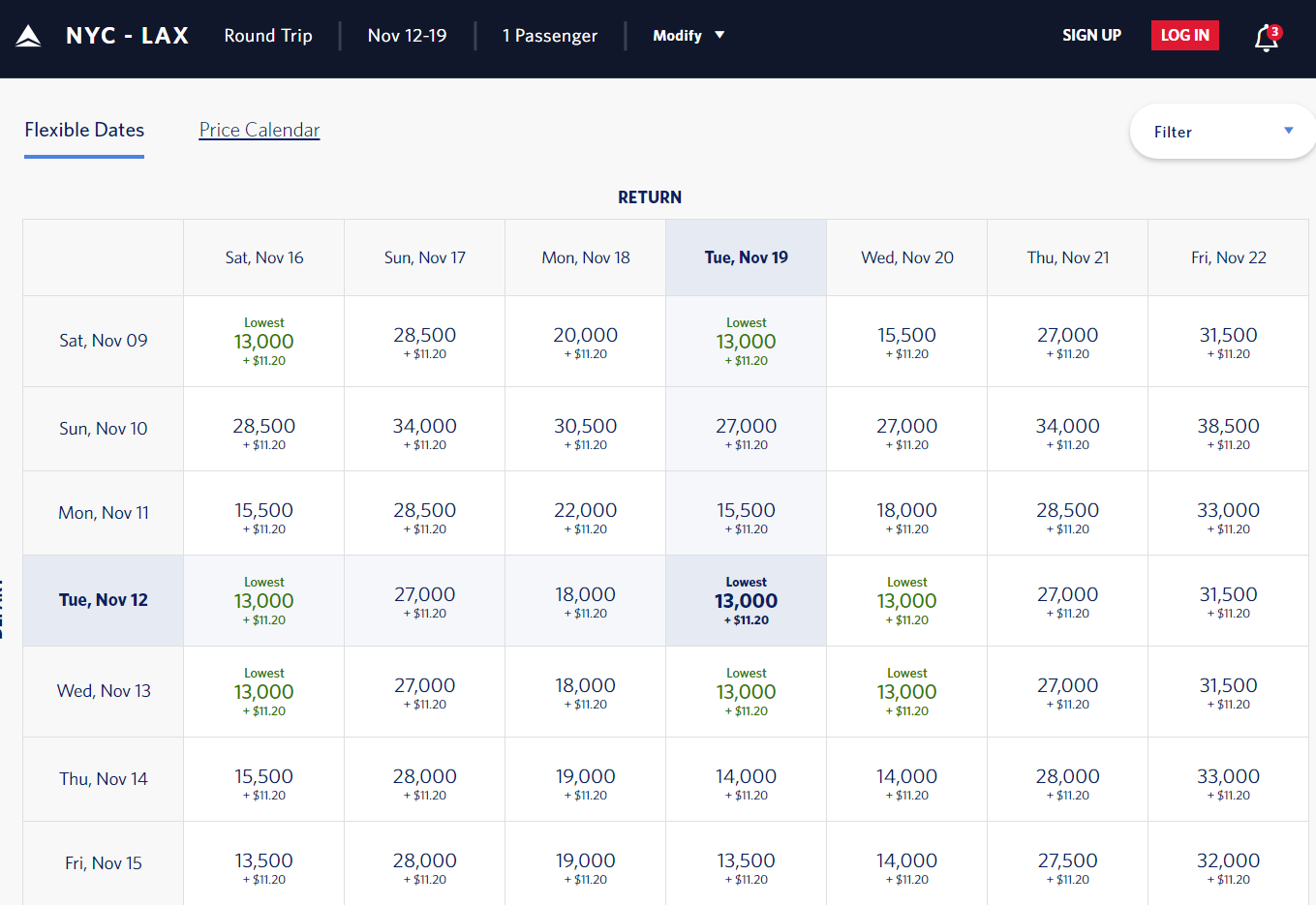

You can even fly JFK to/from Los Angeles for just 13K miles round-trip:

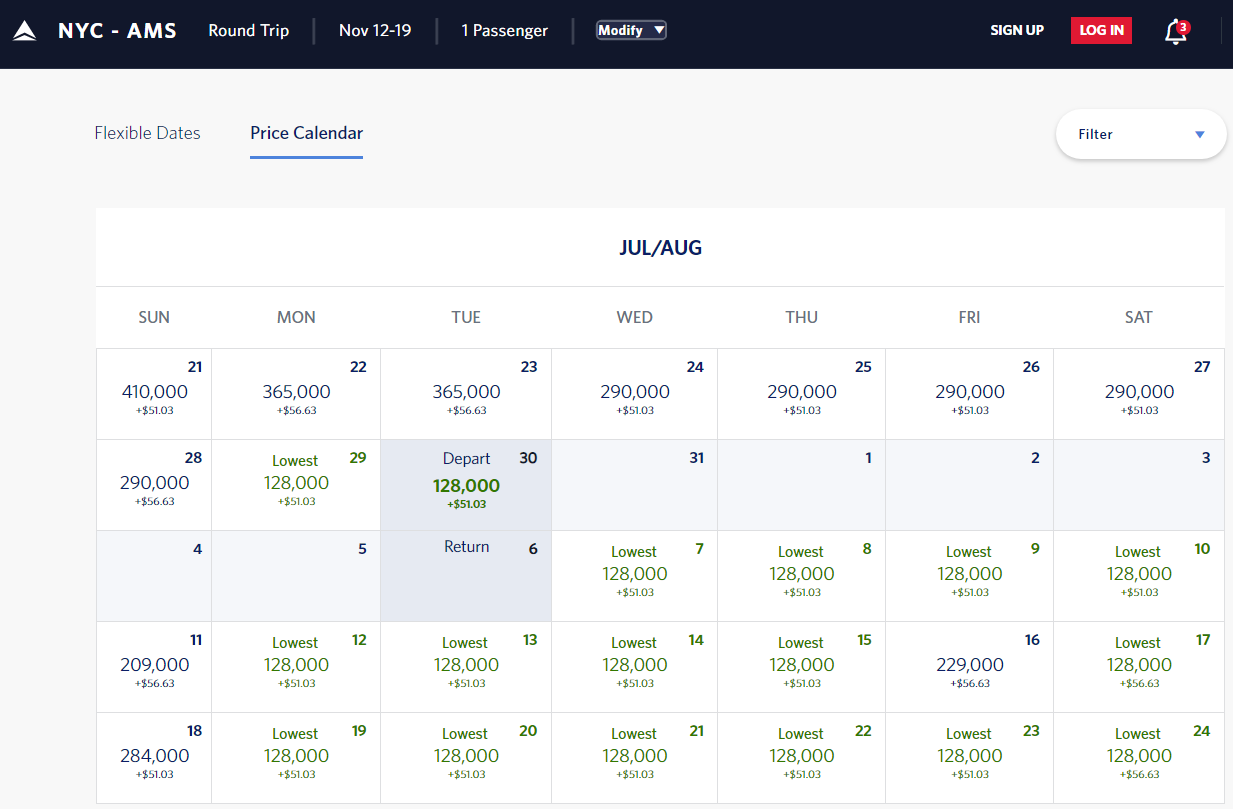

You can even nab business class to Europe for just 128K miles round-trip when there’s no a flash sale:

If you actually want to collect Delta miles you’ll do better spending on the The Blue Business℠ Plus Credit Card from American Express which earns 2 points per dollar everywhere. Plus you can transfer those points to other airlines or Delta on demand as you need them.

However the MQM bonuses can make it worth spending on the Platinum/Reserve Delta cards if you can hit the spend threshold bonuses.

Additionally if you are gunning for Delta medallion status, then spending $25,000 on Delta cards this year will waive the requirement to spend a minimum amount on Delta flights to earn that status ($3,000 for Silver, $6,000 for Gold, or $9,000 for Platinum if you don’t spend $25K in a year across all of your Delta cards).

But the cards are great for the welcome bonus and benefits that they come with for both Delta Medallions and non-Medallions alike.

Which of the Delta AMEX cards will you signup for?

![[AMEX Transfers End Next Month!] WOW! DOT Approves Alaska-Hawaiian Merger, On Condition That Miles Combine At 1:1 Ratio!](https://i.dansdeals.com/wp-content/uploads/2024/08/20170745/WhatsApp-Image-2024-08-20-at-4.01.27-PM-1-137x150.jpeg)

![[June And July Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

![[Wizz Air Returns To Israel, Lufthansa Group, ITA Extend Cancellations] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Arkia Will Add Additional Service With A Neos Air Dreamliner!] Arkia Now Selling Nonstop Flights Between JFK And Tel Aviv!](https://i.dansdeals.com/wp-content/uploads/2025/01/13093827/Hamburg_Airport_Iberojet_Airbus_A330-941_CS-TKH_DSC08679-267x150.jpg)

![[Citi Bonus Ends Tomorrow!] Transfer Bank Points To Virgin Atlantic And Get A 25% Or 30% Bonus: Book Bargain El Al, Delta, ANA, Air New Zealand, And More Awards!](https://i.dansdeals.com/wp-content/uploads/2019/02/08112901/vs-459x150.jpg)

![[Uber One 3,000 Mile Promo] Should You Switch Your Uber Earnings From Marriott To Delta?](https://i.dansdeals.com/wp-content/uploads/2017/08/31234215/uber-serp-logo-f6e7549c89-150x150.jpg)

![[AMEX Explains Upcoming Points Transfer Pause To Emirates] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

49 Comments On "Final Hours! Delta Credit Card Limited Time Offer: Up To 50,000 Miles Plus Up To 50% Rebate/$500 Off Delta Purchases!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

I applied to delta gold biz about 7 weeks ago will this benefit apply to me?

No.

Hey Dan. What is the best American express credit card with no annual fee.

I have tons of Chase cards and no Amex.

https://www.dansdeals.com/credit-cards/heres-may-want-apply-today-best-standalone-everyday-mileage-earning-credit-card/

So that would be the best Amex without a annual fee?

Also of I’m willing to pay annual fee would the bonvoy be the best?

Best for what?

Everyday spending. And good sign-up bonuses. Sorry I’m new to this.

pls do a long term review on the model 3, thank you.

Maybe. So much to say, but I’m not a car guy so that’s out of my wheelhouse.

Are you sure the gift cards will work towards the 50% off if they don’t work for the $200 incidental credit?

Yes, this credit is valid for any Delta charges, including tickets and gift cards.

The $200 incidental credit excludes those items.

Thanks!

When should one file under return protection rather than dispute the charge and vice versa; they seem to overlap? But there must be some differences can you make a post on that?

Return protection is when you don’t want an item and doesn’t hurt the merchant.

Dispute resolution is when there’s something wrong with the item or sale.

you mean amex return protection policy lets you return an item for up to $300 for any reason! what do you mean doesnt hurt the merchant? won’t returning always be a hurt to the merchant?

Correct.

No, AMEX eats the return. Most of the time they even tell you to just keep the item.

that’s amazing! I’m assuming there is time limit to initiate return protection request? otherwise once can try a product and return a year later!

also what’s the time frame with amex to initiate a charge dispute i have received conflicting answers and online site not clear?

90 days for return protection (plus 30 more days to file a claim).

Dispute resolution time varies based on the dispute.

dispute resolution varies based on dispute? meaning they look at the totality of circumstances and determine case by case? because I just saw online article dated in 2018 that said 120 day time frame but maybe things have changed since then?

Yes. I’ve opened up cases even after a year with the help of a supervisor for cases that merited it.

But the sooner the better of course.

platinum seems like good option —– net $300 after annual fee + 50k miles. only downside is sitting on $1000 in delta gift cards.

But using them second year with annual companion pass, while speculative without plans – could be valuable on a last minute expensive roundtrip ticket (perhaps using to positioning for an Awardtrip out of a different city) .

But again as you pointed out your sitting on Delta GC for a year. If your you have the two Amex credit card slots and haven’t app’d Amex Credit cards in last 90 days both Gold and Plat duo – might be a valuable combo 80K miles, + $1,600 GC for $800 $195 AF.

Thanks for the post !

Was searching for the old Delta post for some time

How would you compare this offer, with the last one Delta/Amex had about a month ago?

What was that offer?

https://www.dansdeals.com/?p=186649

Wow. Those offers are much better!

Dan – Can I earn MQMs from spending on the platinum business AND on the reserve personal, for a total of 50k/year in MQMs from spending? What about having a platinum and reserve business and a platinum and reserve personal? Could I earn 100k in MQMs per year just through spend??? Thanks!

Sure can. You can actually have more than 1 of a card, so you can earn more than that.

Dan- what are your thoughts on how this compares to last months offer for 70k miles. Do you think that offer will come back? Is it worth waiting to see what new offers will be?

Depends if you prefer the miles or the cashback on Delta purchases. Also depends if you will max out the cashback.

That offer may not be back until next year.

to buy a delta ticket on priceline.com will work for the 50% cashback ?

Yes.

will the 1k in delta gift card purchase count towards the 3k spend for the spending?

Dan,

Are you sure you can earn the bonus MQMs for exceeding spend thresholds on more than one of the same Delta card? I know you can earn the 30k on the reserve and 20k on say the platinum. And i know one can have two Delta platinum accounts. But i thought they will not give you the 20k bonus on each of them even if you separately exceed the spend thresholds on each.

I had called a few months back and that is what I was told.

Do you think agent told me wrong?

thank you.

Ben

Can I get these bonuses if I upgrade from an existing Gold card to the Platinum card?

Be aware that Delta won’t let you keep the bonus if you cancel in the first year.

Dan, I applied for the card a week or two ago & haven’t even activated the card. Is there a way to get these new benefits ??

I just got targeted email from delta gold for 70k miles after spending 2k. which one is better ?

Do Delta GC Purchase earn 2X and so they count toward SUB?

On the fence to have P2 App one of the Delta Biz cards or the Hilton Honors promo

Sure, as long as you use the Delta desktop site.

Hey Dan, where’d the link disappear to?

The Plat Delta annual companion pass 2nd yr and beyond is it only for “Basic economy” Tickets or can they also be used for “Main Cabin” tickets?

TIA

It can be used for main cabin.

Thanks for responses,

P2 used link and approved for Delta Biz Pt

how would you compare this card to the united chase card? if i only want one which one would you recommend? tyvm

Hi Dan,

needed advice i applied for a business credit credit card last night. i tried putting my ss# as my tax ein and it didn’t work being that i selected i am a corporation. i should have selected i am a sole proprietorship. anyway i wanted the card so i used my social and my dads tax ein. is that bad? should i close the card and re apply. i got approved. will it affect him.

i called amex and asked them to change the business type and they said once approved they cant change it

Can someone confirm that gift cards still work? Don’t want to be stuck with $1000 Delta cards with not perks

Same Question – I know officially GC are not allowed