Update: DEAD

Originally posted on 9/28:

You can view credit card offers by hovering over the “Credit Cards” tab. You can click on “Top Credit Card Offers“ and then hover over “Card Type” to find card offers from the bank you’re looking for.

American Express has released 4 limited time offers on Delta credit cards that are valid until the morning of November 8th. Signup bonuses are valid for the first time you’ve had each type of Delta card, so you can get the bonus for each of the 4 card versions below.

Consumer cards:

1. Gold Delta SkyMiles® Credit Card from American Express:

-Earn 50,000 bonus miles after spending $2,000 in the first 3 months and an additional 10,000 bonus miles for spending an additional $1,000 in the first 6 months, and a $50 statement credit after making a Delta purchase in the first 3 months.

-$0 intro annual fee, then $95.

-Earn 70,000 bonus miles and 10,000 Medallion Qualifying Miles after spending $3,000 in the first 3 months and a $100 statement credit after making a Delta purchase in the first 3 months.

-If you spend $25,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles. If you spend $50,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles.

-This card includes an annual Companion Certificate that is valid for a round-trip Economy Class Companion ticket with the payment of applicable taxes and fees within the 48 contiguous United States. Residents of Hawaii, Alaska, Puerto Rico or the United States Virgin Islands (USVI) must originate from there to the 48 contiguous United States and have an address on their SkyMiles account in Hawaii, Alaska, Puerto Rico or the USVI.

-$195 annual fee.

Business cards:

3. Delta SkyMiles® Gold Business American Express Card:

-Earn 50,000 bonus miles after spending $2,000 in the first 3 months and an additional 10,000 bonus miles for spending an additional $1,000 in the first 6 months, and a $50 statement credit after making a Delta purchase in the first 3 months.

-$0 intro annual fee, then $95.

4. Delta SkyMiles® Platinum Business American Express Card:

-Earn 70,000 bonus miles and 10,000 Medallion Qualifying Miles after spending $4,000 in the first 3 months and a $100 statement credit after making a Delta purchase in the first 3 months.

-If you spend $25,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles. If you spend $50,000 in a calendar year you’ll receive an additional 10,000 bonus miles and 10,000 Medallion Qualifying Miles.

-This card includes an annual Companion Certificate that is valid for a round-trip Economy Class Companion ticket with the payment of applicable taxes and fees within the 48 contiguous United States. Residents of Hawaii, Alaska, Puerto Rico or the United States Virgin Islands (USVI) must originate from there to the 48 contiguous United States and have an address on their SkyMiles account in Hawaii, Alaska, Puerto Rico or the USVI.

-$195 annual fee.

You can view credit card offers by hovering over the “Credit Cards” tab. You can then click on “Credit Cards From All Banks“ to find card offers via the logo of the bank you’re looking for.

Triggering the $50 or $100 statement credit:

Any Delta purchase will trigger the statement credit. There is no minimum Delta purchase required, even a $2 snack or drink on a Delta flight will trigger the full $50 or $100 credit!

Sample purchases include Delta gift cards or eGift cards, food or drinks on a Delta flight, baggage fees, tickets, upgrades, change fees, club entrance fees, etc.

All 4 Delta cards:

- Offer a free checked bag for the primary cardholder and up to 8 companions on the same reservation. You do not need to book tickets on your Delta card for this benefit, you only need to have your Skymiles number in the reservation. That’s critical as it allows you to still get free bags with Hybrid points or allows you to use a card like the AMEX Platinum Card to earn 5 points per dollar.

- Have no foreign transaction fees.

- Offer Zone 1 Priority Boarding on Delta flights for the primary cardholder and up to 8 companions on the same reservation so that you won’t have to gate-check your carry-ons.

- Offer 2 Delta miles per dollar on flight purchases from Delta.

- Offer a 20% savings in the form of a statement credit on eligible pre-purchased meals, in-flight purchases of food,alcoholic beverages and audio headsets, and movies, shows and video games accessed via Delta’s seatback in-flight entertainment system, on Delta-operated flights.

- Waive the Medallion Qualification Dollar requirement to reach Medallion status if you spend $25,000 on the cards in that calendar year. Eligible Purchases will be combined across multiple Delta cards of the primary cardholder if those accounts are linked to the same SkyMiles number. Note that effective for spending in 2018 the $25,000 threshold will remain to waive the flight spending requirement of Silver, Gold, or Platinum status, but the Diamond level spend waiver will increase to a whopping $250,000.

- Offer $29 per person discounted SkyClub lounge access for the cardmember and up to 2 guests.

- Offer free additional cardholders (up to 99 per account). Additional cardholders are each eligible for American promotions like Small Business Saturday, Twitter offers, etc.

American Express benefits:

The cards carry American Express’ awesome top-notch protections that are light-years better than any other banks. Most other banks always look for a way to get out, but that’s not the case with American Express.

- If you need to return an item up to $300 and a store won’t take it back due to a time limited or final sale policy, AMEX will gladly refund you thanks to return protection.The vast majority of the time you’ll even be able to keep the item, but if you do need to send it back the return shipping will be free. That’s a far more generous policy than any other bank offers. This benefit is valid for $1,000 of returns per card per calendar year.

- If a store charged a restocking fee to return an item then AMEX will cover it, up to $300/item, as part of their return protection coverage.

- You get an additional year of warranty coverage and if you have any issue in the extended warranty year they’ll pay to have it fixed or refund your entire purchase price without a hassle. This benefit is far more valuable than warranty benefits offered by other banks.

- If you need to dispute a charge there’s nobody who makes it easier or as pain-free as American Express does. It’s the easiest dispute resolution process in the industry by leaps and bounds and you can do it all online.

- If your item is stolen or broken within 90 days you’ll be covered.

- AMEX cards now cover car rental insurance in Israel.

- AMEX cards offer free Shoprunner membership for 2nd day free shipping and returns from dozens of stores.

See this post to see just how amazing some of the AMEX protections can be.

Business vs Consumer card:

The business cards also offers miles plus Open Savings rebates on purchases from Fedex, HP, Hertz, and more.

AMEX business cards don’t appear on your credit report. That’s good for several reasons.

First of all they won’t count against your 5/24 count for opening new Chase cards. Only cards on your report that have been opened within the past 24 months count for that.

Second, when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an AMEX business card it’s just not reported, so you can wait until the money is due without it having a negative effect on your score.

Third, if you close a business card it won’t ever have an effect on your score.

You may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can just open a business credit card for “Joe Smith Sole Proprietorship” as the business. You don’t need to file any messy government paperwork to be allowed to do that.

Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field

Delta Miles:

I have mixed feelings about Delta miles or “Skypesos.”

Traditionally they have had terrible saver award availability. However that has improved of late and it’s now significantly better than American’s availability, though it’s not as good as United’s.

Delta’s miles also never expire.

However Delta doesn’t publish award charts anymore as they feel than an uneducated customer is their best customer. That’s beyond frustrating. Recently they increased the miles needed for partner flights without warning.

They don’t charge a close-in award fee, but it can be tough to find saver award space available within 3 weeks.

However there are still plenty of good uses of Delta miles, especially as American’s award availability has gone down the drain.

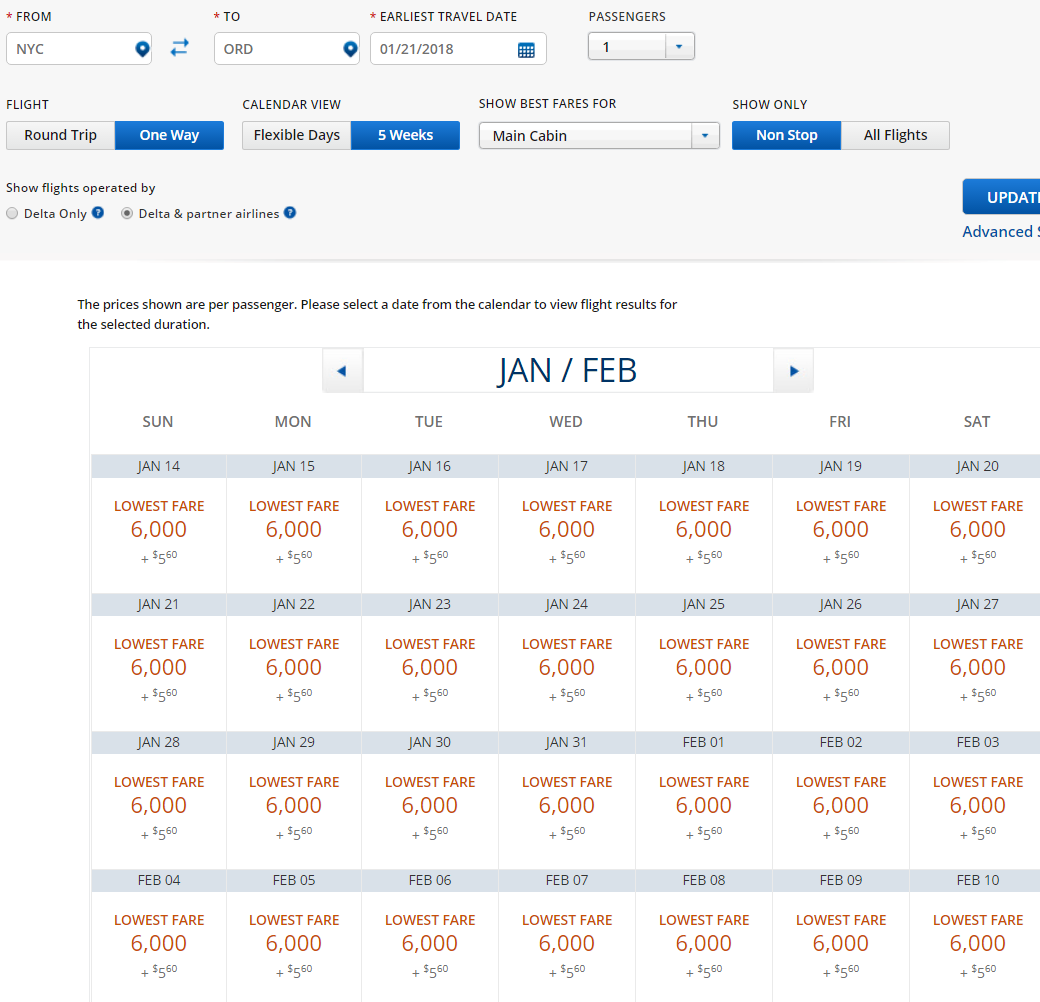

Delta’s one-way flexible award calendar that can be set to search for 5 weeks at a time is also a marked improvement over their old buggy award calendar.

Delta has also lowered the cost of some domestic saver awards from a flat 12.5K to as low as 5K, depending on the route.

Using airline miles also means you don’t have to worry about any Basic Economy restrictions as those don’t apply to award tickets.

For example NYC to Orlando is now just 5.5K miles:

NYC to West Palm Beach is now just 5.5K miles:

NYC to Fort Lauderdale or Miami is now just 6K miles:

NYC to Chicago is now just 6K miles:

Los Angeles to San Francisco is now just 5.5K miles:

If you actually want to collect Delta miles you’ll do better spending on the Starwood AMEX as 20,000 Starpoints transfers into 25,000 miles on dozens of airlines, including Delta or Delta partners like Air France and Alaska. Though there are better airlines that Starwood points can transfer into unless you need a specific Delta award.

However the MQM bonuses can make it worth spending on the Platinum Delta cards if you can hit the $25K or $50K spend threshold bonuses.

Additionally if you are gunning for Delta medallion status, then spending $25,000 on Delta cards this year will waive the requirement to spend a minimum amount on Delta flights to earn that status ($3,000 for Silver, $6,000 for Gold, $9,000 for Platinum, and $15,000 for Diamond if you don’t spend $25K in a year across all of your Delta cards). Note that effective for spending in 2018 the $25,000 threshold will remain to waive the flight spending requirement of Silver, Gold, or Platinum status, but the Diamond level spend waiver will increase to a whopping $250,000.

But the cards are great for the signup bonus and benefits that they come with for both Delta Medallions and non-Medallions alike.

![[United Update] Israel Flight Change Policies And Next Bookable Flights For Major Airlines](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

Leave a Reply

26 Comments On "Last Chance: 4 Delta Credit Cards With Limited Time 60K-70K Signup Bonuses, Good For 10-12 Tickets From NYC To Florida, Chicago, And More"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

The card protections section is outdated. Amex is now a royal pain to deal with regarding disputes and purchase protection. Nobody competent to talk to.

I still have good experiences. Much better than other banks.

Is the companion pass for the delta platinum card included the first year or only upon renewal? Also if you book a ticket on deltas website they will give you the se offer for the gold card plus a $100 statement credit instead of $50.

Renewal, but it will come before you need to pay the annual fee.

Can I use the CP on an booking made with skymiles?

I’m reached platinum with the personal card earlier this year

I’m about 30k MQMs shy of becoming Dimend will a new card give me the extra MQMs needed ?

And do I need to remove the other card from my delta profile or can I have both cards on there

A new Platinum card will give you the MQMs that I wrote about in this post.

No need to remove any cards, you can have all 4 of these.

Could you get the bonus points even if you got it once already?

You can get the bonus once for each of these 4 flavors of the card.

At the risk of sounding like an idiot

How did you find that 5 week calendar? Is it desktop only and not mobile /app? I cannot find it at all. Thanks.

I found it on my desktop.

Thanks! I’ll check when I get home.

Also of I get the bonus with all 4 cards can I combine the points.?

Yes, they can all go into the same Delta account.

Will it work still to do a balance transfer to acquire the $3000 spending within 3 months requirement?

I assume you can book a dummy future refundable flight to trigger the $50/$100 statement credit, then cancel? Any pitfalls?

Question: if I get the Platinum and I downgrade to gold after a few months. Would they pro-rate the annual fee? Also would I then get first year free on the gold card?

I already had the Delta gold a number of years ago.. so I would only qualify for the Platinum bonus

when is this limited time offer ending??

Dan How many points would I get if I reach diamond status, I am billing 150k a month on credit card and want to get best deal, and would like some advice, happy to go through you. please be in touch, Yeshachoach

Is the companion pass work for every time you fly

For the regular person (not a business) what’s the advantage of getting the business platinum card vs the personal platinum? Which one is more “worth it”?

Thanks!

whats the cheapest item i can purchase(not on a flight) that can trigger the statement

what are medalion qualification miles??

thanks

Wow when did delta lower miles prices. It used to be the worst! Every time I would search from ny to Florida it would be 50k rd trip. This is game changer!

dan what do you mean when you spend 25k on credit card to get statues for each 25k you go one level up ? or if i have 4 deltas consumer gold-plat business gold, and plat then i can spend 25 k on each one 100k total to get to top tier? thank you very much much appreciated .also if i have an real estate out of the us is it a problem if i put have that registered down in my account even though i know live in the us and have a passport from the us? meaning to say if i book a ticket directly on my sky miles account can it potentially be a problem because the sky miles account is registered to my tennants address outside the us?alos can you get statues and points on delta even if you book on a 3rd party website like priceline? thank you so much for this educational and informative website very excited to go on it ever day.

I would have liked to apply for these, I find this new dd interface on my phone so hard to navigate, tried to find the links for these cards to apply but had no success, looked all over the cc section… Liked when the link was right in the post

Dan

i applied for this Gold Delta SkyMiles® Credit Card from American Express: and I spent the amount that was needed to qualify and Delta never gave me the bonus points. Delta/amex are saying i should prove to them that they offered this promotion. Who do you recommend i speak to?