Several readers have asked if they should change their credit card strategy because of COVID-19.

Of course nobody knows exactly how long we’ll be sitting at home, but many people understandably want to prioritize cash back over miles these days.

During regular times, a combo like Chase Freedom Unlimited® and Chase Sapphire Reserve® allows you to earn 1.5 points per dollar everywhere and 3 points per dollar on dining and travel. Those points can be cashed out 1 cent each (1.5%-3% cash back everywhere), used for paid travel at 1.5 cents each (2.25%-4.5% back everywhere), or transferred into miles where they can be worth 2 cents each (3%-6% back everywhere) or more when utilized properly.

Or a combo like AMEX Blue Business Plus and AMEX Platinum Business allows you to earn 2 points per dollar everywhere and then get a 35% rebate when you use your points for paid travel.

With the Citi Double Cash Card you earn 2% cash back everywhere. Plus there’s no annual fee.

That’s a pretty good value proposition in times like these!

But what’s more interesting about the card is that you can choose to convert the cash back into Citi ThankYou points. That flexibility is valuable as it allows you to choose between 2% cash back everywhere or miles.

- You can get the Citi Premier® Card ($95 annual fee, 60K signup bonus for spending $4K in 3 months).

- Having this card allows you to transfer points from Citi Double Cash and Citi Rewards+ into miles.

- This card earns triple points on airfare, hotels, travel agencies, and gas.

- Starting on 8/23/20 this card will earn triple points on supermarkets and dining.

- Starting on 8/23/20 this card will also offer a once annual $100 credit for making a $500+ hotel booking through Citi.

- Currently this card earns double points on entertainment, such as sporting events, amusement parks, zoos, museums, tourist attractions, theater, concerts, movies, video rentals, internet steaming media, etc. This will end on 4/10/21, but you can get double points everywhere with Citi Double Cash.

- Currently this card earns triple points on car rentals, cruises, public transportation, timeshares, boat rentals, taxis, tolls, trains, parking, Uber, Lyft. This will end on 4/10/21, but you can still get double points everywhere with Citi Double Cash.

- Currently you can get a 25% bonus for paid travel, but this will end on 4/10/21.

- Citi mileage transfer partners now include:

-

- Aeromexico (Skyteam): 1K:1K

- Air France/KLM Flying Blue (Skyteam): 1K:1K

- Avianca Lifemiles (Star Alliance): 1K:1K

- Cathay Pacific Asia Miles (OneWorld): 1K:1K

- Emirates: 1K:1K

- Etihad: 1K:1K

- EVA (Star Alliance): 1K:1K

- Garuda Indonesia (Skyteam): 1K:1K

- JetPrivilege: 1K:1K

- JetBlue: 1K:1K

- Malaysia (OneWorld): 1K:1K

- Qantas (OneWorld): 1K:1K

- Qatar (OneWorld): 1K:1K

- Singapore (Star Alliance): 1K:1K

- Thai (Star Alliance): 1K:1K

- Turkish (Star Alliance): 1K:1K

- Virgin Atlantic: 1K:1K

-

For example you can transfer miles to Turkish Airlines to fly from the US to Tel Aviv on United for just 32K miles in coach ($16K of spending on Citi Double Cash, plus 3.2K points rebate with Rewards+):

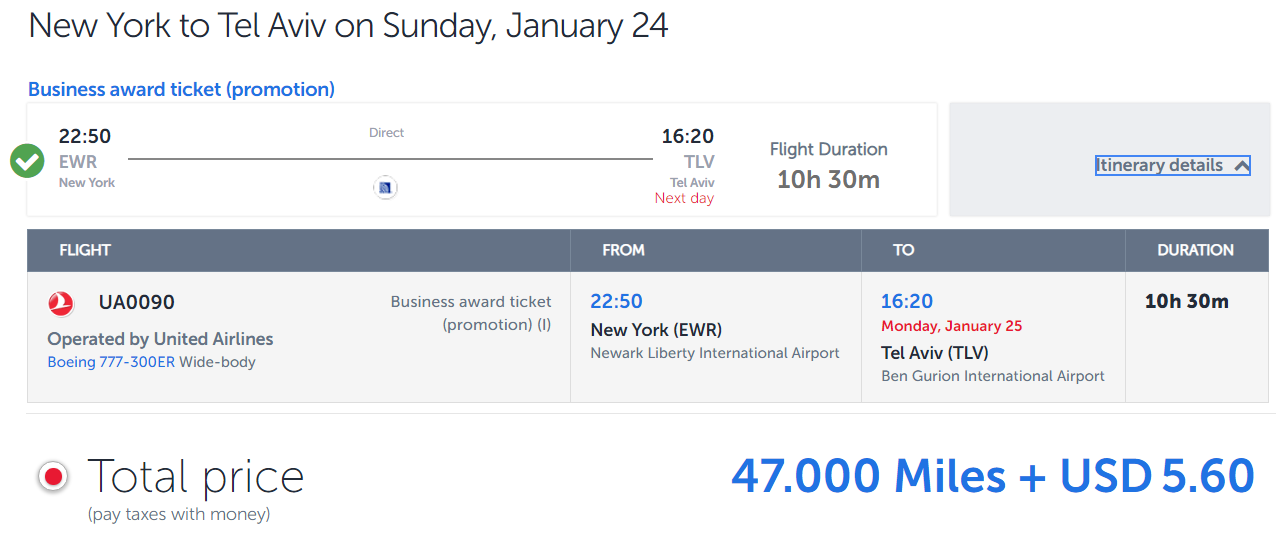

Or 47K miles in Polaris business class ($23.5K of spending on Citi Double Cash, plus 4.7K points rebate with Rewards+):

United award availability is unprecedented, even for next year.

There are lots of other bargains:

- Fly one-way anywhere in the US, including Alaska, Hawaii, Puerto Rico, and USVI, for just 7.5K miles in coach or 12.5K in business class on United with no fuel surcharges.

- Fly one-way anywhere to Canada or Mexico for just 10K miles in coach or 15K in business class on United with no fuel surcharges.

- Fly one-way to Europe for 45K in business class on United with no fuel surcharges.

Plus you’ll save another 10% with Citi Rewards+.

You can start from scratch with no fees by getting a Citi Double Cash Card with no annual fee. Cash out your points for 2% cash back everywhere or let them sit and go into trifecta mode at any point later on.

Or if you have that card already try for a Citi Rewards+ or Citi Premier® Card to complete the Citi Trifecta.

You can also transfer points between any Citi cardholders to transfer points into miles.

Has COVID-19 changed your credit card strategy?

![[Last Chance For Free Membership And Credits!] Don’t Forget To Register All Of Your Eligible Chase Cards For Instacart+ Membership And Credits, How Many Months Have You Stacked?](https://i.dansdeals.com/wp-content/uploads/2021/10/12110805/instacart-logo-wordmark-4000x1600-e4f3c6f-375x150.jpg)

![[August And September Games Now Live!] Redeem Capital One Rewards For Major League Baseball Experiences And Tickets!](https://i.dansdeals.com/wp-content/uploads/2018/11/13130540/500px-Capital_One_logo.svg_-417x150.png)

Leave a Reply

37 Comments On "Citi Double Cash Card: Earn 2% Cashback, With Option To Transfer Into Miles Via Citi Trifecta; United Domestic 7K Points, Business To Israel 42K Points"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Dan I have chase sapherie and all the chase business cards what’s the next card I should sign up for specifically for mile rewards to israel? Capital One?

Thanks

Citi Trifecta from this post is a strong option.

Without getting to deep, How do I know if the saver business space that is available on united.com is also relased to partners like Turkish as well ?

If you’re not logged into United.com, then partners can book it.

If you’re logged in and have a United card or Premier status then it will also display award space that only United can book.

Similar to united saver economy awards? ( I remember something from your posts that having a united card only gets you united expended saver economy awards not business saver awards).

Correct, business class will be accurate for partners even if you’re logged in, as long as you don’t have Platinum/1K/GS status.

Thanks !

What’s Turkish policy for 3rd party bookings and infants award

can thank you points be redeemed for credit 1:1 ratio?

anybody?

Yes

that does not seem correct not at 1:1 ratio

For statement credits, Citi allows you to redeem the points in the following increments:

$10 for 2,000 ThankYou Points

$15 for 3,000 ThankYou Points

$25 for 5,000 ThankYou Points

$50 for 10,000 ThankYou Points

$100 for 20,000 ThankYou Points

$250 for 50,000 ThankYou Points

While Citi allows ThankYou Points credit card holders to redeem for cash and statement credits, it’s not advisable. Why? The ThankYou Points are only worth half a cent compared to redeeming the points for a flight, rental cars, cruises, and hotels for 1.25 cents to 1.6 cents.

Can you add info on Citi card sign up and bonus restrictions?

Citi allows applications for 1 card every 8 days and 2 cards every 2 months.

“Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+SM, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi PremierSM or Citi Prestige®, or if you have closed any of these accounts, in the past 24 months.”

I’m a reading this correctly. You can only get one Citi bonus in 24 months through all cards combined? And if you close the card at any point within the 24 months than you restart the clock for another 24 month?

?

Does downgrading (to a no annual fee CC) reset my 24-month clock (for the closed card)?

Can I balance transfer from a business card to one of these personal cards?

I got an offer from citi through now through 1/2021 for 2.5% back for opening a checking account! Uncapped

“With this card you’ll get all of your purchases rounded up to the nearest 10 points. That means you can earn 10 points on a $0.50 Amazon balance reload!” Or rather 100,000 points for a $5,000 spend.

That’s got to be to good to be true!

They’ll shut you down long before you finish 10,000 50 cent transactions.

What’s the best Amazon strategy now? We are not going out to stores un-necessarily, so physical gift cards are out.

Does citi care at all about 5/24?

No.

citi tri or the other Citi card mentioned in the link?

booked round trip for R”H for 94K. will see what will be

Citi supervisor and other posts say it is not 24 months any more from closing, but 48 months from when you last received bonus, especially for premier and prestige cards. Why are you stating old policies here?

Was the supervisor giving me incorrect information that this only applies to AA when he said it was all citi cards?

“If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.”

what does this mean? minimum payments?

Dan thanks for posting, quick question im having trouble booking a infant ticket on Turkish for UA flight from EWR-TLV in business, do I need to do this at the airport? How much will they charge me if I booked a reward ticket thru Turkish?

TIA

Is it possible to transfer points from the double cash card to someone else, or it’s I only possible to transfer to one self?

You can get the Citi Rewards+ Card ($0 annual fee, 15K signup bonus for spending $1K in 3 months) and convert points from Citi Double Cash into ThankYou points.

With this card you’ll get all of your purchases rounded up to the nearest 10 po

what does this mean covert points from double cash to thank you points? You can do that anyway without Citi Rewards card?

as stated here:

“But what’s more interesting about the card is that you can choose to convert the cash back into Citi ThankYou points. That flexibility is valuable as it allows you to choose between 2% cash back everywhere or miles.”

I had a Prestige and Premier, downgraded Prestige to Rewards+ in March. Now the Premier annual fee is due, requested retention offers twice but no dice. Do you think it’s worth paying the $95 so I retain the enhanced Premier point redemption options for one more year?

I have about 20K points on the Rewards+ and 70K on the Premier. I do hope to travel before the end of the year but hard to say how much and when.

I only have the Citi double cash card. Am I able to convert to thank you points without having any of the other citi cards? Am I able to buy thank you points to supplement any points missing from a cashback transfer?

I only have Chase cards and it doesn’t look like they can transfer to Turkish. What my options for booking United at the cheapest possible rate?

does the citi rewards plus card make me more points than the double cash card?