Update, 7/4: Citi is in the process of converting cards from a 24 month to a 48 month signup bonus restriction, so be sure to read the terms of the card that you apply for.

For example on AA.com all of the AA card offers now have the new 48 month restriction, though this Citi AA Executive Card link still shows a 24 month restriction.

You can still get a Citi Premier® Card Card with a limited time 60,000 point signup bonus under the 24 month restriction, though I’d guess that will change to 48 months soon as well.

Originally posted on 6/16:

Back in the good old days I was able to open 3 Citi AA cards every 30 days and rack up millions of miles as well as lifetime AA Platinum status. But those days are long gone.

In 2016 Citibank added a 24 month card family restriction so that you couldn’t get the bonus on any AA consumer cards or any ThankYou cards if you opened or closed a card in that card family in the past 24 months.

That restriction started off on some applications before making its way onto all Citi applications.

DDF member davidrotts63 posts that he just found some Citi AA Consumer, Citi AA Executive, and Citi AA Business card applications that restrict the signup bonus if you have received a bonus within the past 48 months.

That’s a big step up from the current 24 month restriction and it matches the 48 months restriction now found on Chase Sapphire cards.

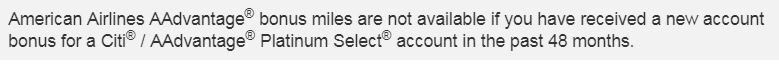

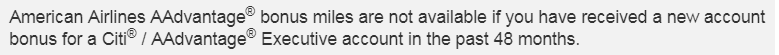

There are a few bright spots though. The restriction is on each individual card not on a card family, so the Consumer card and the Executive card are no longer lumped together. Getting the bonus on one doesn’t affect the other:

Plus the 48 month restriction is from the time of the bonus, so closing a card doesn’t reset the timeline.

For now, the links below as well as most Citi application links still have the 24 month language. We’ll see how long these last…

- Citi Premier® Card Card: Earn 60,000 points for a limited time only. Earn 3 points per dollar on travel and gas and 2 points per dollar on dining and entertainment. Points are worth 25% more towards airfare. Read more here.

- Citi Rewards+® Card: Earn 15,000 points. Automatically rounds up rewards earned on every purchase to the nearest 10 points, meaning you earn 10 points on a $0.50 Amazon balance reload. Earn 2 points on $6K in annual spending at supermarkets, 0% intro APR on purchases and balance transfers for 15 months, and a 10% points rebate when you redeem points, up to a 10K points rebate per year. If you also have a Citi Premier® Card Card you can transfer points into miles or get a 25% added value for paid airfare, plus get a 10% points rebate on transferred or redeemed miles.

- Citi AA Executive Card: Earn 50,000 miles and get AA lounge access for you and your guests. Get up to 10 free authorized user cards that also get AA lounge access for them and their guests. Get a free checked bag and priority boarding on AA flights, even in basic economy.

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

27 Comments On "Citi Signup Bonus Restrictions Are Changing From 24 To 48 Months, Take Advantage Of 24 Month Offers Now!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Gotta love the way you notice the details, I completely skipped past the fact that they aren’t lumping all cards there.

May be a good idea for someone who has gotten a Platinum card recently to get an executive card with that link.

If I downgraded from a citi AA to a citi double cash would that be considered as a closed account to restart the 48 months clock?

The 48 months will no longer count closed cards, only the time from the last bonus.

Sorry I meant for the cards that still have the 24 month rule with closing an account included.

Is a product change considered as account closing?

If the card number stays the same then it won’t count as a closure, but if the number changes then it will count as a closure.

You can ask them if the number will change.

how do you downgrade the aa card?

Can you still do three at a time?

No, you need to wait 8 days before you can get a 2nd card and 60 days before you can get a 3rd card.

What’s the recommended amount of times you can do the fifty cents Amazon before getting flagged

What’s the ‘fifty cents Amazon’?

What Dan mentioned about doing a fifty cent amazon reload to get ten points on the rewards plus card

Can you 2bm and get the second card approved by reconsideration 8 days after the first?

42

Remains to be seen if the family rule changes or is just termed this way

if you have not closed your card yet is it 24 months from when you opened or 24 months from when you got your bonus

Honorable mention @davidrotts63

Are you able to have more than one of the same card, open at the same time?

If i applied for a Thank You cc last Sept and I want to cancel my existing AA card that I have for more than 4 years, when will i be able to reapply for an AA card to be eligible for signup mileage bonus? Thank you in advance.

It’s closing the card that resets the clock that really bugs me. I don’t actually have a problem with 48 months from bonus receipt.

@Dan is there a way to find out when I last got a bonus or closed a card ?

chat with them

will reopening a closed card reset the 24 waiting period?

Citi +AA. PERFECT FOR EACH OTHER.

What about all the benefits they just discontinued?

Be cognizant of what spending you’re putting on what card.

Hello if I would book a airline ticket today will I have a free cancellation period until Monday ? Since it’s a holiday ?

Can you confirm if AT&T access card closure affect getting any other Thankyou point cards?