DansDeals will receive compensation if you are approved for a credit card via a link in this post. Terms apply to American Express benefits and offers, visit americanexpress.com to learn more.

Update: DEAD!

Update: DEAD!

Originally posted on 5/30:

American Express has just released 6 limited time offers on Delta credit cards! The business card offers are the highest offers ever!

Table of Contents

Welcome bonus and card highlights:

Business cards:

- Delta SkyMiles® Gold Business American Express Card:

- Through 7/2, earn 70,000 bonus miles after spending $4,000 in the first 3 months of card membership and a $50 statement credit after making a Delta purchase in the first 3 months. This card normally offers 30K miles.

- 0% introductory APR for 6 months on purchases. Terms and restrictions apply, see rates and fees here.

- $0 annual fee for the first year, then $95

- Delta SkyMiles® Platinum Business American Express Card:

- Through 7/2, earn 80,000 bonus miles and 5,000 Medallion Qualifying Miles after spending $6,000 in the first 3 months of card membership and a $100 statement credit after making a Delta purchase in the first 3 months. This card normally offers 35K miles.

- If you spend $25,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles. If you spend $50,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles.

- This card includes an annual Companion Certificate that is valid for a round-trip Economy Class Companion ticket within the 48 contiguous United States. Residents of Hawaii, Alaska, Puerto Rico or the USVI must originate from there to the 48 contiguous United States and have an address on their SkyMiles account in Hawaii, Alaska, Puerto Rico or the USVI.

- 0% introductory APR for 6 months on purchases. Terms and restrictions apply, see rates and fees here.

- $195 annual fee.

- Delta SkyMiles® Reserve Business American Express Card:

- Through 7/2, earn 80,000 bonus miles and 5,000 Medallion Qualifying Miles after spending $6,000 in the first 3 months of card membership and a $100 statement credit after making a Delta purchase in the first 3 months. This card normally offers 40K miles.

- If you spend $30,000 in a calendar year you’ll receive an additional 15,000 bonus miles and 15,000 Medallion Qualifying Miles. If you spend $60,000 in a calendar year you’ll receive an additional 15,000 bonus miles and 15,000 Medallion Qualifying Miles.

- This card includes an annual Companion Certificate that is valid for a round-trip First Class, Delta Comfort or Main Cabin Companion ticket within the 48 contiguous United States. Residents of Hawaii, Alaska, Puerto Rico or the USVI must originate from there to the 48 contiguous United States and have an address on their SkyMiles account in Hawaii, Alaska, Puerto Rico or the USVI.

- Get complimentary access to Delta Sky Club for yourself and a discounted rate for up to two guests when flying on Delta. Enjoy snacks and beverages, Wi-Fi access, satellite TV, personalized flight assistance, private restrooms and more at the Club. You can even request complimentary hot kosher meals at select clubs!

- Premium Roadside Assistance, free of charge up to 4 times per year.

- 0% introductory APR for 6 months on purchases. Terms and restrictions apply, see rates and fees here.

- $450 annual fee.

Consumer cards:

- Gold Delta SkyMiles® Credit Card from American Express:

- Through 7/31, earn 60,000 bonus miles after spending $2,000 in the first 3 months of card membership and a $50 statement credit after making a Delta purchase in the first 3 months. This card normally offers 30K miles.

- $0 annual fee for the first year, then $95

- Platinum Delta SkyMiles® Credit Card from American Express:

- Through 7/31, earn 70,000 bonus miles and 10,000 Medallion Qualifying Miles after spending $3,000 in the first 3 months of card membership and a $100 statement credit after making a Delta purchase in the first 3 months. This card normally offers 35K miles.

- If you spend $25,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles. If you spend $50,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles.

- This card includes an annual Companion Certificate that is valid for a round-trip Economy Class Companion ticket within the 48 contiguous United States. Residents of Hawaii, Alaska, Puerto Rico or the USVI must originate from there to the 48 contiguous United States and have an address on their SkyMiles account in Hawaii, Alaska, Puerto Rico or the USVI.

- $195 annual fee

- Delta Reserve Credit Card:

- Through 7/31, earn 75,000 bonus miles and 10,000 Medallion Qualifying Miles after spending $5,000 in the first 3 months of card membership and a $100 statement credit after making a Delta purchase in the first 3 months. This card normally offers 40K miles.

- If you spend $30,000 in a calendar year you’ll receive an additional 15,000 bonus miles and 15,000 Medallion Qualifying Miles. If you spend $60,000 in a calendar year you’ll receive an additional 15,000 bonus miles and 15,000 Medallion Qualifying Miles.

- This card includes an annual Companion Certificate that is valid for a round-trip First Class, Delta Comfort or Main Cabin Companion ticket within the 48 contiguous United States. Residents of Hawaii, Alaska, Puerto Rico or the USVI must originate from there to the 48 contiguous United States and have an address on their SkyMiles account in Hawaii, Alaska, Puerto Rico or the USVI.

- Get complimentary access to Delta Sky Club for yourself and a discounted rate for up to two guests when flying on Delta. Enjoy snacks and beverages, Wi-Fi access, satellite TV, personalized flight assistance, private restrooms and more at the Club. You can even request complimentary hot kosher meals at select clubs!

- Premium Roadside Assistance, free of charge up to 4 times per year.

- $450 annual fee.

Welcome bonus terms:

You can receive the bonus once for each of these 6 flavors of the Delta card. You will get an ineligibility popup if you have had the card or if AMEX determines that you have opened and closed too many cards.

Triggering the $50 or $100 statement credit:

Any Delta purchase will trigger the statement credit. There is no minimum Delta purchase required, even a $2 snack or drink on a Delta flight will trigger the full $50 or $100 credit!

Sample purchases include any denomination of Delta gift cards or eGift cards via the Delta desktop site only, food or drinks on a Delta flight, baggage fees, tickets, upgrades, change fees, club entrance fees, etc.

Benefits offered on all 6 Delta cards:

- Offer a free checked bag for the primary cardholder and up to 8 companions on the same reservation. You do not need to book tickets on your Delta card for this benefit, you only need to have your Skymiles number in the reservation. That allows you to buy airfare on a card that offers more points per dollar on airfare.

- Have no foreign transaction fees.

- Offer Zone 1 Priority Boarding on Delta flights for the primary cardholder and up to 8 companions on the same reservation so that you won’t have to gate-check your carry-ons.

- Offer free priority boarding along with a free carry-on and checked bag even on a Basic Economy fare. That can equal major savings on domestic and international basic economy deals.

- Offer 2 Delta miles per dollar on flight purchases from Delta.

- Offer a 20% savings in the form of a statement credit on eligible pre-purchased meals, in-flight purchases of food, alcoholic beverages and audio headsets, and movies, shows and video games accessed via Delta’s seatback in-flight entertainment system, on Delta-operated flights.

- Waive the Medallion Qualification Dollar requirement to reach Silver, Gold, or Platinum Medallion status if you spend $25,000 on the cards in that calendar year. Eligible Purchases will be combined across multiple Delta cards of the primary cardholder if those accounts are linked to the same SkyMiles number. Note that the Diamond level spend waiver is now a whopping $250,000.

- Offer $29 per person discounted SkyClub lounge access for the cardmember and up to 2 guests. Children under 2 are free Reserve cardholders can also bring in unlimited children at the $29 rate.

- Offer free additional cardholders (up to 99 per account). Additional cardholders are each eligible for American promotions like AMEX Offers.

Spend Threshold:

If you need a little help to meet the threshold, you can pay your federal taxes for a 1.87% fee. If you overpay your taxes you can request a refund or apply it to your next year’s taxes.

My local natural gas company allows me to prepay up to $1,000 on a credit card for a $1.65 flat fee. That’s a great way to earn miles and help meet a spend threshold. My electricity supplier allows me to pay with a credit card for free as long as I am enrolled in autopay.

American Express benefits:

The cards carry American Express’ awesome top-notch protections that are light-years better than any other banks. Most other banks always look for a way to get out, but that’s not the case with American Express.

- If you need to return an item up to $300 and a store won’t take it back due to a time limited or final sale policy, AMEX will gladly refund you thanks to return protection. The vast majority of the time you’ll even be able to keep the item, but if you do need to send it back the return shipping will be free. That’s a far more generous policy than any other bank offers. This benefit is valid for $1,000 of returns per card per calendar year.

- If a store charged a restocking fee to return an item then AMEX will cover it, up to $300/item, as part of their return protection coverage.

- You get up to 2 additional years of warranty coverage (matching the length of the manufacturer’s warranty) and if you have any issue in the extended warranty year they’ll pay to have it fixed or refund your entire purchase price without a hassle. This benefit is far more valuable than warranty benefits offered by other banks!

- If you need to dispute a charge there’s nobody who makes it easier or as pain-free as American Express does. It’s the easiest dispute resolution process in the industry by leaps and bounds and you can do it all online.

- If your item is stolen or broken within 90 days you’ll be covered.

- AMEX cards now cover car rental insurance in Israel.

- AMEX cards offer free Shoprunner membership for 2nd day free shipping and returns from dozens of stores.

See this post to see just how amazing some of the AMEX protections can be.

Business vs Consumer card:

AMEX business cards don’t appear on your credit report. That’s good for several reasons.

First of all, they won’t count against your 5/24 count for opening new Chase cards.

Second, when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an AMEX business card it’s just not reported, so you can wait until the money is due without it having a negative effect on your score.

Third, if you close a business card it won’t ever have an effect on your score.

You may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that. Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field.

Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field

It’s important to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork.

0% Intro APR:

As part of this limited time offer, the business cards cards offer 6 months of 0% intro APR on purchases.

0% APR is a lucrative offer as carrying balances on consumer cards can have a very harmful effect on your credit score, but because on business cards, those balances won’t hurt your credit score.

Best Uses Of Delta Miles:

I have mixed feelings about Delta miles or “Skypesos.”

Traditionally they have had terrible saver award availability. However that has improved of late and it’s now significantly better than American’s availability, though it’s not as good as United’s.

Delta miles also never expire.

However Delta doesn’t publish award charts anymore as they feel than an uneducated customer is their best customer. That’s beyond frustrating.

They don’t charge a close-in award fee, but it can be tough to find saver award space available within 3 weeks.

However there are still plenty of good uses of Delta miles, especially as American’s award availability has gone down the drain.

Delta has also lowered the cost of some domestic saver awards from a flat 12.5K to as low as 5K, depending on the route.

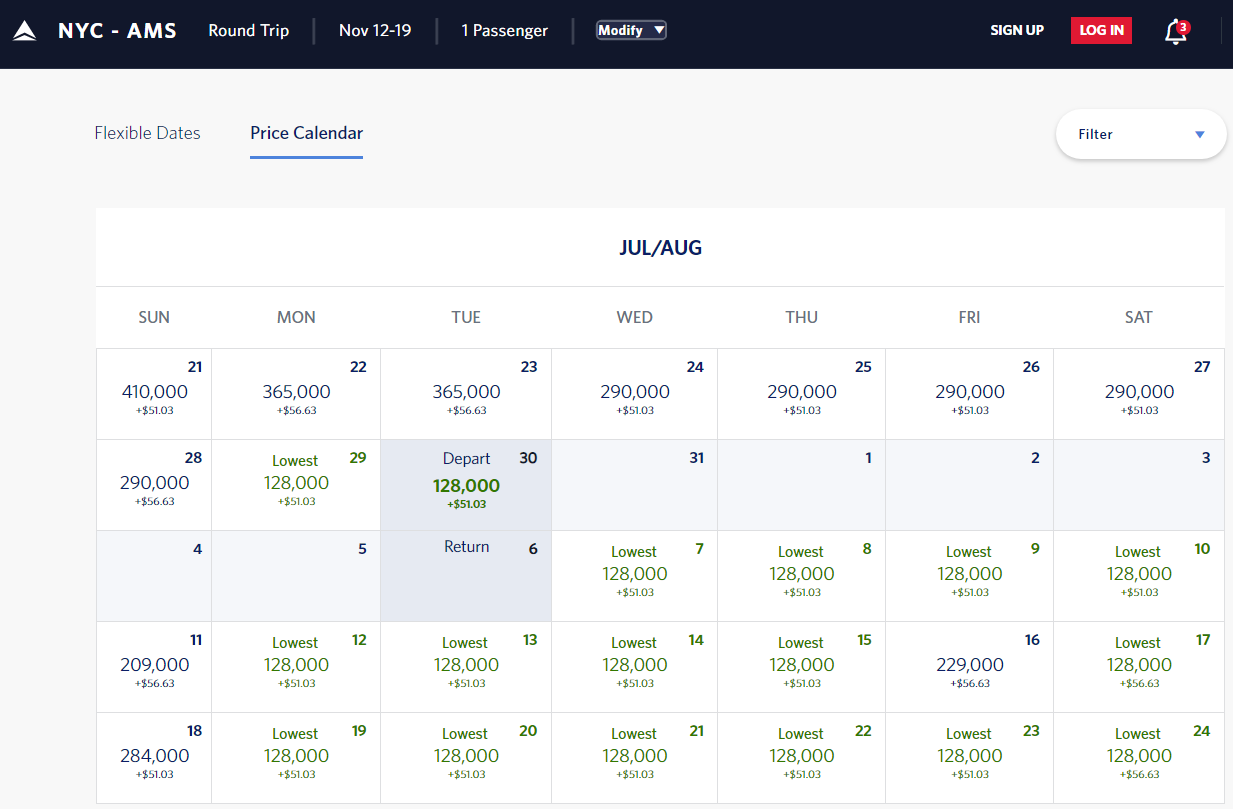

They frequently run flash sales. Earlier this month I flew to Amsterdam for just 49K Delta miles each way in DeltaOne Business Suites:

You can read the Amsterdam trip report and my thoughts on Delta A350 suites here.

Here are some examples of routes that can now be booked for just 10K miles round-trip:

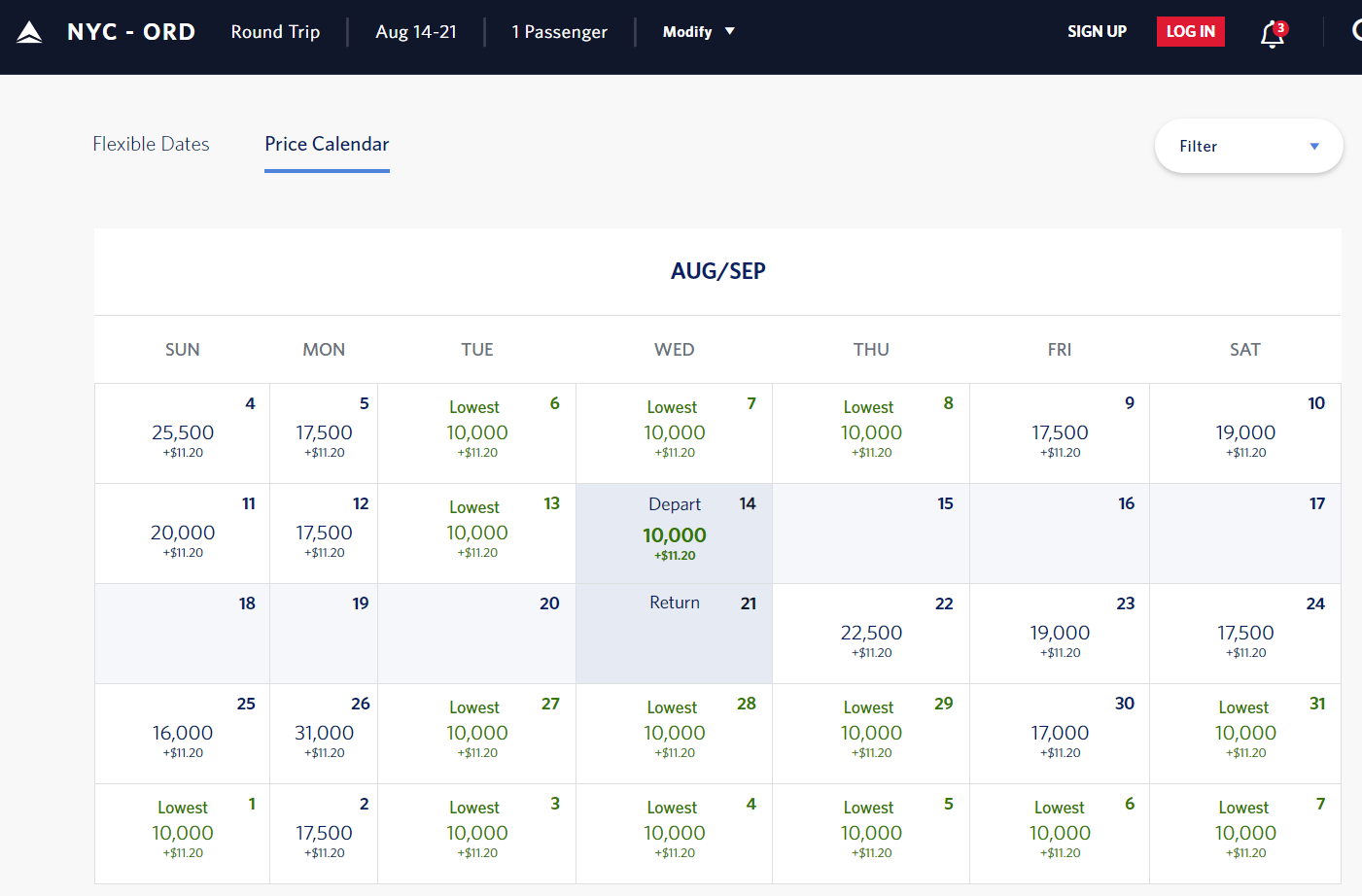

NYC to/from Chicago:

NYC to/from Cleveland:

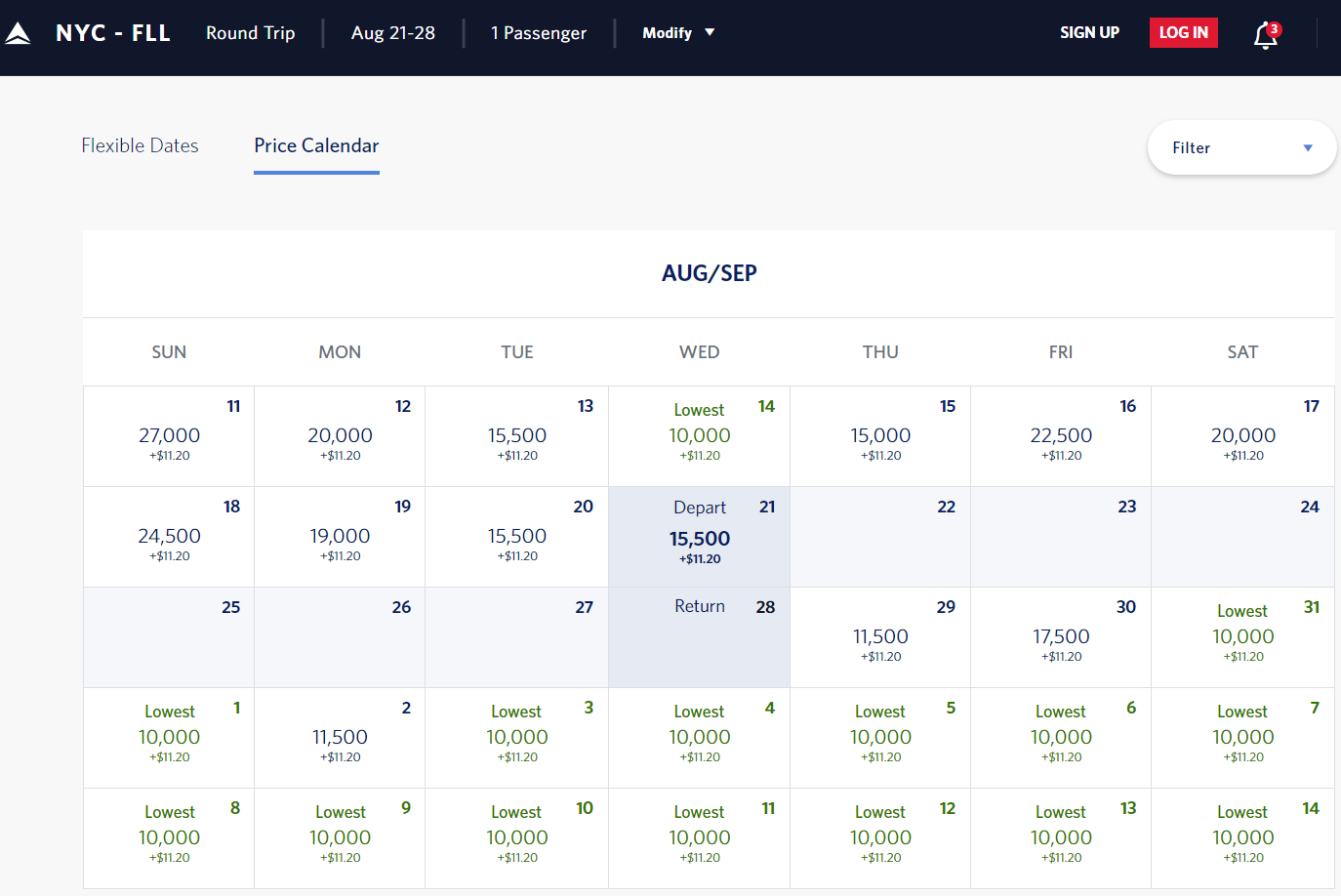

NYC to/from Fort Lauderdale:

NYC to/from Orlando:

Los Angeles to/from Las Vegas:

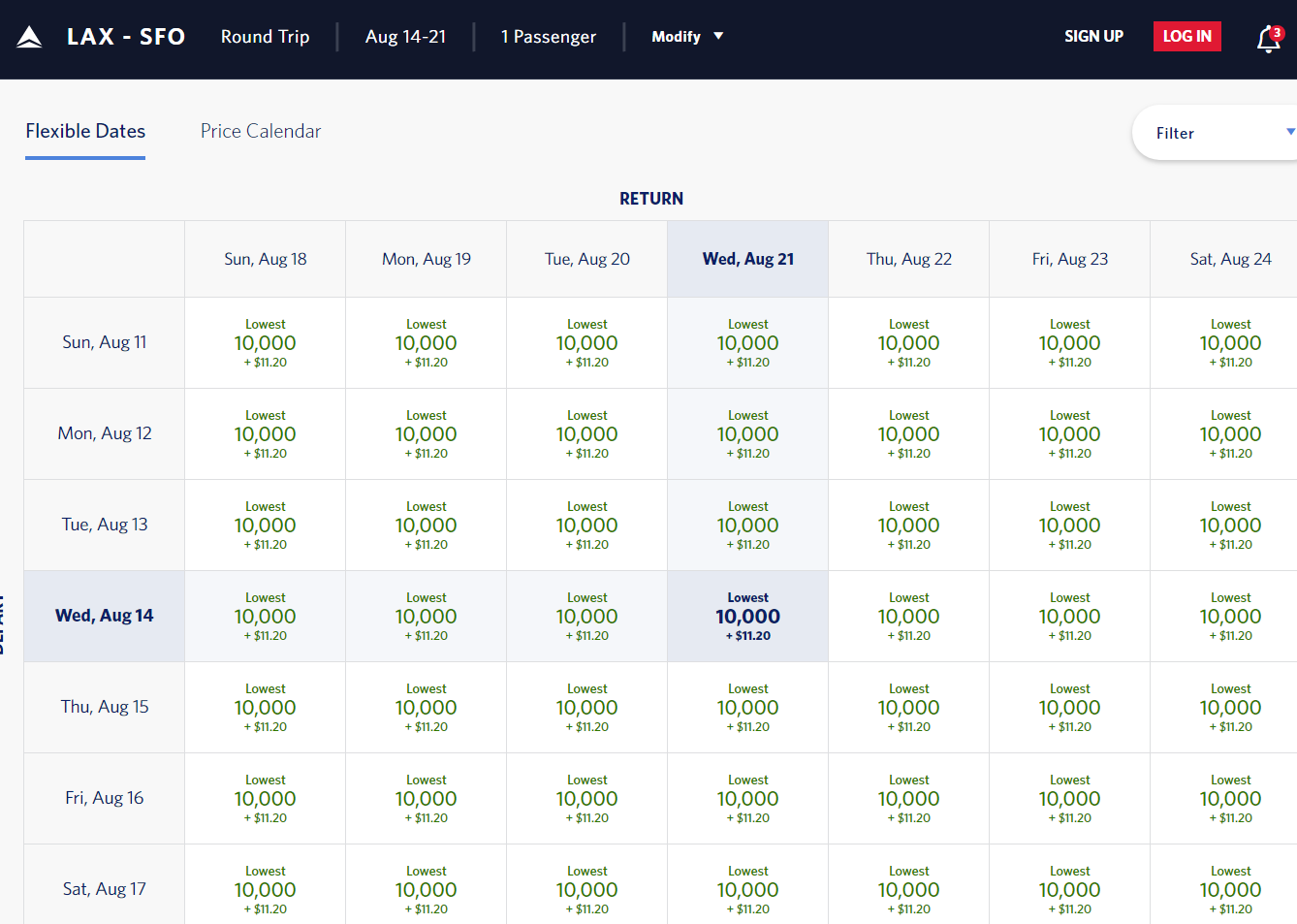

Los Angeles to/from San Francisco:

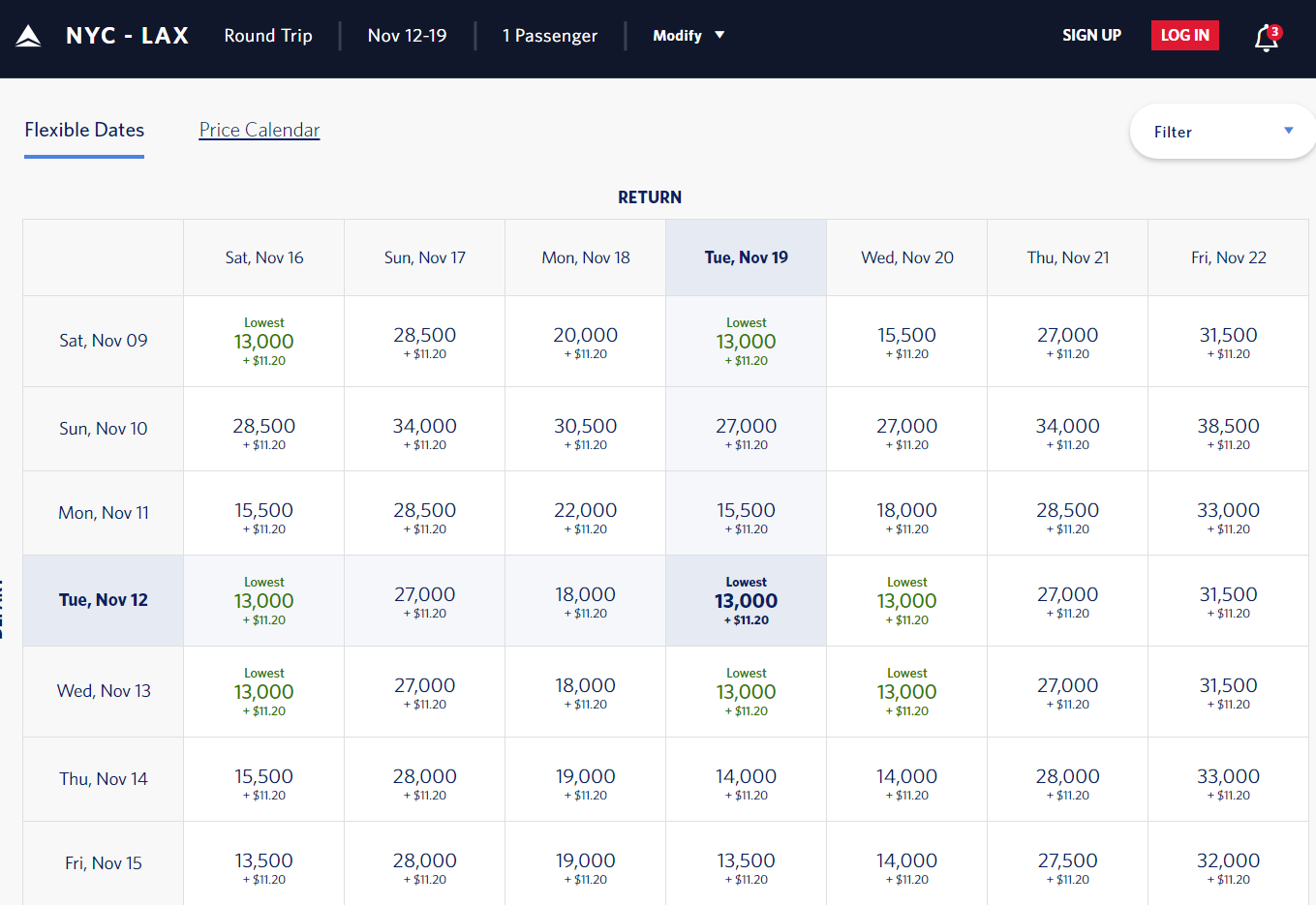

You can even fly JFK to/from Los Angeles for just 13K miles round-trip:

You can even nab business class to Europe for just 128K miles round-trip when there’s no a flash sale:

If you actually want to collect Delta miles you’ll do better spending on the The Blue Business℠ Plus Credit Card from American Express which earns 2 points per dollar everywhere. Plus you can transfer those points to other airlines or Delta on demand as you need them.

However the MQM bonuses can make it worth spending on the Platinum/Reserve Delta cards if you can hit the spend threshold bonuses.

Additionally if you are gunning for Delta medallion status, then spending $25,000 on Delta cards this year will waive the requirement to spend a minimum amount on Delta flights to earn that status ($3,000 for Silver, $6,000 for Gold, or $9,000 for Platinum if you don’t spend $25K in a year across all of your Delta cards).

But the cards are great for the welcome bonus and benefits that they come with for both Delta Medallions and non-Medallions alike.

Which of the Delta AMEX cards will you signup for?

![[United And Air Baltic Will Resume Tel Aviv Flights Next Week] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Update: AA And Delta Match United’s Solo Passenger Surcharges] Forget Hidden City Ticketing, Have You Tried Hidden Passenger Ticketing?](https://i.dansdeals.com/wp-content/uploads/2017/09/03174721/United-Airlines1-768x432-267x150.jpg)

![[Updated With Comments From Both Airlines] JetBlue And United Launch Blue Sky Partnership!](https://i.dansdeals.com/wp-content/uploads/2025/05/29085514/United-JetBlueAnnouncementHeroPhoto-267x150.jpg)

![[Final Days To Transfer Before Emirates Transfer Pause, 1 Month Left For Alaska Transfers] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

89 Comments On "2 Hours Left! 6 Delta Credit Cards With Limited Time 60K-80K Welcome Bonuses, Good For Up To 8 NYC-Florida Round-Trips, 6 NYC-LA Round-Trips, And More!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Does the $100 statement credit for making a Delta purchase work for buying gift cards?

https://www.dansdeals.com/points-travel/airlines/delta/6-delta-credit-cards-limited-time-60k-80k-signup-bonuses-good-8-nyc-florida-round-trips-6-nyc-la-round-trips/#Triggering_the_50_or_100_statement_credit

“This card includes an annual Companion Certificate that is valid for a round-trip First Class, Delta Comfort or Main Cabin”

Do I get a companion when I travel first class with delta points ?

If I have 5 cards with amex already would I get approved for a 6’th delta business card ?

YMMV. You may be get approved or you may get a call asking if you want to close a current card in order to get approved.

But wont get declined bcs of that? And just waste a pull ?

Are you not willing to trade another card in if they ask you to do so?

I am. But I had in the past where I was declined bcs of that and didn’t gave mr the option to close another card and approve me for a new one.

I’ve always been able to, including just last month. Did you call reconsideration?

Yup

Are these the highest bonuses ever on those cards ?

I don’t recall seeing higher bonuses for any of the business cards.

They had 70k on the ‘personal gold’ in back in February. I was a benefactor of that

That’s why I said business.

What are meddalion points

Miles towards earning elite status.

I have had the delta Gold few years ago. If the system approves me does that mean I’ll get the sign up bonus again?

YMMV.

Dan,

Where can i find out what all the shorthand means? (I know what HUCA means but thats about it…)

Try Google 🙂

This should help you 🙂

https://forums.dansdeals.com/index.php?topic=10531.0

Thanks!

We all go thru the learning curve at some point!

Would a 2bm work for business and consumer with 1 pull ?

It should.

How about the once in a lifetime bonus restriction?

So many exceptions recently

I wrote that you can get the bonus once per card.

Though reports are you can get it again after a certain amount of time, though the exact time period isn’t known. You should get a popup when you apply if you are not eligible.

Additionally, they have published a lot of NLTL promos.

So $25k of spend gets medallion status? Auto upgrades?

It waives the spending requirement, not the mileage requirement.

The companion pass is valid on only 1 flight/12 mo Correct?

Right.

Can you downgrade at any time to a no-fee card? Is that the Blue?

Hi Dan,

sorry a little off topic but if i use amex card to buy to buy a new door and came a little damaged but the company refused to do anything about it would i get protection as broken or should i dispute the charge thanx in advance for your response

You can either file for purchase protection or dispute the charge.

thanks dan just got platinum business but had to call anyway to make you get credit?

if i bought an item with no warranty amex will add 1 year?

whats the best way to handle electric skateboard bought with amex that does not operate as it should?

No, it matches the warranty.

You can either file for purchase protection or dispute the charge.

any halachic issue disputing a charge(does it matter if it a yid or not)?

what in your mind is the better route to go disputing or file for purchase protection?

Can these cards be downgraded to a no AF card after the year is up??

can you stack mqms if you have alot of versions of the card? the

Sure!

do you think restocking fees are covered by ebay purchases? where the seller charges a restock fee? or only from major retailers not private ebay sellers?

can you get teh 10k round trip deals to toronto as that is also short haul?

Hi Dan! Is the first checked bag free even if I don’t book with Delta Credit card, just with a Delta Mileage number?

Yes.

To clarify, I mean to ask if I don’t have a Delta card now, just a Mileage account, Will the bag fee still be waived?

If you are a cardmember when you check in, you get the free bag

Also Dan another 2 important benefits to Amex’s return protection.

1. Amex allows return protection on used items like ebay (chase does not).

2. Amex has online portal (chase it has to be done over phone)

at least afaik

Thanx dan I got approved I just dont understand the whole Medallion Qualifying Miles system if im not flying delta 25000 miles in a yr its totally worthless for me?

For the Delta Platinum card, do you get the companion passfor your first year with the card or do you only start receiving it after your first anniversary having the card?

Dan, do you recommend signing up for all 3 of the cards at one shot or may have issues from Amex?

Also, I have a personal platinum charge card, can I get the sign up bonus if I sign up for the branded platinum charge cards like Goldman Saks or others that they offer? Thanks

Is there a way I can get these larger bonuses on the personal card if I opened a platinum delta on May 19? (Did not activate the card yet if that helps)

Dan,

Is it possible to get approved for 3 Amex cards in less then 90 days?

Is the expiration (7/2) for the spending threshold or to get accepted

That’s the deadline to apply for the card.

Could anyone help me please? I got the delta gold card and have Progressive policy bill $4000+ but they dont accept Amex. What i had in mind is to link the delta card with paypal and use paypal cash card to pay the bill that will pull the money from the delta card. What im not sure about is: will that be considered as cash advance?

Can a husband and wife pool their points/miles?

No, but you can book tickets for anyone.

Hey Dan,

If I close an Amex Delta gold, will the points get deleted or taken away from my Skymiles account?

If you close an AMEX within a year of opening it, they may take back the welcome bonus.

Otherwise you won’t lose any Delta miles.

For the $100 statement credit after you make a Delta purchase with your new Card within your first 3 months – would a purchase of food/drink on board a delta flight qualify?

Thanks

Dan,

I heard that NOT being a US resident gets better Delta Medallion benefits. Any ideas into that?

I really want to apply but I will have to close the card before the second year since I don’t want to pay the annual fee and I’m afraid I will loose the miles.

Any suggestions ?

No need to close before the 2nd year for that. You can also downgrade to a free card.

I got the popup, never had a business card

How does the companion pass work?

Hey Dan,

I got the pop up for too many cards.

Any suggestions? Worth retrying, or applying by phone?

Tnx

Thanks for the post DansDeals! Just got Delta Business Reserve card. Hopefully you’ll get credit for it. Do you know if i need to request companion certificate, or it comes automatically?

It says that because I have had this card already I don’t qualify for the offer. How do I get to qualify for this offer?

Dan, firstly thanks for all the qantas stuff, stocked up with about 800k-a bit risky 🙂

I’d like to sign up for as many of these as possible tonight through your links of course. I have a tax id and real business. I’ve never had the biz cards b4 from what i remember but i’ve had all the personal over the years. Any recommendations how, what to sign up for. should i open a bunch of sceens and try every card? can I get same card twice if i do application same time? also, I have some cards with amex under my first name and some on middle just becasue i go by middle name and only became issue recently that banks require first but should i try both names or it goes by social? Thanks

Hi Dan

I want to open a new delta card for the points but I have the delta gold, and don;t own a business. what can I do?

Read the post? No hobby businesses that you would need a credit for to track expenses?

If I book a mileage ticket at basic economy through Chase ultimate rewards on Delta, does having one of these cards then allow me to bring a free checked bag?

Sure!

How long after applying do you get an email confirmation? My application was approved and I got this msg “Please check your inbox for an email confirmation and online account setup.” but I still did not get an email confirmation..

Hi Dan

I tried to apply yesterday for platinum delta amex online. I was accepted but cannot get the offer. I called the customer service and spoke to the supervisor. Apparently when the agent filled out the application with me on the phone in november 17, even though , she said I will get an answer within 10 days, I never got anything. I thought my application was declined. It happen that I was accepted but I did not know. I told them i never got the card. They refuse to give me the offer. I have already the gold. Any idea what can i do? Thanks. I really would like to have the platinum with the offer. Thanks.

I tried applying for the personal card but they said I will not get the bonus points.

I have the SPG, Hilton and everyday card.

Any suggestions?

Got the dreaded: “Based on your… you are not eligible to receive the welcome offer.”

Have had the Delta Gold before (and cancelled a while back) but not Delta Platinum. do you know if anyone has ever received the bonus offer after receiving that popup and opting to proceed with their application, rather than cancel?

Applying for the Delta Gold Business Card, currently have 4 amex cards and not under the 2/90 rule, and never had a Delta Gold Business in my lifetime.. I get this message trying to submit my application:

based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed, you are not eligible to receive this welcome offer.

I never close an amex card to reverse the annual fee prematurely, I wait a full year and then cancel or product change.. I’ve only cancelled about 3 amex cards in my life.. should I still proceed with the application? What are my chances of convincing them to approve me for the offer?

I wonder if anyone has reported success in receiving thebonus after receiving that message

Thanks Dan – approved for 2 cards – one for me and one for my father from your link.

If I have an amex platinum business- how do I decide if its worth the spend? I am a platinum Delta flier

Dan, Thank you. I was just approved for the Platinum Business card. I have a few current Delta reservations, how do I make sure that I get the free checked bags and other benefits for the existing fights?

Dan, I signed up for 2 cards for myself with your links-I would have done more but you didn’t answer my post from allay night. Thanks

Was approved for the gold business with just 2k credit

That’s a bit silly since I have to spend 4k for the bonus

any benefit for seat selection with basic economy with these cards?

My annual fee is due for the gold Delta business card, i called to ask if it can be waived said no also asked about downgrading to no annual fee was told no

Any suggestions on how to get the annual fee waived or conversion? How to retain the credit limit?