Update: Citi has devalued the transfer ratio to Shop Your Way points from 1:12 to 1:10 without warning, which effectively kills this gift card option. You can still redeem points for gift cards at a 2.2% value with Citi Double Cash and Citi Rewards+.

Originally posted on 8/26:

The Citi Double Cash® Card was always a solid product offering with 2% cashback everywhere and no annual fee.

But it became a lot more interesting when Citi started allowing you to convert the cash back into Citi ThankYou points. That flexibility is valuable as it allows you to choose between 2% cash back everywhere or converting into miles where they can be more valuable.

While you need a card like the $95/year Citi Premier® Card card to transfer those points into most airline miles, you can transfer your 2% cash back earnings into 24 Sears Shop Your Way points without any other card. 1 Citi ThankYou point converts into 12 Shop Your Way points, and with Citi Double Cash you earn 2 ThankYou points (or 24 Shop Your Way points) per dollar spent.

Why should you care about Shop Your Way points?

Well, you definitely don’t want to store points there. But you can transfer points there and immediately redeem those points for gift cards to other stores. 5,000 Shop Your Way points can be redeemed for a $5 gift card, 30,000 Shop Your Way points can be redeemed for a $30 gift card, etc.

In other words if you spend $1,250 on a Citi Double Cash Card, you’ll earn $25 cash back. You can transfer that cash back into 2,500 ThankYou points and you can transfer that into 30,000 Shop Your Way points. You can then use those points for a $30 gift card to hundreds of stores. That’s an effective 2.4% back on your $1,250 in spending!

If you also have a Citi Rewards+® Card you’ll earn a 10% rebate on up to 100K redeemed and transferred ThankYou points. That means you would get back 250 ThankYou points in the scenario above, so that 2,250 ThankYou points would earn a $30 gift card. That’s an effective 2.67% back on your $1,250 in spending!

Of course if you also have a Citi Rewards+® Card then all of your purchases are rounded up to the nearest 10 points. That means you can earn 10 ThankYou points on a $0.50 Amazon balance reload! Those 10 ThankYou points would convert into 120 Shop Your Way points, and you would get back 1 ThankYou point with the 10% rebate.

You’ll want to use Citi Rewards+ over Citi Double Cash for all purchases under $5.

Gift cards are available via Shop Your Way points with 2.4%-2.67% back at stores such as AutoZone, Barnes & Noble, Bass Pro Shops, Bed Bath & Beyond, Burlington, BuyBuy Baby, Chuck E Cheese, Cinemark, Clarks, Columbia, Crate & Barrel, Dave & Busters, DoorDash, DSW, Dunkin, eBay, Express, Forever 21, GameStop, Google Play, Groupon, Grubhub, H&M, Holland America, Hotels.com, iTunes (also valid on anything sold from Apple), Lowes, Nordstrom, Office Depot, Overstock, Petco, RayBan, Regal Cinemas, REI, Saks, Southwest, Stubhub, The Home Depot, The North Face, TopGolf, Uber, and Walmart.

Being able to choose between 2% cash back or 2.4-2.67% for gift cards on no annual fees cards is excellent!

Plus, if you’re a mileage junkie, you can always decide to keep those points and transfer them to airline miles with the help of Citi Premier® Card.

- Citi mileage transfer partners include:

- Aeromexico (Skyteam): 1K:1K

- Air France/KLM Flying Blue (Skyteam): 1K:1K

- Avianca Lifemiles (Star Alliance): 1K:1K

- Cathay Pacific Asia Miles (OneWorld): 1K:1K

- Emirates: 1K:1K

- Etihad: 1K:1K

- EVA (Star Alliance): 1K:1K

- Garuda Indonesia (Skyteam): 1K:1K

- JetPrivilege: 1K:1K

- JetBlue: 1K:1K

- Malaysia (OneWorld): 1K:1K

- Qantas (OneWorld): 1K:1K

- Qatar (OneWorld): 1K:1K

- Singapore (Star Alliance): 1K:1K

- Thai (Star Alliance): 1K:1K

- Turkish (Star Alliance): 1K:1K

- Virgin Atlantic: 1K:1K

As I’ve written about before, Turkish Airlines has a ridiculously generous Star Alliance award chart.

And they don’t charge any fuel surcharges for United flights.

Here is the North America version of the chart with one-way award pricing:

| Between the US and: | Economy | Business | First |

|---|---|---|---|

| US, including Alaska, Hawaii, Puerto Rico, and USVI | Was 7.5K Now 10K | Was 12.5K Now 15K | N/A |

| North America | Was 10K Now 30K | Was 15K Now 40K | N/A |

| Western Europe (2) | Was 30K Now 55K | Was 45K Now 90K | Was 67.5K Now 135K |

| Eastern Europe (1) | Was 30K Now 50K | Was 45K Now 85K | Was 67.5K Now 130K |

| Turkey | Was 30K Now 40K | Was 45K Now 65K | Was 67.5K Now 100K |

| Middle East | Was 32K Now 58K | Was 47K Now 93K | Was 68.5K Now 140K |

| North Africa | Was 30K Now 60K | Was 49K Now 105K | Was 73K Now 160K |

| Central Africa | Was 30K Now 65K | Was 49K Now 125K | Was 73K Now 190K |

| Southern Africa | Was 45K Now 75K | Was 67.5K Now 140K | Was 100K Now 210K |

| Central Asia | Was 34K Now 60K | Was 52.5K Now 100K | Was 77K Now 150K |

| Far East | Was 45K Now 75K | Was 67.5K Now 130K | Was 100K Now 195K |

| South America and Oceania | Was 52.5K Now 90K | Was 75K Now 140K | Was 115K Now 210K |

As part of the Star Alliance, Turkish can book award travel on airlines like United and Air Canada.

You can open a Turkish Airlines mileage account online (Hint: Your password must be exactly 6 numbers or else it will give an error).

And you can book Star Alliance awards with Turkish miles here (Login and then click this link again). You can’t search for partner awards from their home page. Search for one-way at a time for best results.

For example you can transfer ThankYou points to Turkish Airlines to fly from the US to Tel Aviv on United for just 32K miles in coach ($16K of spending on Citi Double Cash, plus get a 3.2K points rebate with Citi Rewards+):

Or 47K miles in Polaris business class ($23.5K of spending on Citi Double Cash, plus get a 4.7K points rebate with Citi Rewards+):

United award availability is unprecedented, even for next year.

There are lots of other bargains:

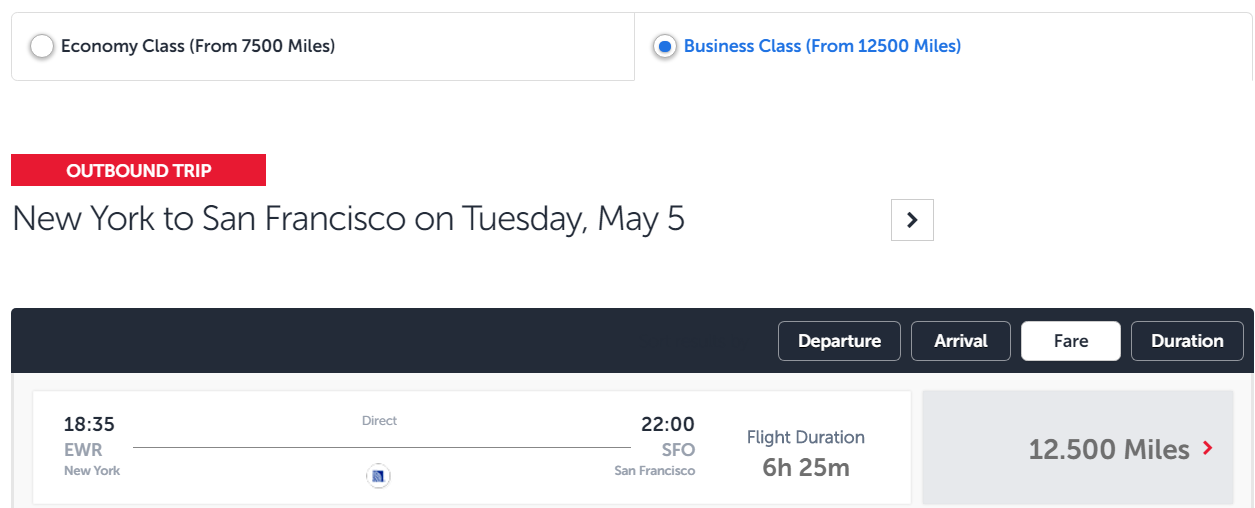

- Fly one-way anywhere in the US, including Alaska, Hawaii, Puerto Rico, and USVI, for just 7.5K miles in coach or 12.5K in business class on United with no fuel surcharges.

- Fly one-way anywhere to Canada or Mexico for just 10K miles in coach or 15K in business class on United with no fuel surcharges.

- Fly one-way to Europe for 45K in business class on United with no fuel surcharges.

Those are some incredibly lucrative redemption rates, plus you’ll save another 10% with Citi Rewards+.

You can start from scratch with no fees by getting a Citi Double Cash Card with no annual fee. Cash out your points for 2% cash back everywhere, use them for gift cards at 2.4%-2.67%, or let them sit and go into trifecta mode at any point later on.

If you have that card already try for a Citi Rewards+ or Citi Premier® Card to complete the Citi Trifecta.

You can freely switch between all 3 card products.

You can also transfer points between any Citi cardholders to transfer points into miles.

Citi has long trailed AMEX and Chase in the points game, but this is certainly an option worthy of consideration. Is it enough to make you switch to the Citi trifecta?

HT: FM

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

45 Comments On "Citi Double Cash And Citi Rewards+ No Annual Fee Cards Become Even More Valuable And Versatile With 2.4%-2.67% Back In Gift Cards"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Where do you see a special 7.5k for the US vs 10k for North America? I just see the NA on Turkish website…

Intra-country pricing.

Can you do this conversion with the weird TYP you get from a checking account, that can’t be transferred to airlines?

I don’t think checking account rewards can be transferred.

You’re right, they can’t (heard from a very experienced mileage broker).

Any tips on what to do with them then?

I think the information regarding transfer of points to miles converted from Citi Double Cash is inaccurate … Currently it only allows Jet Blue miles for thank you points transferred from Citi DC … When I login thankyou.com and select premier card then it allows for all the available airlines within Citi airline partners …

You can combine those points or ThankYou accounts in order to make the transfer.

Without a sign-up bonus or only a small (150) bonus, why would these cards be preferable to other cards that may not have the best per purchase rewards, but do have sign up bonus’s that more than make up for lesser “rewards per dollar” (as well as other perks).

I know there are tax implications to big sign up bonus’s, that do not exist for cash back, but still….

Not trying to be snarky; I am honestly curious.

There are cards with big signup bonuses and cards that are great for everyday spending.

These excel for everyday spending and are now even more versatile thanks to 2.4-2.67% back or being able to transfer miles to lucrative airlines like Turkish.

Just curious, do you put the lost 2% cashback into the calculation for the gift card redemption? We are talking about people who get a minimum of 2% on all purchases with the double cash card.

Why is it lost?

You can choose between:

-2% cash back on Double Cash

-2.4% back when redeemed for gift cards on Double Cash

-2.67% back when redeemed for gift cards if you also have Rewards+

-Transferring to miles if you also have PRemier

It’s lost because if you would charge the, say, Walmart purchase on the double cash card and wipe it out with a statement credit from your cash back, you would earn %2 on that purchase.

Instead now you are paying with a gift card and not receiving any cash back.

In other words the $30 gift card is worth $30 – 2% = $29.40 so technically it’s a bit less then %2.4-%2.67

That’s like calculating the cost of the paid airfare when you redeem miles for it. Sure, you should keep that in mind, but it doesn’t change the math of what you you effectively earn for your spending.

Your’re right, I hadn’t realized it was that insignificant.

You still can’t compare it to the cash back earned on other cards.

It’s a opportunity cost, it might be small but it’s a valid point to bring up in the calculations

how much longer will Sears be in business/ you’ll want to usethose SYW points immediately

Like I said in the post, only do the conversion to redeem for a gift card immediately.

Can you choose to redeem part of your citi 2% cash back balance as TYP so you can coordinate your purchases of gift cards using ShopYourWay?

Yes, you can convert exactly the amount you want.

!! THANK YOU so much !! The hint for Miles & Smiles password is much appreciated – had been trying to sign up for days with errors on the password, different browser, different OS. Sheesh…it’s almost like they don’t want us to sign up.

My pleasure 🙂

just to point out I got courtesy points from reps that did not transfer into airlines because they were not earned thru spending or bonuses, they were earned thru reps awarding me points

Most of those gift cards are available at greater discounts either through deals in stores like Rite Aid, by using Amex and Chase offers at retail stores, by buying them with an Ink card at Staples or Office Depot, or on the second-hand gift card market.

Where do you get 20% off say, Walmart gift cards like that?

Also, you can’t compare buying original gift cards with secondary gift cards that often have problems with fraud.

Where did you mention 20% off? In your post I’m seeing less than 3% off. I agree about the secondary market, which is why I listed it last. Walmart is an exception, since it seems to be sold only at Walmart and Sam’s Club. I did get a significant discount on a small quantity of Walmart gift cards when there was an Amex offer for Sam’s Club.

If you have just Double Cash you can use $25 of cash back for a $30 Walmart gift card, which is like buying the gift card at 16.7% off. It’s a value of 2.4% cash back for your spending.

If you have Double Cash and Rewards+ you can use $22.50 of cash back for a $30 Walmart gift card, which is like buying the gift card at 25% off. It’s a value of 2.67% cash back for your spending.

Right, but you have to spend $1250 to get that $5 discount. That’s a lot of spend for a small benefit. Don’t get me wrong, I like the Double Cash/Premier combo (one of these days I’ll PC my old Thank You Preferred to a Double Cash), but I think TY points are more valuable for travel (whenever that becomes a thing again).

I said in the post that miles certainly has the highest upside. But if you’re after cash back, this is a good option.

“You can also transfer points between any Citi cardholders to transfer points into miles”.

what does this mean? I think you mean between family members?

or even friends?

You can transfer to anyone.

wow that is the most flexible policy of all the other banks! how do you transfer to others?

IME you only get 9 points for every transaction under a $1

Should be 1 base+9 bonus.

Apparently they don’t give the 1 base for charges under a $1 only the bonus. At least in my experience.

some citi points, i.e earned from checking account bonuses will nit be eligible to transfer to airlines even if transferred to another citi ty account which has premier cc etc. am not sure if that also applies tp points earned monthly on the checking account

Please note: The option of transfer points between any Citi cardholders is currently unavailable.

thanks, they now become versatile or you just realized it ? i just redeemed 47k citi ty for walmart gc. i earn them in the sears ty card which routinely offers 10 – 20 points back per dollar on groceries !! but have long reached the 100k sharing limit for the year..

Well written Dan.

Beautiful post of yours once again.

Enjoyed the post.

Loved the clarity and tricks and tips you pointed out in the post!

Keep up the Amazing work of yours!

And as always thanks for sharing!

How many times can I refill amazon @ $0.50 to get 10 points without them getting suspicious? Is it a minimum of $0.50?

Don’t forget citi dropped their standard credit card benefits.

having trouble buying gift cards, getting this error: “failed to get brand: failed to exec get brand: sql: no rows in result set”

What do you currently mark citi typ at? .018 or so? Also still .0075 for bonvoy? Im always maximizing both but just curious.

How quick is the transfer to Turkish Airlines?

I cannot find any flights booked through Turkish between America and Canada. I searched dates from EWR to Toronto on united with award flights showing but on Turkish it always comes back “Flight not found on the selected date and route.”